- United States

- /

- Software

- /

- NYSE:PAR

Will New Loyalty Deals With Krystal and Layne’s Reshape PAR Technology’s (PAR) Growth Narrative?

Reviewed by Sasha Jovanovic

- PAR Technology announced that Krystal Restaurants LLC and Layne’s Chicken Finger have chosen its digital loyalty and engagement platforms to support rapid national expansion and modernize guest experiences across hundreds of locations.

- This series of new client partnerships highlights PAR's role as a technology provider to fast-growing restaurant brands, even as financial concerns, including cash burn and potential capital raising, continue to draw close attention from the market.

- We'll explore how winning key expansion-driven clients like Krystal and Layne’s Chicken Finger fits into PAR Technology’s investment outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

PAR Technology Investment Narrative Recap

To be a shareholder in PAR Technology, you need to believe the company can convert its momentum in acquiring fast-growing restaurant tech clients into sustained, profitable growth, despite current losses and ongoing cash burn. The Krystal and Layne’s Chicken Finger wins reinforce PAR’s ability to attract valuable partners, but do not fundamentally change the immediate risk: whether large client rollouts and cross-sell strategies can materialize quickly enough to improve cash flow and delay the need for more capital.

Of the recent announcements, Krystal’s adoption of PAR Punchh stands out for its scope and alignment with PAR’s recurring revenue ambitions. Krystal’s 300 locations and national growth strategy fit PAR’s focus on larger, multi-year, and multi-product contracts, which are vital for hitting ARR and margin improvement targets over the next 12 to 18 months.

In contrast, investors should be aware that short-term pressures around cash burn and possible capital raising remain...

Read the full narrative on PAR Technology (it's free!)

PAR Technology's narrative projects $608.8 million in revenue and $55.1 million in earnings by 2028. This requires a 13.4% annual revenue growth rate and an earnings increase of $146.6 million from the current earnings of -$91.5 million.

Uncover how PAR Technology's forecasts yield a $71.33 fair value, a 95% upside to its current price.

Exploring Other Perspectives

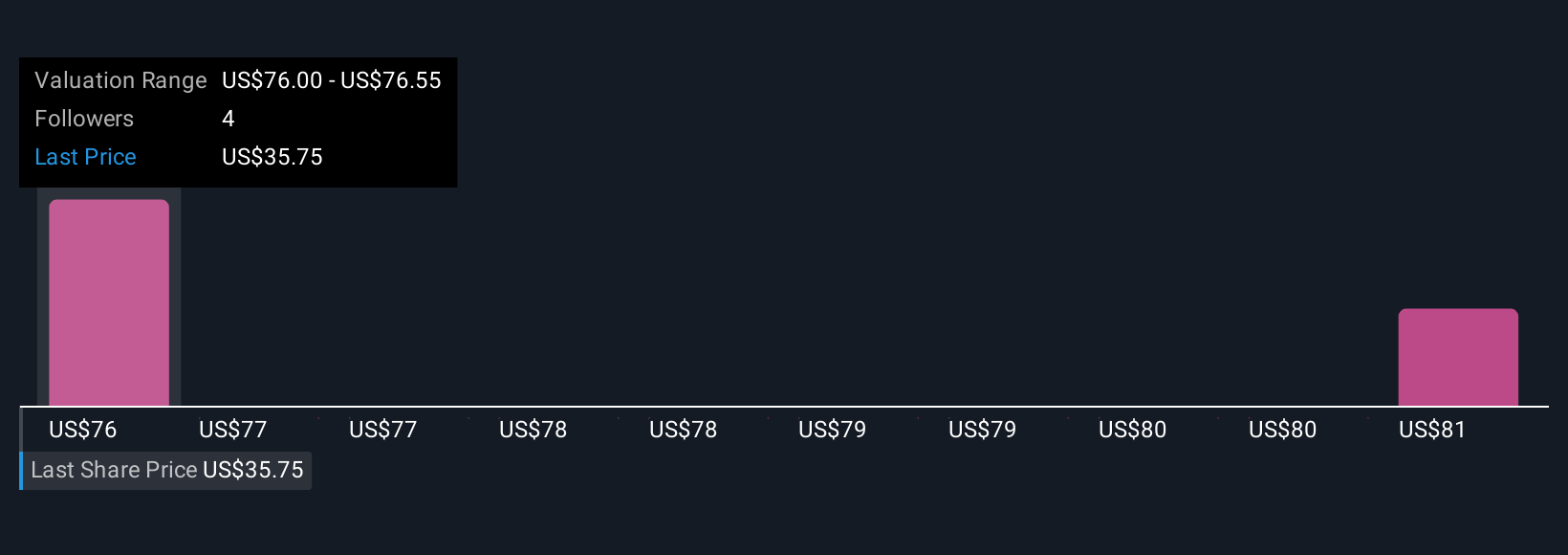

Three fair value estimates from the Simply Wall St Community range from US$71.33 to US$81.08, illustrating how opinions on PAR’s valuation often vary by expectation for revenue conversion and profitability. While many see upside, short-term execution risks on large-scale client rollouts remain a critical factor driving differing outlooks, consider looking at a variety of views before making a decision.

Explore 3 other fair value estimates on PAR Technology - why the stock might be worth over 2x more than the current price!

Build Your Own PAR Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PAR Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PAR Technology's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives