- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Powers Tractian's AI Revolution As Stock Remains Flat

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently garnered attention following Tractian Technologies Inc.'s announcement on March 24, 2025, regarding the adoption of Oracle Cloud Infrastructure, aimed at enhancing Tractian’s AI solutions in manufacturing. Despite this positive development, Oracle's share price witnessed a minor 1% decline over the past week. This movement comes amidst a broader market rally driven by potential tariff changes and positive sentiments in the tech sector as major indices like the S&P 500 and Nasdaq rose. Meanwhile, Oracle's continual product expansion and partnerships indicate a robust growth strategy, notwithstanding the week's modest stock movement.

Buy, Hold or Sell Oracle? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 20 stocks are leading the charge.

The last five years have seen Oracle Corporation's total returns, combining share price appreciation and dividends, reach an impressive 225.89%. During this period, Oracle's strategic focus on expanding its cloud services through multi-cloud partnerships with AWS, Google, and Azure has been critical. March 2025 saw Lloyds Banking Group expand its database migration to Oracle's infrastructure, which seems to reflect Oracle's growing influence in the cloud sector. Furthermore, the company's substantial growth in remaining performance obligations to US$130 billion highlights robust demand for its cloud services.

In the past year, Oracle has outpaced the US Software industry, showcasing strong annual returns compared to an industry average of just 0.4%. Key product enhancements, such as the integration of AI in Oracle Cloud applications, have likely played a role in attracting new business. Additionally, Oracle's partnership with NVIDIA to develop sovereign AI solutions in March 2024 signifies a commitment to maintaining a competitive edge in technology infrastructure.

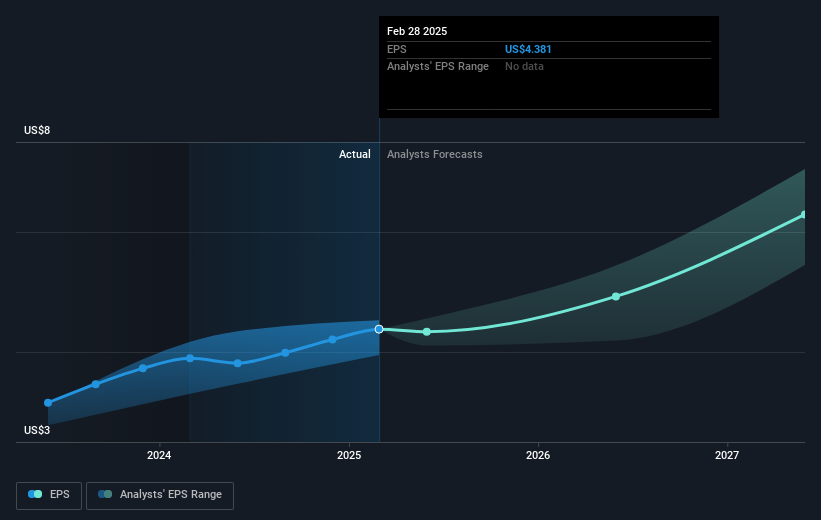

Examine Oracle's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives