- United States

- /

- Software

- /

- NYSE:OOMA

Is Ooma (NYSE:OOMA) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ooma, Inc. (NYSE:OOMA) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Ooma

How Much Debt Does Ooma Carry?

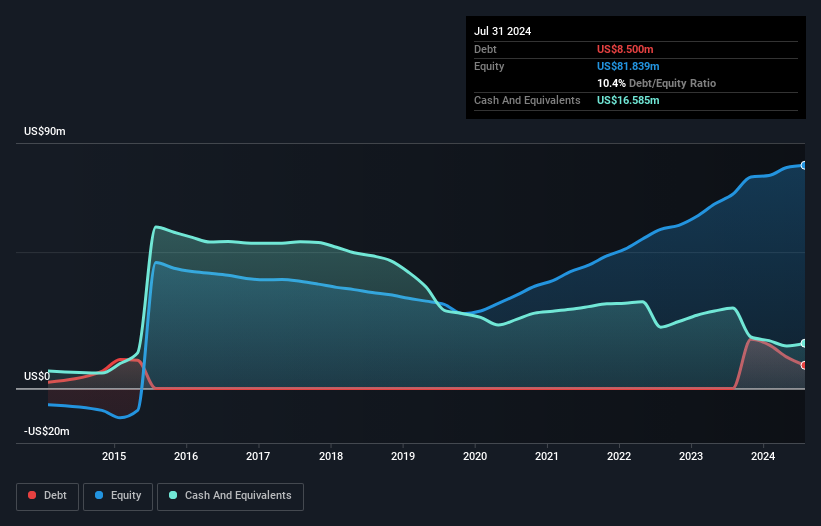

The image below, which you can click on for greater detail, shows that at July 2024 Ooma had debt of US$8.50m, up from none in one year. However, its balance sheet shows it holds US$16.6m in cash, so it actually has US$8.09m net cash.

How Healthy Is Ooma's Balance Sheet?

The latest balance sheet data shows that Ooma had liabilities of US$48.5m due within a year, and liabilities of US$21.2m falling due after that. Offsetting this, it had US$16.6m in cash and US$8.19m in receivables that were due within 12 months. So it has liabilities totalling US$44.9m more than its cash and near-term receivables, combined.

Given Ooma has a market capitalization of US$354.0m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Ooma also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Ooma's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Ooma wasn't profitable at an EBIT level, but managed to grow its revenue by 8.7%, to US$248m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Ooma?

Although Ooma had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$12m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Ooma , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OOMA

Ooma

Provides communications services and related technologies for businesses and consumers in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion