- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) shareholders are still up 694% over 5 years despite pulling back 6.3% in the past week

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. To wit, the ServiceNow, Inc. (NYSE:NOW) share price has soared 694% over five years. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 13% gain in the last three months. It really delights us to see such great share price performance for investors.

Although ServiceNow has shed US$8.3b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for ServiceNow

We don't think that ServiceNow's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years ServiceNow saw its revenue grow at 28% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 51% per year in that time. It's never too late to start following a top notch stock like ServiceNow, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

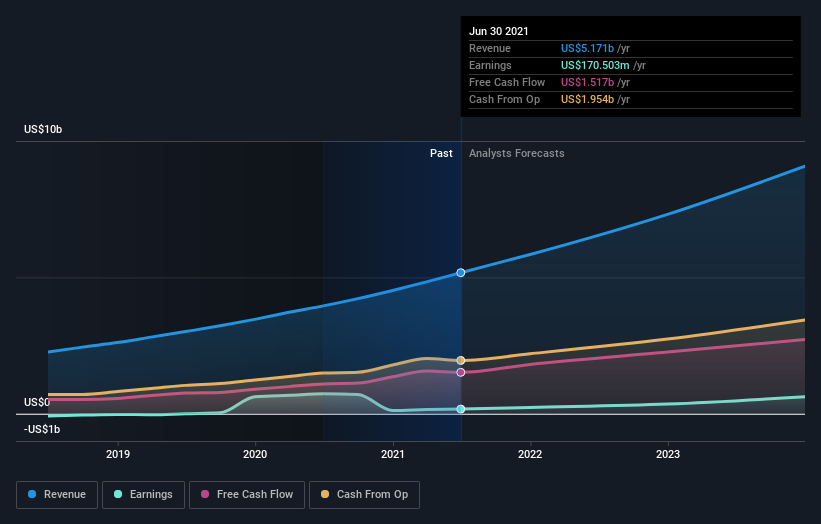

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

ServiceNow is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

ServiceNow shareholders have received returns of 26% over twelve months, which isn't far from the general market return. It has to be noted that the recent return falls short of the 51% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes ServiceNow a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for ServiceNow that you should be aware of.

We will like ServiceNow better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NOW

ServiceNow

Provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.