- United States

- /

- Software

- /

- NYSE:PAR

PAR Technology Deepens Restaurant Platform Push With Jack’s And Netchex

- PAR Technology (NYSE:PAR) has expanded its partnership with Jack’s Family Restaurants, which will roll out a unified platform for point of sale, payments, loyalty, and hardware across about 300 locations.

- The company has also broadened its integrations with workforce management provider Netchex, linking restaurant operations more tightly with payroll and HR systems for multi location operators.

PAR Technology is leaning into its role as a full stack restaurant tech provider at a time when its share price, at $21.58, reflects a tough stretch for investors. The stock is down 21.7% over the past week, 39.0% over the past month, and 39.6% year to date, with a 69.9% decline over the past year and a 74.3% decline over five years. These moves put extra focus on how effectively PAR can convert product traction and partnerships into long term value for shareholders.

For you as an investor, the Jack’s rollout and the deeper Netchex link show how PAR is working to make its platform stickier and more integrated across restaurant operations. The key questions ahead are how widely these solutions are adopted across existing and new customers, and how that adoption translates into contract wins, renewals, and broader ecosystem usage over time.

Stay updated on the most important news stories for PAR Technology by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on PAR Technology.

How PAR Technology stacks up against its biggest competitors

The expanded Jack’s Family Restaurants rollout positions PAR as more of a full-platform partner rather than a single-product vendor, which can deepen customer lock-in and support higher average revenue per location over time. In combination with the broader Netchex integration, PAR is leaning into a “front-of-house to payroll” workflow that can make its stack more attractive to multi-location operators evaluating alternatives such as Toast, Oracle MICROS, or Block’s Square ecosystem.

How this ties into the PAR Technology narrative

These agreements line up with the existing narratives that focus on bundled, cloud-based solutions and cross-sell across POS, payments, loyalty, and operations. For investors tracking PAR’s push into larger, multi-year deployments with brands like Papa Johns and Jack’s, this news fits the picture of a company trying to turn product breadth and integrations into more durable, software-led revenue from each restaurant customer.

Key risks and rewards to keep in mind

- Jack’s unified rollout across roughly 300 locations supports the idea that restaurant groups are willing to standardize on PAR’s multi-product stack when it solves complexity.

- The deeper Netchex link strengthens PAR’s ecosystem story, adding payroll and HR connectivity that can help it compete with end to end offerings from larger rivals.

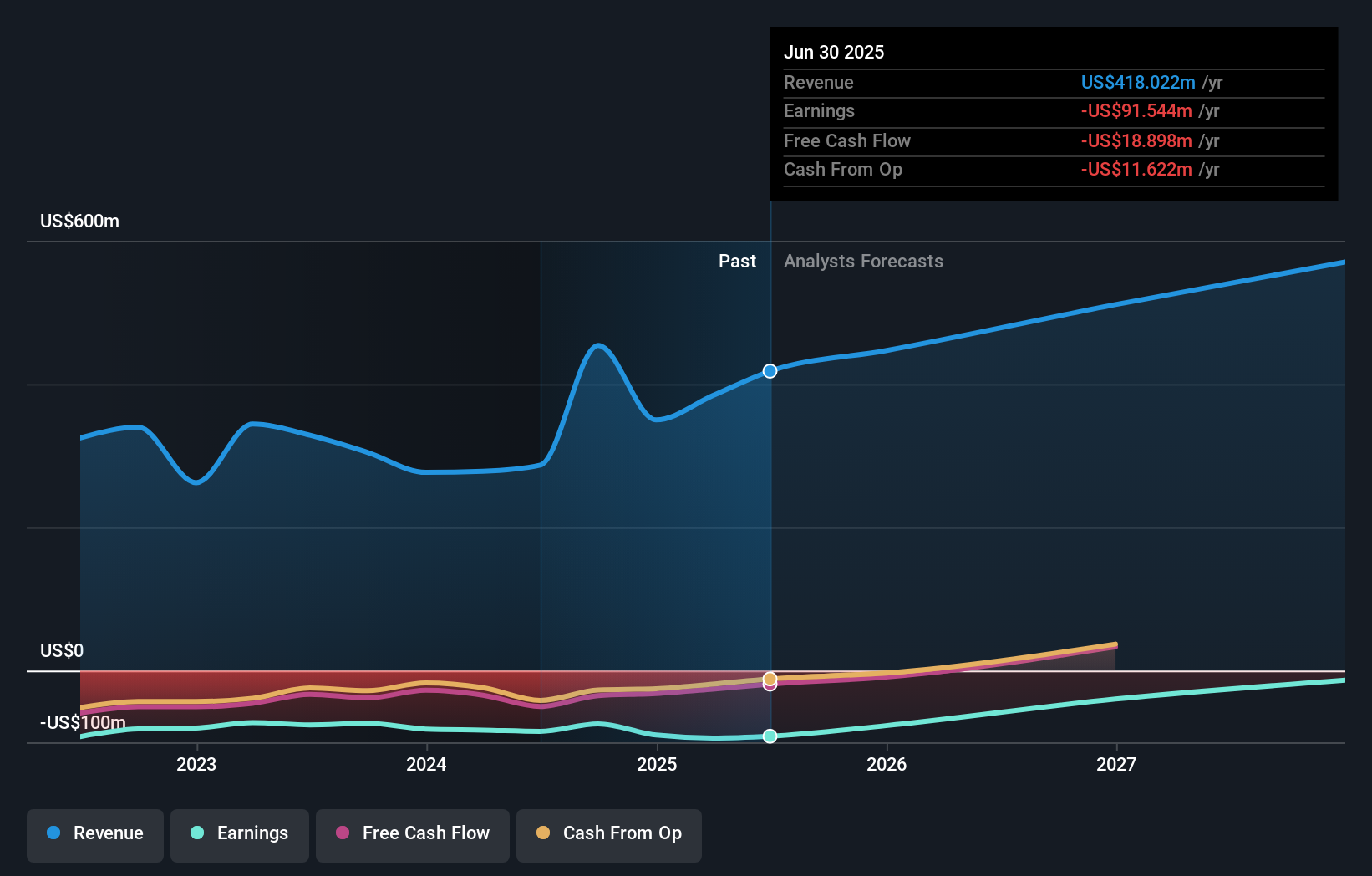

- PAR remains unprofitable and analysts do not expect profitability within the next 3 years, so investors still face execution risk around turning these partnerships into sustainable earnings.

- Heavy exposure to large rollouts and integrations means delays, client churn, or stronger competition from players like Toast or Oracle could weaken the long term payoff from deals like Jack’s.

What to watch from here

From here, you may want to watch how quickly Jack’s completes the rollout, whether PAR wins additional modules such as back office and analytics with existing clients, and how often Netchex powered integrations show up in new logo announcements. If you want to see how other investors are thinking about this shift toward a unified restaurant tech platform, take a look at the community narratives for PAR on this dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.