- United States

- /

- Software

- /

- NYSE:ORCL

What the TikTok Deal Means for Oracle Shares After Its 2025 Rally

Reviewed by Bailey Pemberton

Deciding what to do with Oracle stock right now feels a bit like standing at a crossroads, doesn’t it? If you’ve been tracking the recent price action, there’s a lot to unpack. Over the last month, Oracle saw a stunning 20.2% rally, even after dipping by 8.2% this past week. If you zoom out, the company’s shares have notched a jaw-dropping 70.7% gain so far this year and are up 383.4% over the past three years. That kind of performance puts Oracle in rare company among tech giants.

What’s behind these swings? The latest headlines have a lot to do with it. With Oracle poised to be a key investor and technology partner in the U.S. business of TikTok, news of evolving deals and potential regulatory hurdles have clearly fueled both optimism and bouts of caution. Investors are weighing the growth potential of Oracle’s expanded role in the high-profile social media space against the shifting risks as deals take shape. Plus, the company’s ongoing relevance in U.S. national security conversations only adds another layer to market sentiment.

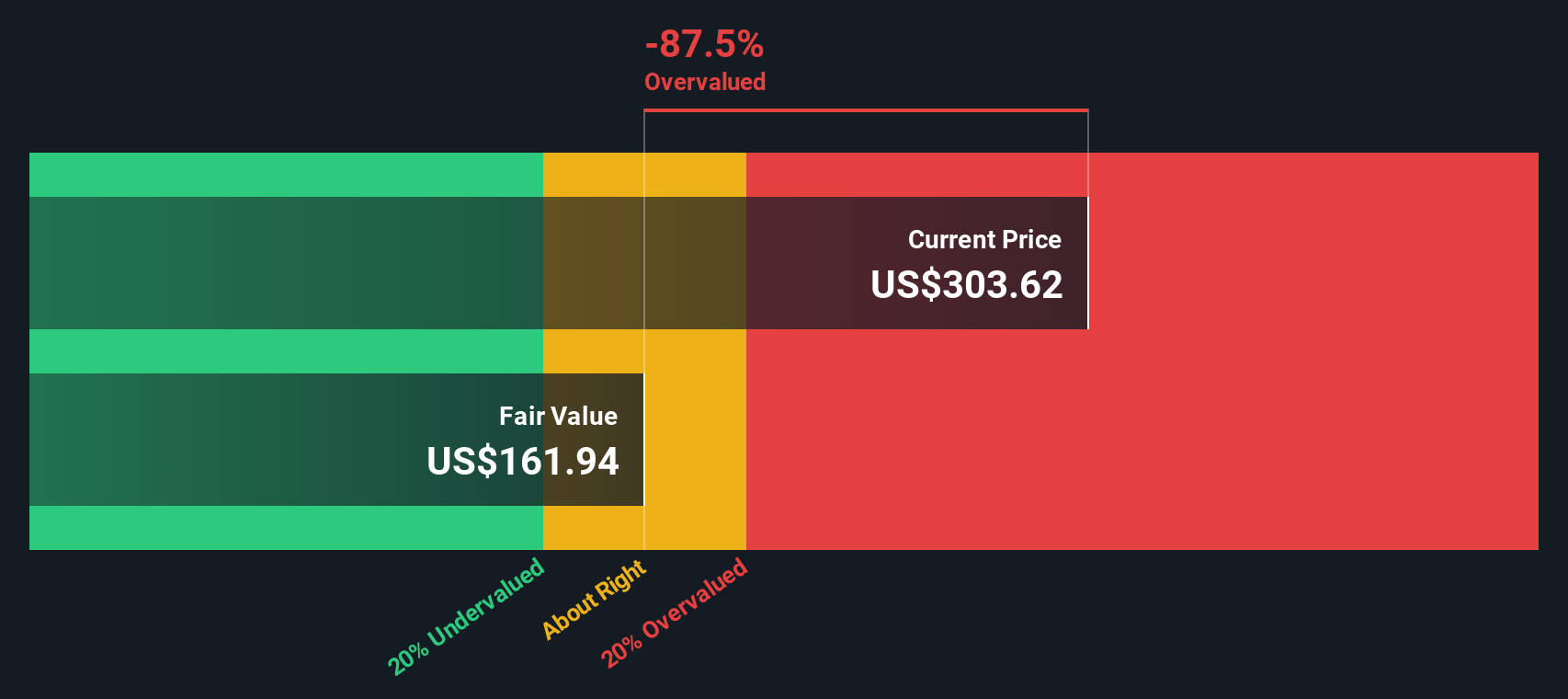

But, let’s face it, past performance and headline buzz only tell part of the story. If you’re trying to figure out whether Oracle’s current share price makes sense, a deeper dive into valuation is critical. Right now, Oracle scores a 1 out of 6 using a typical undervaluation checklist, which means most traditional metrics see it as a bit expensive at the moment. In the next sections, I’ll break down those valuation approaches one by one, and then wrap up with a perspective that cuts through the noise even better than standard checklists do.

Oracle scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Oracle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model calculates what a company's shares are really worth by projecting future cash flows and then discounting them back to today’s value. For Oracle, this analysis starts with today's Free Cash Flow, which stands at $5.84 billion. Looking ahead, analysts see a big jump, forecasting annual Free Cash Flow to reach $19.16 billion by 2030. It’s important to note that only the next five years are based on actual analyst estimates, with the rest extrapolated to offer a longer-term outlook.

When all of these projected cash flows are discounted to the present, the estimated intrinsic value per share comes out to $84.17. However, Oracle’s recent surge means the current market price sits about 236.8% above this calculated value. According to the DCF model, Oracle is currently trading well above what its cash flows would justify, even accounting for strong growth projections over the next decade.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Oracle.

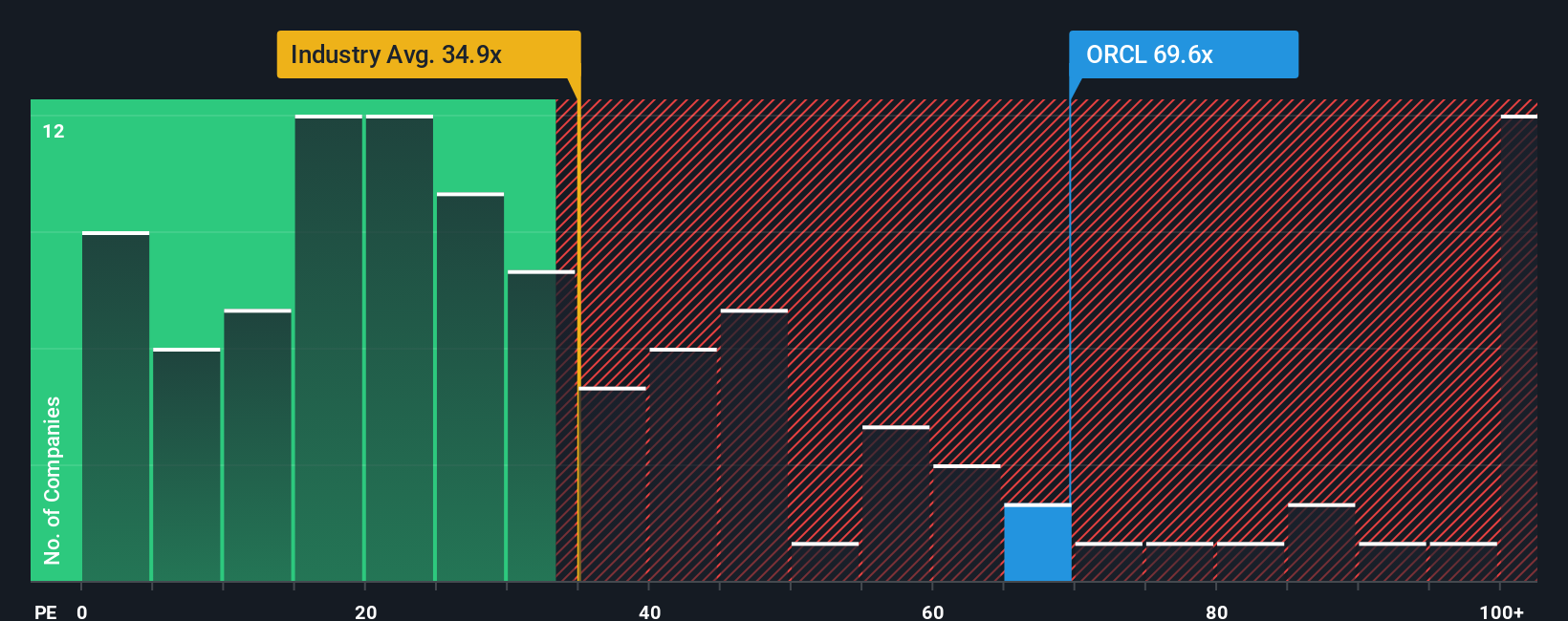

Approach 2: Oracle Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the go-to valuation tool for profitable companies like Oracle because it measures how much investors are willing to pay for each dollar of earnings. A higher PE can indicate expectations for strong growth, while a lower PE might signal more modest prospects or greater risks. Deciding what a "normal" PE should be depends on factors such as growth outlook, company risk, and how it compares to sector norms.

Currently, Oracle’s PE ratio stands at 64.7x, which is considerably higher than both the Software industry average of 36.0x and the peer average of 76.7x. On the surface, this premium might look steep, but Oracle’s consistent earnings and strong market position can partly justify a higher multiple. To refine this comparison, it helps to use the proprietary "Fair Ratio" from Simply Wall St, which blends key factors such as Oracle's expected growth, profit margins, market cap, and industry dynamics to calculate where the PE should reasonably sit.

According to Simply Wall St’s Fair Ratio, Oracle deserves a PE of 57.7x, which is below its current level. This customized benchmark goes deeper than a plain peer or industry comparison by weighing the company’s unique risk and growth story. Since Oracle’s actual PE exceeds its Fair Ratio by a meaningful margin, this approach signals the stock may be a bit rich at the moment.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Oracle Narrative

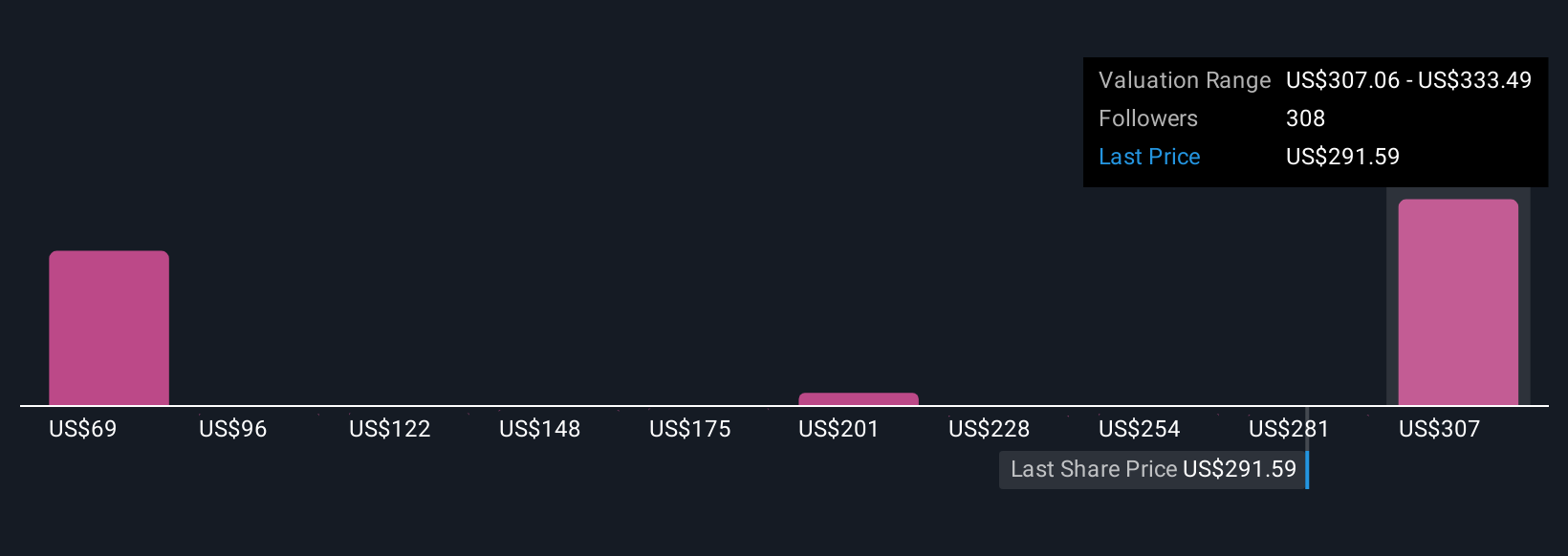

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a simple, dynamic approach that connects a company's story and future prospects directly to its financial forecasts and fair value. Narratives let investors combine their personal perspective on Oracle’s strengths, risks, and trajectory with assumptions about future revenue, margins, and valuation multiples, making investment decisions much more relevant and grounded than just following the numbers alone.

Available on Simply Wall St’s Community page, Narratives are easy to use and update in real time as new news or earnings arrive, so your view always adapts with the market. With Narratives, you can see at a glance how your fair value compares to Oracle’s live share price and quickly decide whether it’s a buy, hold, or sell, according to your unique story and assumptions. For example, some investors currently see Oracle’s fair value as high as $333, fueled by explosive AI-driven cloud demand, while others are more cautious, estimating a fair value closer to $212, reflecting concerns over competition and execution risks. This demonstrates that there is no one-size-fits-all answer.

For Oracle, however, we'll make it really easy for you with previews of two leading Oracle Narratives:

- 🐂 Oracle Bull Case

Fair Value: $333.49

Current share price is 15% below this fair value

Forecasted Revenue Growth: 29.94%

- Analysts expect Oracle’s AI and cloud offerings to drive industry-leading double-digit revenue growth, margin expansion, and record performance obligations via multi-year enterprise deals.

- Cloud infrastructure deployment, secure AI integration, and database migrations support higher contract values, more reliable revenues, and improved operating income.

- The bullish case assumes Oracle leverages AI tailwinds to deliver $99.5B revenue and $25.3B earnings in 2028, supporting consensus price targets well above today’s market price.

- 🐻 Oracle Bear Case

Fair Value: $212.00

Current share price is 33% above this fair value

Forecasted Revenue Growth: 14.39%

- This view sees Oracle as a leading player in enterprise cloud and AI integration but warns of intense competition from AWS, Azure, and Google Cloud, creating risks to market share and margins.

- Emphasizes that high debt levels and the capital intensity of global data center expansion could constrain flexibility and put pressure on free cash flow.

- Sees Oracle’s long-term growth as positive but believes the current market price already reflects these future expectations, which could make it vulnerable if growth falls short or competition intensifies.

The bottom line? Oracle draws passionate bulls and bears, with sharply different fair values, so take a look at both narratives above and decide which future you find more convincing.

Do you think there's more to the story for Oracle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion