- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Partners With HCLTech to Drive Global Automation Enhancements

Reviewed by Simply Wall St

In a significant development, UiPath (NYSE:PATH) recently announced a strategic partnership with HCLTech aimed at enhancing agentic automation, coinciding with a 5.9% price increase over the last quarter. This partnership aims to improve business agility and optimize workforce efficiency, which may have bolstered investor confidence. Additionally, first-quarter revenue growth and a reduced net loss, alongside innovative product launches such as the next-generation UiPath Platform and UiPath Medical Record Summarization agent, likely added weight to this positive trend. Despite Laela Sturdy resigning from the board, these developments align well with an overall market uptrend over the past year.

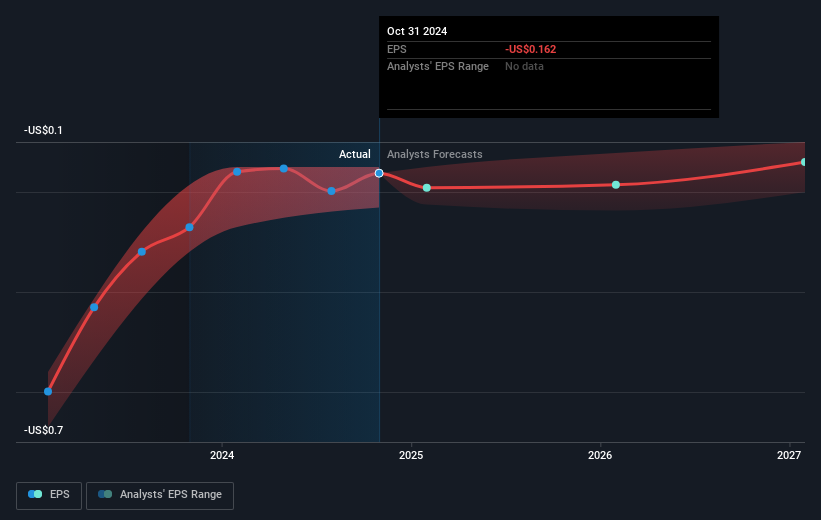

The recent partnership between UiPath and HCLTech is expected to catalyze further expansion in agentic automation, which could strengthen revenue streams and potentially align with the company's aim for deeper customer relationships and expanded market opportunities. Over the longer term, this partnership might influence forecasts, given the expected acceleration in cloud and AI-driven product adoption, enhancing both customer engagement and ARR growth. Analysts are currently projecting annual revenue growth of 8.0% over three years, with profitability not anticipated within that timeframe.

UiPath's total shareholder return of 4.78% over the past year reflects modest performance, contrasting with its industry peers. When comparing its one-year overall return with the US Software industry, which saw a 23.7% increase, UiPath's underperformance is evident. Additionally, the company's current price is trading at a 2.6% discount to the analyst consensus target of US$12.13, suggesting that many assess the shares to be fairly priced by the market.

Given UiPath's current revenue of US$1.45 billion and earnings loss of US$67.51 million, the expectation is that the HCLTech partnership, alongside new product launches like Agent Builder and Agentic Orchestration, could yield higher revenue and potentially convergence on industry-standard profit margins. Analysts suggest that by 2028, earnings may increase significantly, providing some optimism for improved financial performance. The current share price of US$11.82 also reflects investor sentiment on the expected future improvement, with a potential alignment towards the industry average PE ratio of 31.6x, depending on these outcomes aligning with future projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives