- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Collaborates With U.S. Department Of Defense For Secure Cloud Infrastructure

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) saw a significant 13% increase in its share price over the past week, possibly bolstered by several recent announcements. Notably, the availability of SONIFI's SORA on the Oracle Cloud Marketplace reflects the company's ongoing expansion in cloud services, enhancing guest experience technologies. Additionally, Oracle's collaboration with the U.S. Department of Defense to provide secure cloud infrastructure aligns with its strategic growth ambitions in government contracts, likely adding further investor optimism. Despite the broader market posting gains, Oracle's focused initiatives, especially in cloud integration and defense sector engagements, might have contributed to its outperformance.

You should learn about the 1 possible red flag we've spotted with Oracle.

The recent developments at Oracle, such as the integration of SONIFI's SORA on its Cloud Marketplace and the strategic collaboration with the U.S. Department of Defense, are likely to positively influence Oracle's expanding cloud services narrative. These initiatives could drive both revenue and earnings forecasts by strengthening Oracle's position in sectors like cloud integration and defense contracts. Given the company's emphasis on cloud expansion and strategic partnerships, these factors could enhance Oracle's competitive edge and fuel growth in AI demand and database migration.

Over the past five years, Oracle's total shareholder return, including share price and dividends, has been 188.18%, reflecting significant growth. For context, over the past year, Oracle outperformed the US Market, which returned 7.5%. This long-term growth demonstrates Oracle's resilience and adaptability in the rapidly evolving technology sector. The company's increased investment in infrastructure and substantial growth in performance obligations underscore continuing strong demand and future growth prospects.

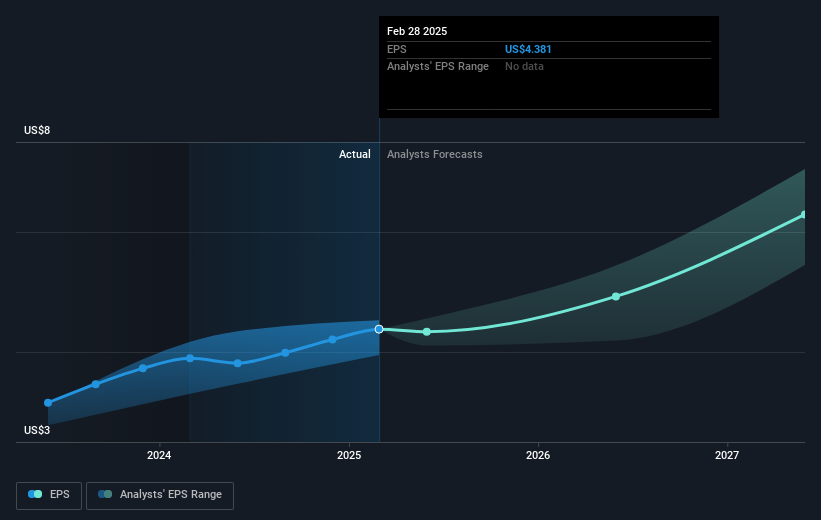

While the recent 13% share price increase boosts confidence, it’s essential to consider this in relation to the analyst consensus price target of US$178.12. Currently, Oracle trades at a discount of just over 28% to this target, highlighting potential upward momentum. Moreover, the price target is based on forecasts of US$86.7 billion in revenue and US$19.5 billion in earnings by 2028. Investors should assess these predicted outcomes against their own insights into Oracle's strategic advancements and market trends.

Explore Oracle's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives