- United States

- /

- Software

- /

- NYSE:PAR

PAR Technology (PAR): Evaluating Valuation After Q2 Earnings Beat and Mixed Growth Outlook

Reviewed by Kshitija Bhandaru

PAR Technology posted second-quarter results that beat expectations on both earnings and revenue, drawing attention from investors. However, the company’s guidance on annual recurring revenue growth has sparked some debate about its long-term trajectory.

See our latest analysis for PAR Technology.

PAR Technology’s share price has faced pressure recently, with the stock hitting a 52-week low and a year-to-date share price return of about -0.5%, even after its latest earnings surprise. Despite outperforming estimates on both EPS and revenue, mixed sentiment around annual recurring revenue growth has kept momentum muted. The one-year total shareholder return sits slightly negative. Over the longer term, the three-year total shareholder return remains in positive territory, suggesting some resilience despite recent volatility.

If you’re weighing opportunities beyond a single stock, consider expanding your search and discover fast growing stocks with high insider ownership.

After a sharp downturn and a notable earnings surprise, investors are left wondering whether PAR Technology presents a bargain at current levels or if the market is already factoring in the company’s future growth prospects.

Most Popular Narrative: 49% Undervalued

PAR Technology’s narrative fair value estimate is nearly double the latest close, setting up a bold case for future upside if projections hold true. Analyst consensus points to aggressive growth and margin improvement.

PAR's expanded, unified, cloud-native platform (including PAR OPS, Engagement Cloud, and AI-driven tools like Coach AI) is positioned to benefit from industry-wide modernization and demand for operational efficiency, automation, and actionable analytics. These are secular drivers that should support sustained ARR and earnings growth.

Curious how a cloud transformation and global expansion could unlock major profit potential? The real intrigue is in the narrative’s leap of faith on sustained growth and a future earnings multiple that is rarely seen outside tech’s biggest disruptors. Discover the surprising quantitative assumptions that shape this bullish target.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent rollout delays and heavy reliance on a few large enterprise contracts could quickly change the outlook if execution stumbles or if competitors gain ground.

Find out about the key risks to this PAR Technology narrative.

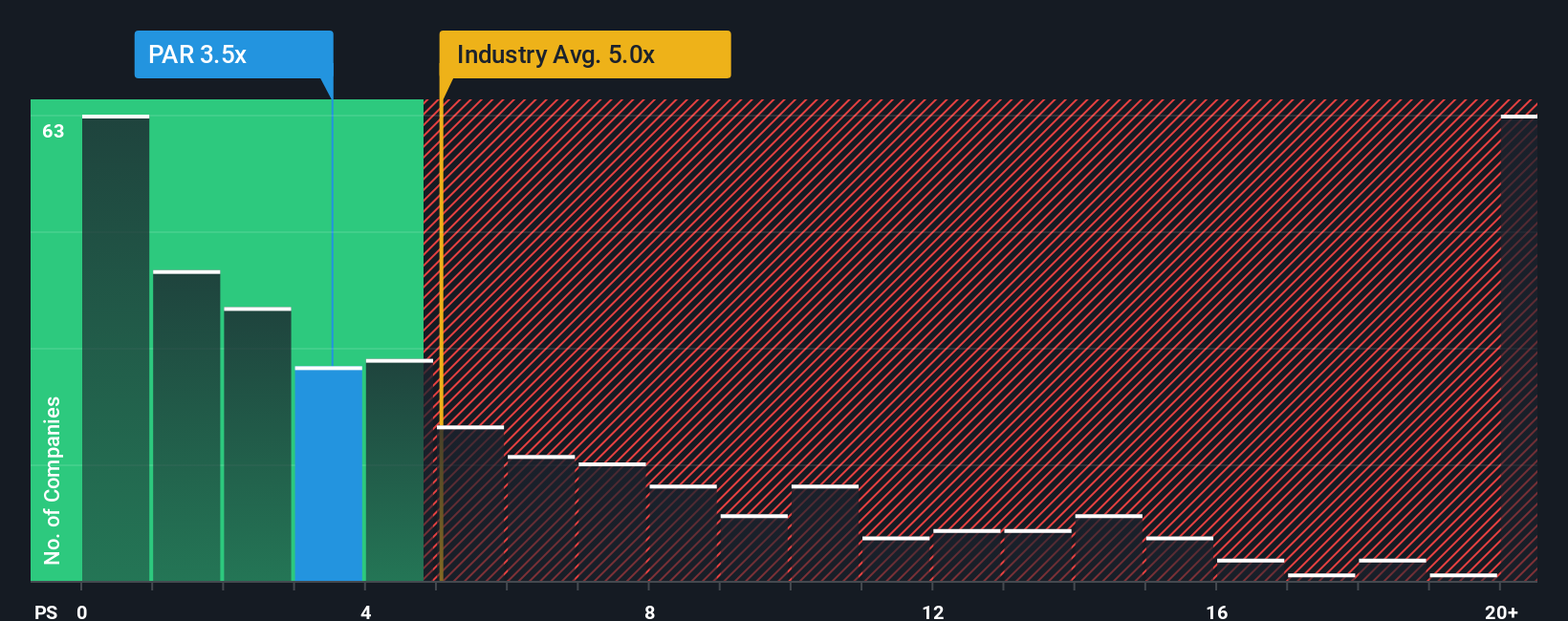

Another View: The Price-to-Sales Perspective

Looking through the lens of price-to-sales, PAR Technology trades at 3.8x sales, which is cheaper than both industry peers at 5.1x and the broader US Software group at 5.3x. However, this is still above its fair ratio of 2.7x, highlighting both opportunity and risk if markets re-rate. Could this gap close, or is it justified for a still-unprofitable business?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PAR Technology Narrative

If you prefer to conduct your own analysis or question these assumptions, it takes less than three minutes to explore the data yourself and form your own perspective, so why not Do it your way.

A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for one opportunity when there is a whole world of ambitious companies available. Get ahead with these powerful strategies and never miss what’s next:

- Uncover high-yield potential by tapping into these 19 dividend stocks with yields > 3%, where companies offer robust dividends and strong balance sheets.

- Accelerate your portfolio’s edge with these 24 AI penny stocks that are driving innovation in artificial intelligence and automation.

- Unlock real value by targeting these 900 undervalued stocks based on cash flows, featuring stocks trading below their intrinsic worth and positioned for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion