- United States

- /

- Software

- /

- NYSE:PAR

PAR’s Strong Quarter And New AI Platform Could Be A Game Changer For PAR Technology (PAR)

Reviewed by Sasha Jovanovic

- In recent months, PAR Technology Corporation reported a strong third quarter that exceeded analyst revenue and EPS expectations, launched its embedded PAR AI intelligence layer, and added new clients such as Abelardo's Mexican Fresh while expanding AI and payroll-focused partnerships across its restaurant technology platform.

- These developments suggest PAR is deepening its role as a unified, AI-enabled operating system for modern restaurants, with broader adoption of its cloud-native suite and tighter integrations into core workflows like payments, kitchen operations, and labor management.

- We’ll now examine how PAR’s stronger-than-expected quarter and launch of PAR AI may influence its existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PAR Technology Investment Narrative Recap

To own PAR, you need to believe it can turn its unified, cloud-first restaurant platform and AI layer into higher quality, recurring software and payments revenue, despite ongoing losses and competitive pressure. The strong Q3 beat and PAR AI launch support the near term catalyst of deeper multiproduct adoption, but do not fundamentally change the key risk that execution missteps or slower rollouts on large enterprise deals could extend the path to profitability.

The Abelardo's Mexican Fresh win is especially relevant here, because it showcases PAR’s full-stack offering across POS, payments, engagement, and PAR OPS in a single deployment. For investors watching for proof points on cross sell and higher ARPU per customer, this type of full-suite adoption is directly tied to the central catalyst: converting the unified platform strategy into steadily expanding subscription and transaction revenue.

But even with this momentum, investors should be aware that slower than expected rollouts or failed enterprise implementations could...

Read the full narrative on PAR Technology (it's free!)

PAR Technology's narrative projects $608.8 million revenue and $55.1 million earnings by 2028. This requires 13.4% yearly revenue growth and a $146.6 million earnings increase from -$91.5 million today.

Uncover how PAR Technology's forecasts yield a $59.33 fair value, a 73% upside to its current price.

Exploring Other Perspectives

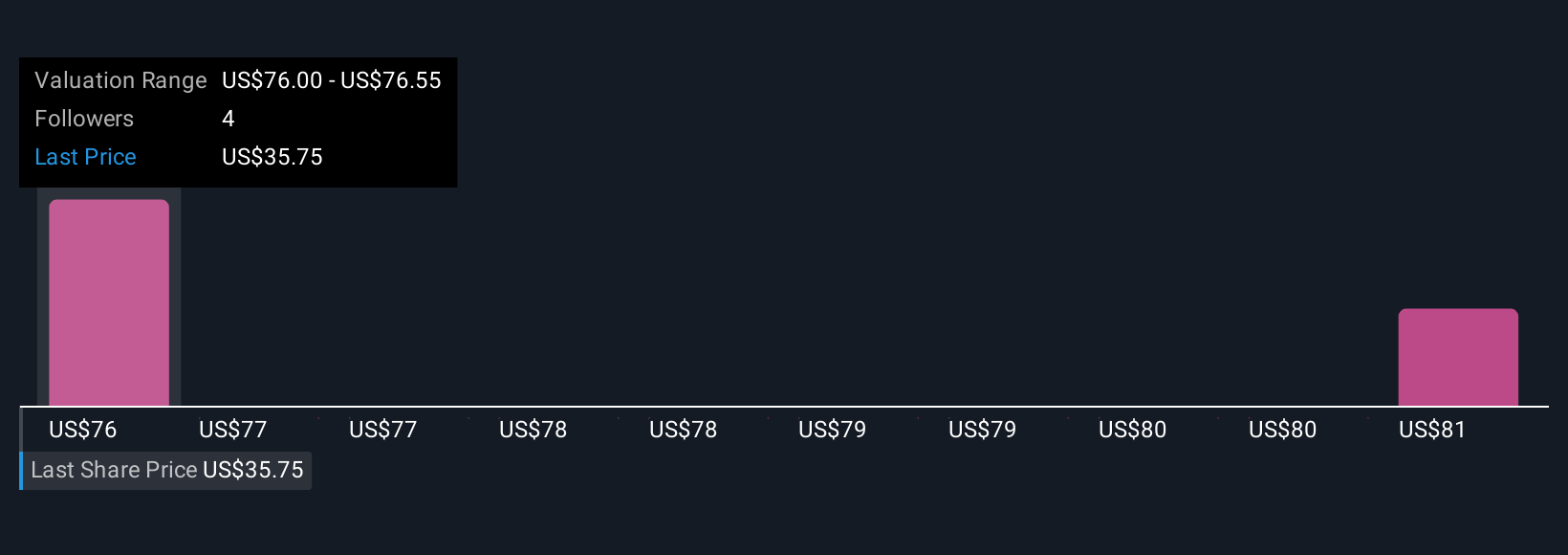

Three Simply Wall St Community valuations cluster between US$59.33 and US$65.55 per share, suggesting a tight band of higher fair value views. Against that optimism, the ongoing risk that large enterprise rollouts slip or underperform could have real consequences for PAR’s path to stronger revenue quality and margins, so it is worth weighing several viewpoints before forming a view.

Explore 3 other fair value estimates on PAR Technology - why the stock might be worth just $59.33!

Build Your Own PAR Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PAR Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PAR Technology's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026