- United States

- /

- Entertainment

- /

- NYSE:SPOT

US High Growth Tech Stocks To Watch For Potential Gains

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it has risen by 14% over the past 12 months with earnings expected to grow by 15% per annum in the coming years. In this context of steady market performance and anticipated growth, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation, scalability potential, and resilience in evolving market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.13% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.33% | 105.07% | ★★★★★★ |

Click here to see the full list of 224 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Netflix (NFLX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Netflix, Inc. offers entertainment services with a market capitalization of $532.10 billion.

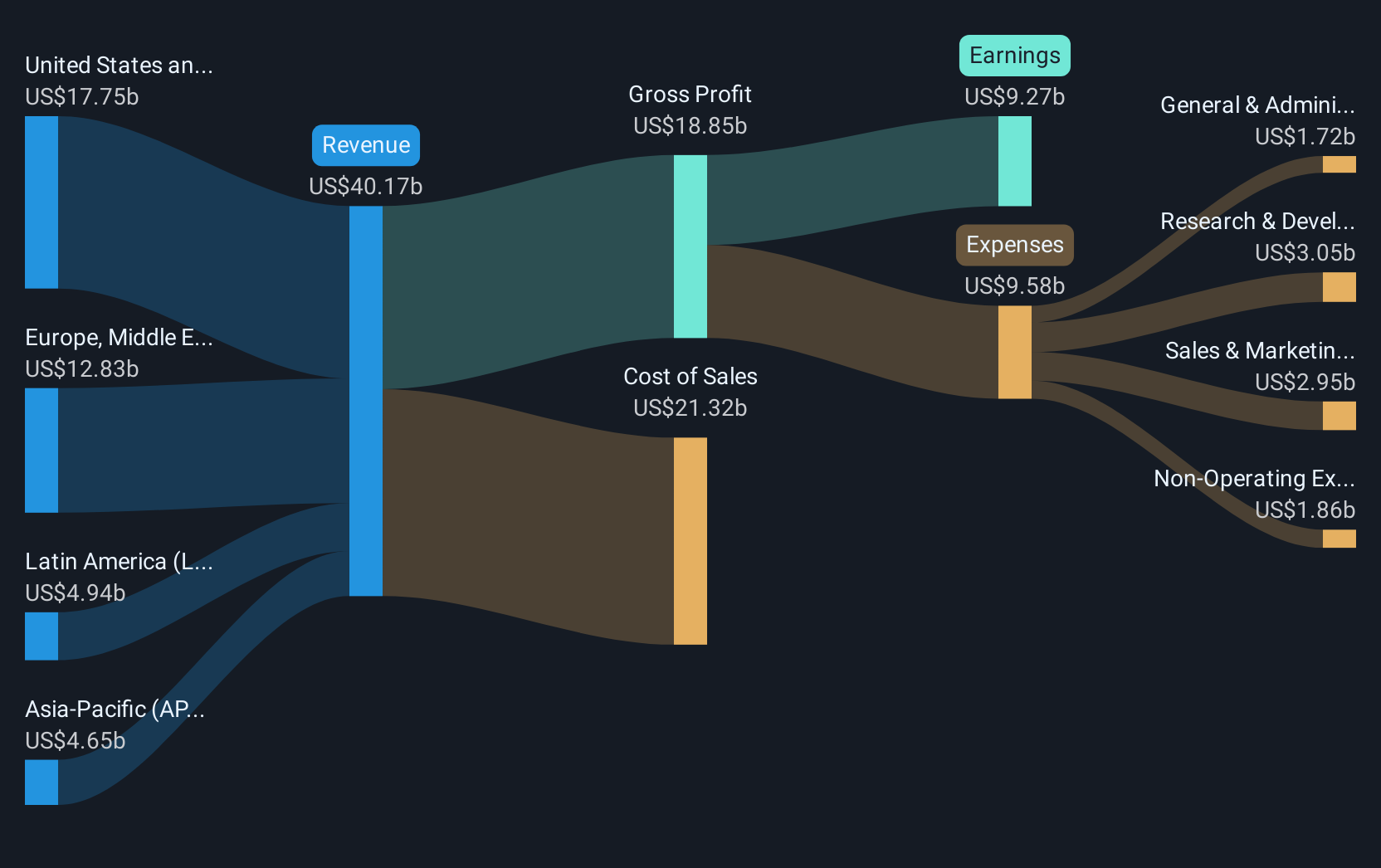

Operations: The company's primary revenue stream is its streaming entertainment service, generating $40.17 billion.

Netflix has demonstrated robust financial performance with a 44.1% increase in earnings over the past year, significantly outpacing the Entertainment industry's average. The company's strategic focus on R&D is evident from its substantial investment, ensuring continuous innovation and enhancement of its service offerings. This commitment is further underscored by recent strategic alliances and expansions, such as the introduction of Netflix House and partnerships for content distribution in France, which are set to enrich user experience and expand market reach. These initiatives complement Netflix's impressive revenue growth forecast at 10.5% annually, outstripping broader market projections.

- Click to explore a detailed breakdown of our findings in Netflix's health report.

Gain insights into Netflix's past trends and performance with our Past report.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market capitalization of $65.79 billion.

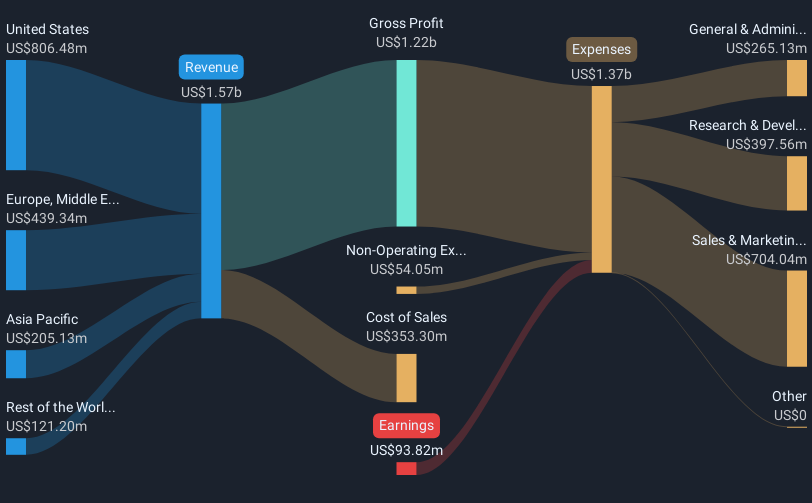

Operations: Cloudflare generates revenue primarily from its Internet Telephone segment, which amounted to $1.77 billion.

Cloudflare's recent initiatives underscore its strategic focus on enhancing cybersecurity and operational efficiency. The company's introduction of settings to block unauthorized AI crawlers marks a pioneering step towards protecting digital content creators, potentially reshaping internet economics. Additionally, Cloudflare's Log Explorer tool has been broadly adopted, reflecting its commitment to reducing complexity and costs in IT security management. These efforts complement the firm’s financial trajectory with a forecasted revenue growth of 19.6% per year and an anticipated profitability within three years, showcasing its potential in a rapidly evolving tech landscape.

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. is a global provider of audio streaming subscription services, with a market capitalization of $144.68 billion.

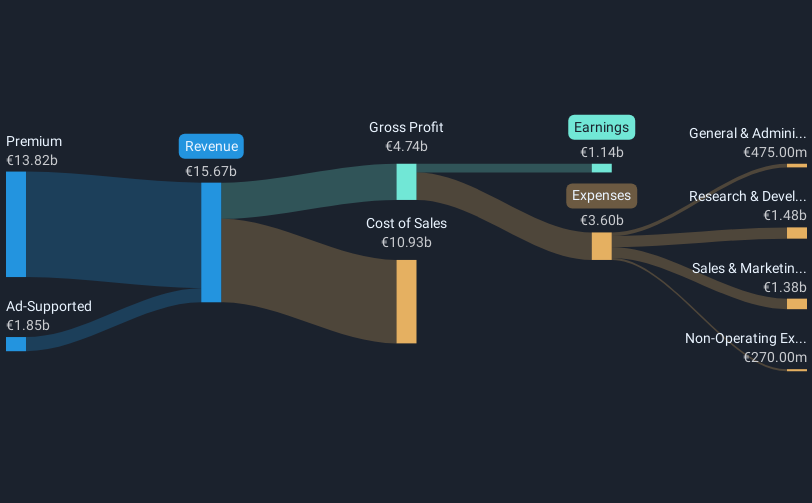

Operations: Spotify generates revenue primarily through its Premium subscription service, which accounts for €14.34 billion, and an ad-supported segment contributing €1.88 billion.

Spotify Technology has demonstrated a robust financial and operational performance, with first-quarter sales rising to EUR 4.19 billion from EUR 3.64 billion year-over-year, and net income increasing to EUR 225 million from EUR 197 million. This growth is complemented by an earnings forecast predicting a revenue of $4.3 billion for the upcoming quarter, reflecting a sustained upward trajectory. The company’s strategic presentations at industry conferences, like the Snowflake Summit and Web Summit Rio, underscore its commitment to innovation and market expansion in digital music streaming—a sector poised for continued growth amid evolving consumer media consumption habits.

Key Takeaways

- Gain an insight into the universe of 224 US High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)