- United States

- /

- Software

- /

- NYSE:NOW

What Recent AI Partnerships Mean for ServiceNow’s 2025 Valuation Outlook

Reviewed by Bailey Pemberton

So you are wondering what to do with your ServiceNow shares, or whether now is the right time to start a position. It is a question plenty of investors are asking, especially as ServiceNow’s stock has felt both the energy and the jitters from wider tech sector swings. Over the past week, shares have dipped by 0.9%, while the last month is almost flat at -0.1%. Bigger picture, the stock is up a modest 2.2% over the past year, but if you zoom out to three and five years, ServiceNow’s returns jump to 117.5% and 83.3%, respectively. That kind of long-term trajectory tells a story of remarkable growth potential. This is perhaps why markets continuously debate if the stock is overvalued or if it still has room to run.

That brings us to valuation, which is the crux of the debate around ServiceNow right now. Is it still worth buying at current prices, or should you expect more turbulence as the market figures out what this company is truly worth? Based on six widely used valuation checks, ServiceNow scores a 1 out of 6 for being undervalued, pointing toward a somewhat premium price tag. But each method tells its own story, and in the next section, I will break down what those valuation checks mean for investors and hint at why there might be an even sharper way to slice this analysis before we are done.

ServiceNow scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ServiceNow Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method aims to answer what the business is logically worth, based on how much cash it is expected to generate.

For ServiceNow, the current Free Cash Flow stands at about $3.76 billion. Analyst estimates project strong growth over the coming years, forecasting Free Cash Flow to reach roughly $9.04 billion by 2029. It is worth noting that while analysts typically provide projections only for the next five years, further forecasts beyond that horizon are extrapolated based on growth trends from Simply Wall St.

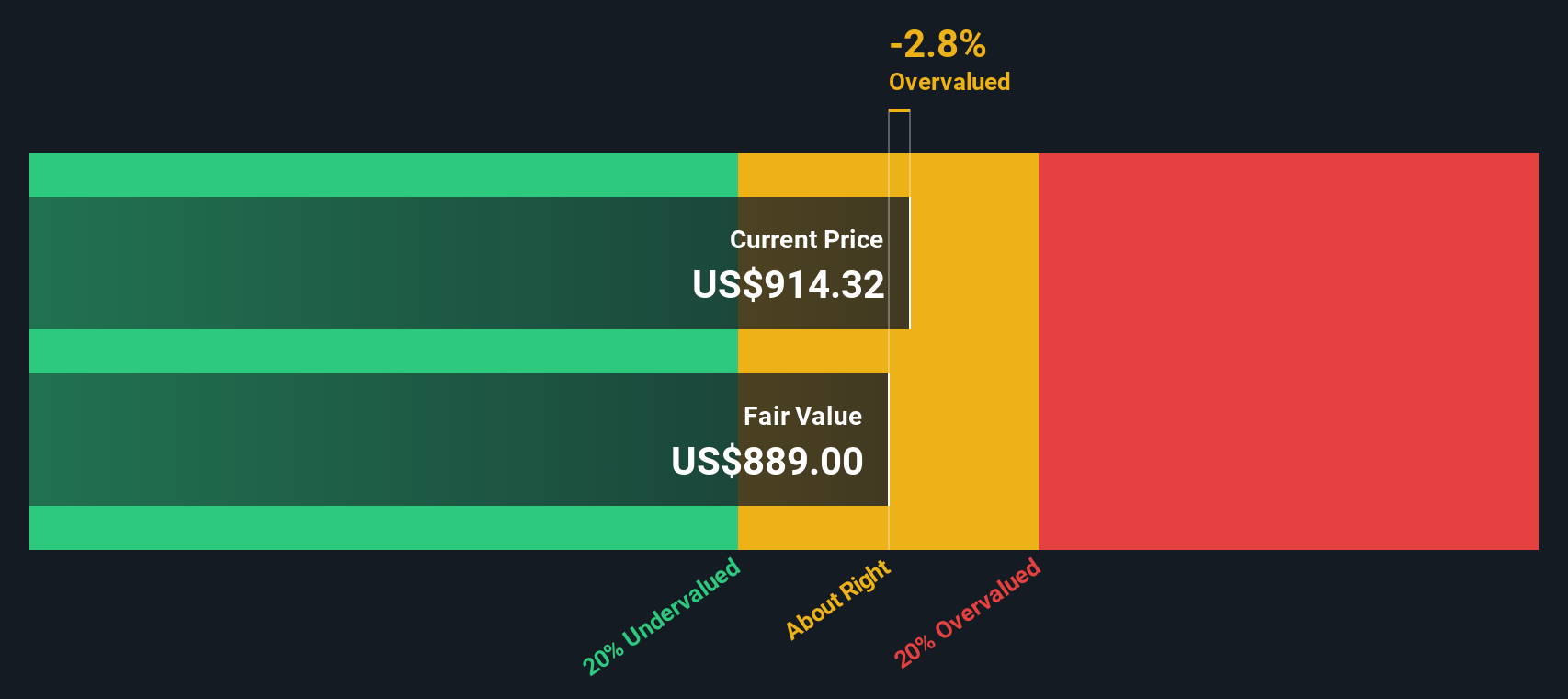

Based on these projections, the DCF analysis calculates an intrinsic value of $883.13 per share. When compared to the current stock price, this suggests the shares are about 3.1% overvalued. While this points to a slight premium, the difference is modest and within a normal margin of error for valuation models.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ServiceNow's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ServiceNow Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it directly relates a company’s current share price to its per-share earnings. When a company is delivering consistent profits, the PE ratio serves as a simple yardstick for how much investors are willing to pay for each dollar of earnings. It is a great way to compare companies across different sizes and industries, especially when you are assessing whether future growth is already reflected in a stock’s price.

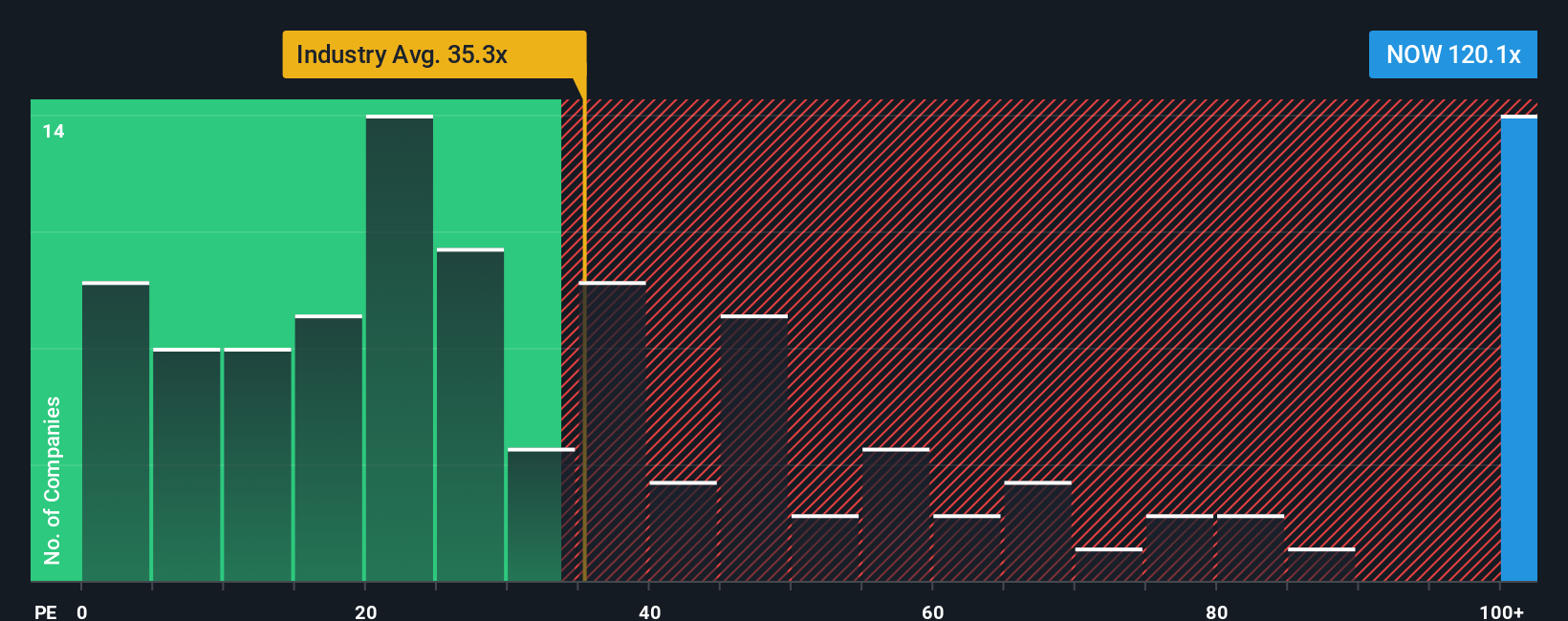

However, not all PE ratios are created equal. High-growth companies typically trade on higher PE multiples because investors are willing to pay a premium for the potential of future earnings expansion. In contrast, riskier companies or those with slow growth usually see lower PE ratios. What is “normal” for one business may not be fair for another, and context matters.

Currently, ServiceNow is trading at a PE ratio of 113.7x, which stands out against the software industry average of 35.6x and the peer group average of 62.3x. Simply Wall St’s Fair Ratio for ServiceNow is calculated at 50.1x, which factors in the company’s expected earnings growth, industry dynamics, profit margins, market cap, and associated risks. This Fair Ratio offers a more refined yardstick than simply comparing with peers or the broad sector, as it tailors the benchmark to ServiceNow’s unique fundamentals.

With its current multiple nearly double the Fair Ratio, ServiceNow’s stock appears to be trading at a premium relative to its growth outlook and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your ServiceNow Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. This approach helps you weave your perspective about a company’s future into an actionable investment plan. A Narrative is more than just a number; it is your story of what you believe ServiceNow can achieve, pairing your expectations around future revenue, profits, and margins with a tailored fair value.

Narratives connect the dots between a company’s business story, financial forecast, and what you think its shares should be worth right now. On Simply Wall St’s Community page, investors of all experience levels can easily build or adopt Narratives to check if the current share price aligns with their own outlook. This makes it simpler to decide when to buy or sell.

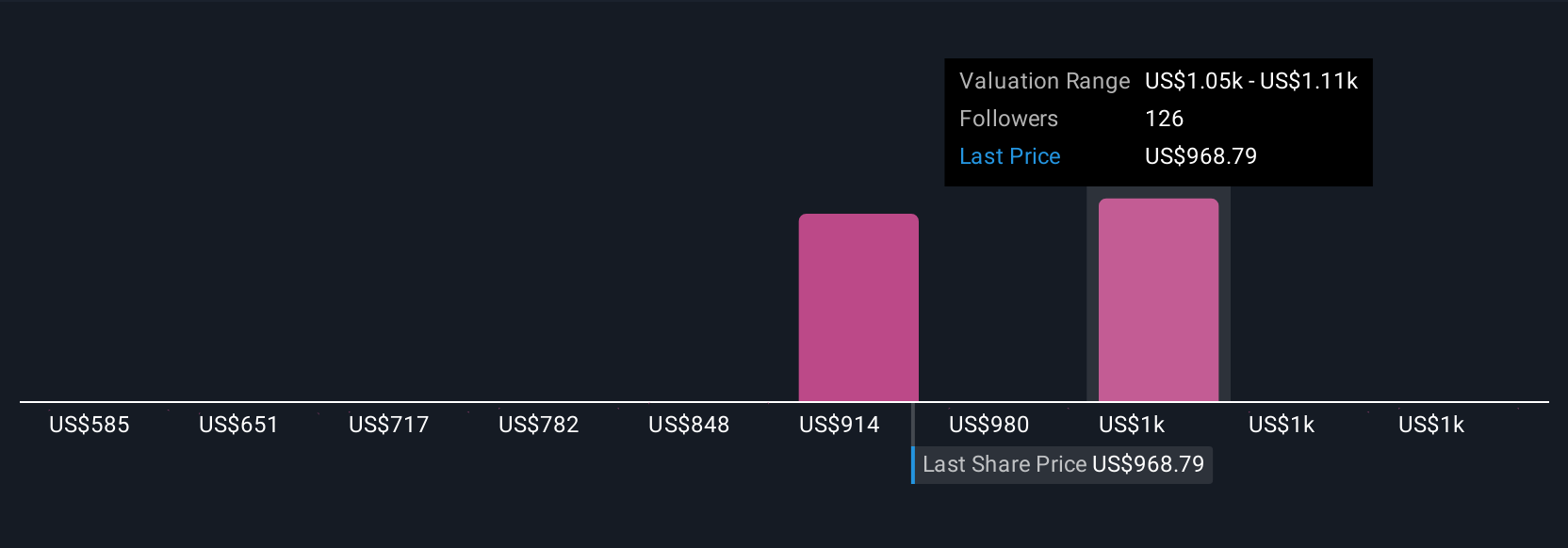

What makes Narratives powerful is that they update automatically when big news or fresh earnings land, so your investment view evolves as fast as the market does. For example, one investor’s Narrative might see ServiceNow reaching $1,242 per share on the back of rapid AI and CRM expansion with rising profit margins, while another may estimate just $904 if they expect margin pressure or risks from new pricing models. There is no single answer, only your unique path.

For ServiceNow, we will make it easy for you with previews of two leading ServiceNow Narratives:

Fair Value: $1,142.59

Implied Undervalued: 20.4%

Projected Revenue Growth: 18.9%

- AI focus and targeted acquisitions are expected to drive significant revenue growth and margin expansion. This will be supported by new product launches, CRM expansion, and a strong push into public sector digital transformation.

- Bullish analysts estimate profit margins will rise to 16.2%, with annual earnings potentially doubling by 2028. This scenario would require the stock to trade on a high PE ratio if forecasts prove correct.

- Main risks include dependency on U.S. government contracts, macroeconomic uncertainty, and the need for successful integration of acquisitions and ongoing AI initiatives.

Fair Value: $904.36

Implied Overvalued: 0.7%

Projected Revenue Growth: 17.5%

- Emphasis on AI adoption and a new hybrid pricing model could slow near-term revenue and earnings growth. Monetization may be delayed as customers transition to consumption-based pricing.

- Profit margins are projected to decline rather than rise, with competitive and currency pressures affecting pricing, and investments in data centers and R&D holding back short-term profitability.

- Risks include challenges with adoption of the hybrid model, delayed "hockey stick" AI growth, and macroeconomic or competitive headwinds that could impact both revenue predictability and market share.

Do you think there's more to the story for ServiceNow? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives