- United States

- /

- Software

- /

- NYSE:OOMA

Is Ooma (NYSE:OOMA) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Ooma, Inc. (NYSE:OOMA) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Ooma

What Is Ooma's Debt?

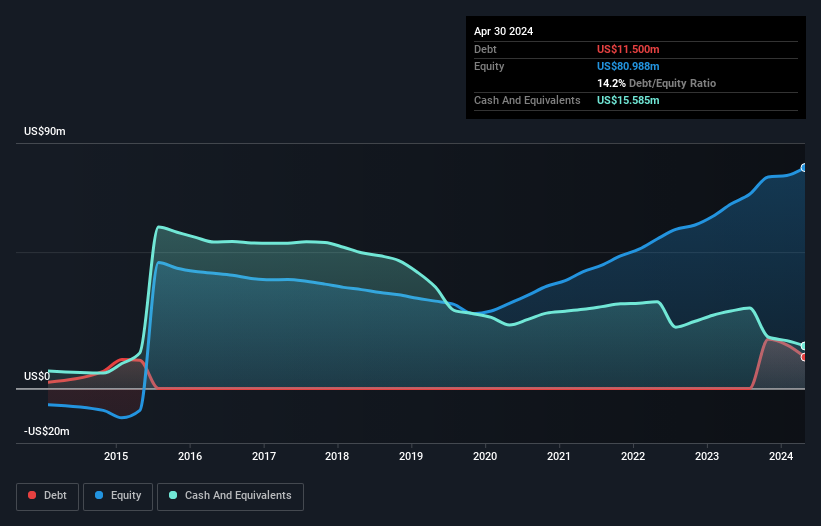

The image below, which you can click on for greater detail, shows that at April 2024 Ooma had debt of US$11.5m, up from none in one year. However, its balance sheet shows it holds US$15.6m in cash, so it actually has US$4.09m net cash.

A Look At Ooma's Liabilities

The latest balance sheet data shows that Ooma had liabilities of US$49.4m due within a year, and liabilities of US$24.8m falling due after that. On the other hand, it had cash of US$15.6m and US$10.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$47.8m.

Of course, Ooma has a market capitalization of US$258.9m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Ooma also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Ooma can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Ooma wasn't profitable at an EBIT level, but managed to grow its revenue by 8.8%, to US$242m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Ooma?

Although Ooma had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$8.3m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Ooma that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OOMA

Ooma

Provides communications services and related technologies for businesses and consumers in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion