- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NOW): Evaluating Valuation After a Surge of AI Launches and Strategic Growth Partnerships

Reviewed by Simply Wall St

If you have been watching ServiceNow (NOW) lately, there has been no shortage of news. In just the past week, the company announced a slew of deals and product launches, from the much-anticipated Zurich AI platform release to eye-catching partnerships that expand ServiceNow’s reach across government and global enterprise clients. These updates could reshape how investors view ServiceNow, especially as it takes a visible lead in the surge toward AI-enabled workflow automation.

The stock’s performance has reflected this burst of strategic activity. After a stretch of slow gains, ServiceNow has picked up momentum, delivering steady growth in the past month, even as year-to-date returns remain muted. Long-term shareholders have still been rewarded, with the three-year performance handily outpacing the broader market. While new partnerships and expansion plans build on ServiceNow’s reputation, the recent rally hints that investors may be pricing in these future opportunities.

The real question now is whether this run of good news has made ServiceNow a buy at today’s levels, or if the market is already factoring in a bright future for the stock.

Most Popular Narrative: 18.4% Undervalued

According to the most widely followed market narrative, analysts see ServiceNow as significantly undervalued, with current prices well below fair value estimates based on future growth projections.

Expansion into CRM and industry workflows, supported by AI-powered improvements, could significantly boost earnings by capturing higher-value deals and expanding the company’s addressable market. Strategic growth in the public sector, particularly with government transformation initiatives, positions ServiceNow for substantial long-term opportunities. This could lead to revenue stability and growth even in uncertain economic conditions.

Curious how this bullish outlook comes together? The secret sauce of this narrative is a head-turning combination of ambitious earnings growth, bigger profit margins, and a hefty multiple that rivals the market’s top-tier tech names. Want to uncover the numbers driving that double-digit upside to fair value? There’s more under the hood than meets the eye.

Result: Fair Value of $1,143 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including execution hurdles as ServiceNow enters new markets and potential revenue slowdowns if U.S. government contracts face budget cuts.

Find out about the key risks to this ServiceNow narrative.Another View: How Does the Market Compare?

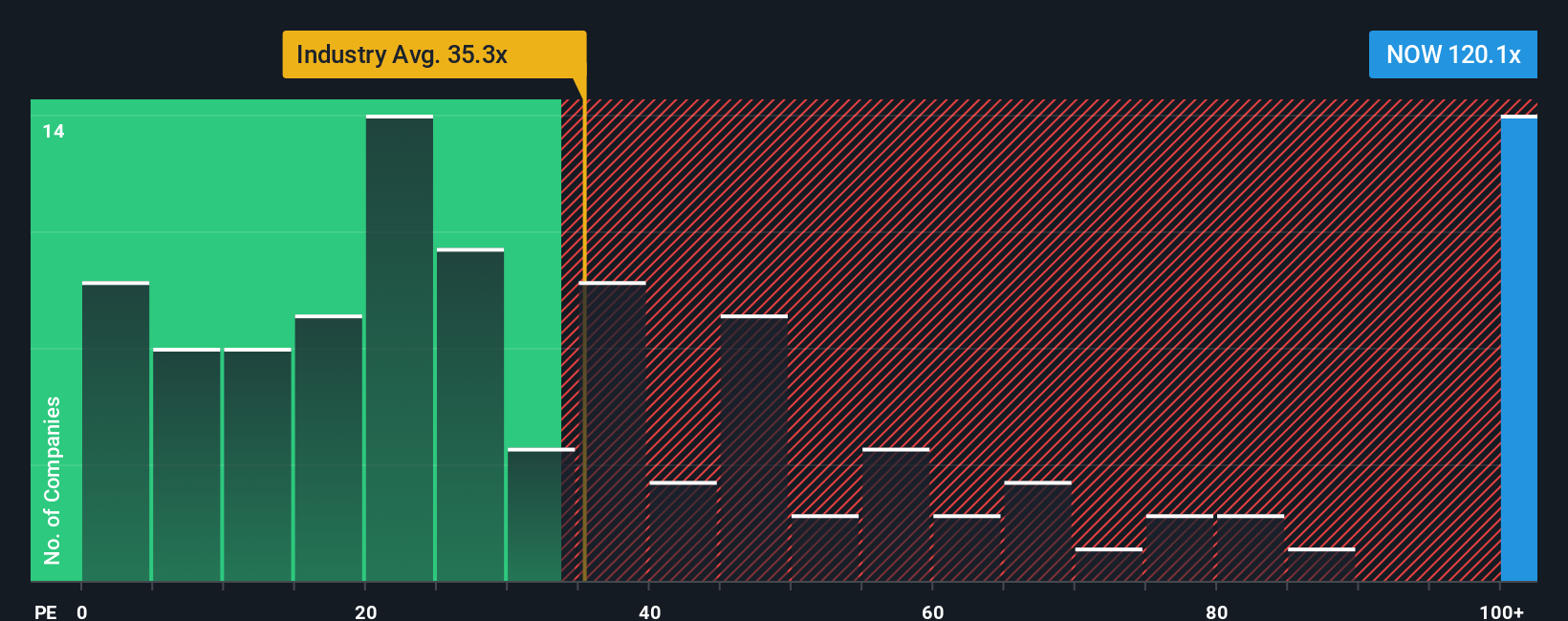

On the flip side, if we look at how ServiceNow is priced relative to the broader industry, the company’s valuation appears much steeper than its peers. This raises a fresh point: is growth alone enough to justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you’re ready to dig into the details or want to challenge the consensus, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Don’t let your next big idea slip away. Step up your search with handpicked lists that spotlight tomorrow’s leaders and smart value picks, all tailored to your interests.

- Accelerate your portfolio’s tech edge by tapping into fast-moving innovation and rising startups with AI penny stocks leading the charge in artificial intelligence.

- Unlock overlooked gems positioned for growth by hunting through undervalued stocks based on cash flows that trade below their potential. This gives you a real shot at bargain opportunities.

- Level up your future-focused strategy and gain an early seat at the table with quantum computing stocks as it pushes boundaries in breakthrough computing and next-gen research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives