- United States

- /

- IT

- /

- NYSE:NET

Is Cloudflare’s Rally Justified After Shares Soar Over 170% This Year?

Reviewed by Bailey Pemberton

If you are wondering whether to jump into Cloudflare stock or take some profits off the table, you are not alone. The past year has been nothing short of remarkable for Cloudflare shareholders, with the stock surging 174.6% over the last 12 months and an eye-popping 330.1% over the past three years. Even in just the past week and month, the stock has managed to climb 1.1% and 3.1%, respectively. Investors continue to reward Cloudflare for its role in powering the backbone of the modern internet, as demand for digital security and performance surges with every fresh wave of market optimism.

It is these kinds of moves that get everyone talking. Cloudflare has fast become a market darling, capturing headlines as a poster child for durable tech growth. But as the price keeps rising, so do the questions about whether it has gone too far, too fast. In valuation terms, Cloudflare sports a value score of zero out of six on our usual checklist of undervalued metrics. This means it does not look attractively priced by traditional standards right now.

Still, that does not mean investors should walk away just yet. A deeper look at how valuation is typically measured, and why those methods sometimes miss the bigger picture, is coming up. Stay tuned, because we will close with a practical angle on what valuation really means for Cloudflare today.

Cloudflare scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

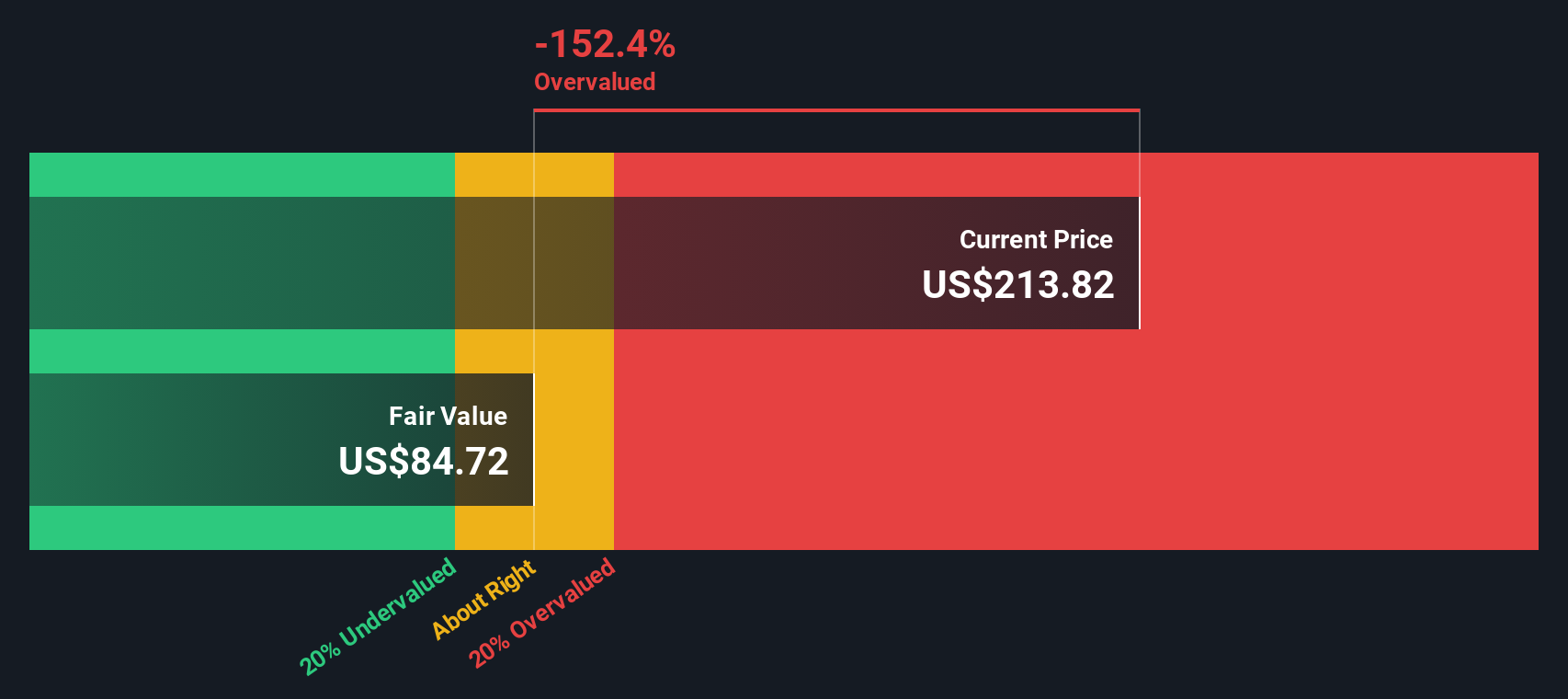

Approach 1: Cloudflare Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This method is one of the most widely used approaches for valuing growth businesses, as it attempts to capture both near-term performance and long-term opportunities.

For Cloudflare, the latest trailing twelve month Free Cash Flow (FCF) stands at $226 million. Analysts project significant growth in FCF, expecting it to reach $1.24 billion by 2029. Further out, extrapolations suggest FCF could exceed $2.7 billion by 2035, although the most reliable estimates only go out about five years.

Based on these detailed projections and discounting them to present value, Cloudflare's estimated intrinsic value is $84.39 per share. When compared to the current share price, this implies the stock is trading at a hefty 161.9% premium according to the DCF model. In other words, the price investors currently pay is well above what the cash flow projections alone would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cloudflare may be overvalued by 161.9%. Find undervalued stocks or create your own screener to find better value opportunities.

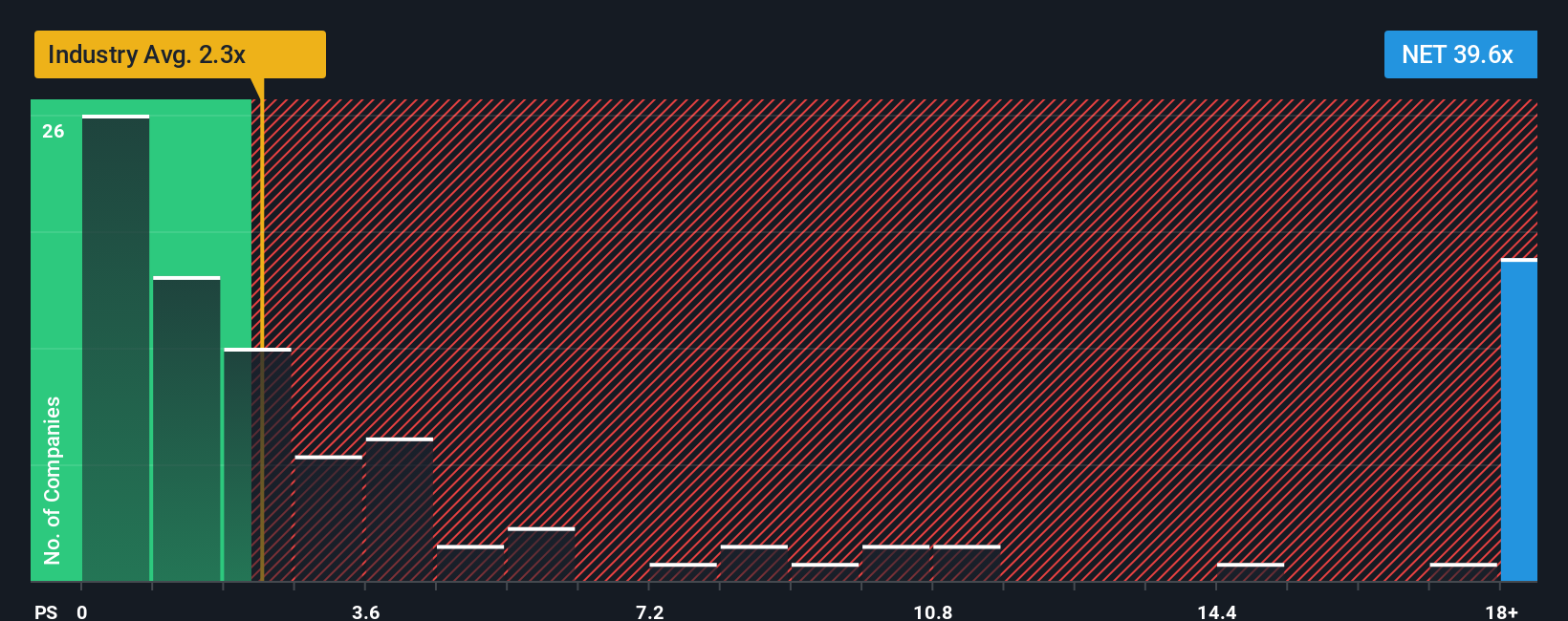

Approach 2: Cloudflare Price vs Sales

For companies like Cloudflare that are experiencing rapid growth but are not yet consistently profitable, the Price-to-Sales (P/S) ratio is a preferred valuation metric. This ratio is especially useful because it focuses on revenue, which is less susceptible to accounting adjustments and can provide a clearer picture of market expectations for expanding businesses. Growth prospects and risk both play a role in determining what P/S ratio is “normal.” Fast-growing or less risky companies often command much higher multiples than slow-growing or mature businesses.

Cloudflare currently trades on a Price-to-Sales ratio of 40.94x, which stands out as one of the highest among its peers. For comparison, the average P/S ratio across the IT industry is just 2.40x, and direct peers average 18.20x. Such a wide gap reflects the market’s expectations for Cloudflare’s future expansion and profit potential, but it also signals increased risk if growth ever disappoints.

Simply Wall St’s proprietary “Fair Ratio” is a more nuanced benchmark, representing the P/S multiple one might expect for Cloudflare given its strong revenue growth, sizable market cap, operating margins and exposure to tech sector volatility. This Fair Ratio comes in at 18.03x, a figure that takes into account all those moving pieces, rather than just making simple comparisons to peers and industry averages.

With its P/S ratio more than double the Fair Ratio, Cloudflare’s share price looks rich even when allowing for its powerful growth story and sector leadership. It appears that much of the future optimism is already baked into today's valuation.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cloudflare Narrative

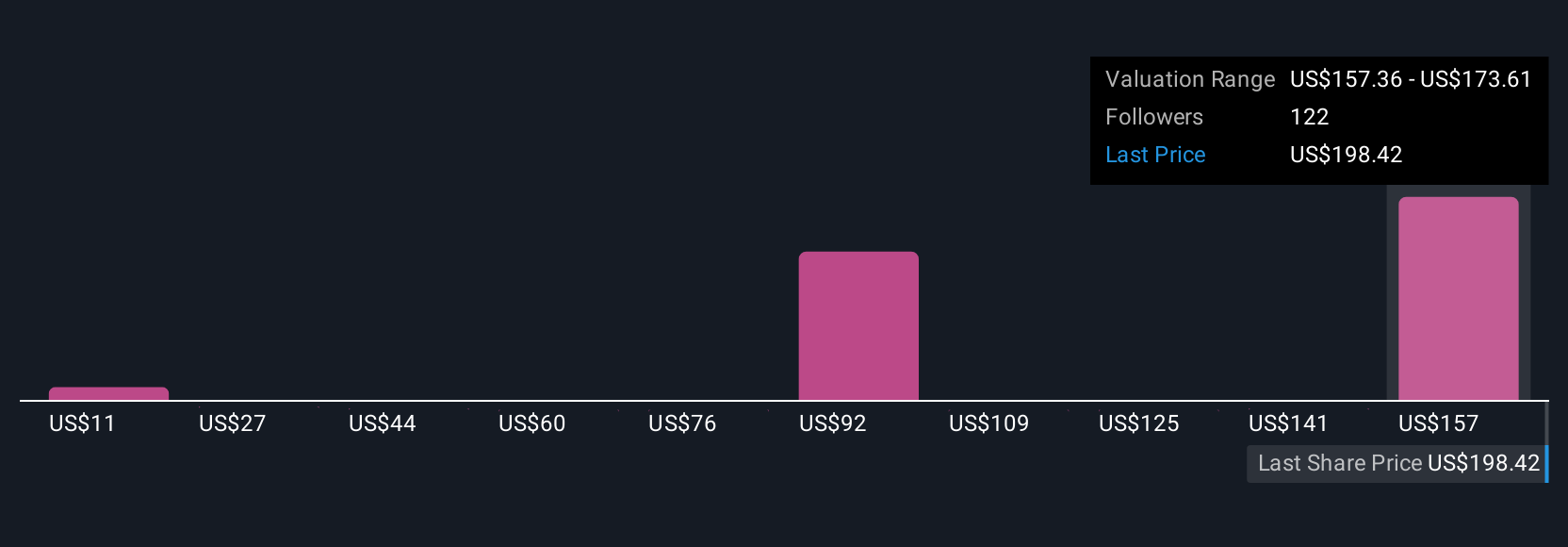

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, plain-English way for investors to express their unique perspective or story about a company, explaining why they think it deserves a certain fair value, supported by their assumptions for future revenue, earnings, and margins.

Narratives bridge the gap between a company's business outlook and its numbers by linking a story to a set of financial forecasts, ultimately connecting to an estimated fair value. This approach moves beyond static metrics and lets you sense-check your own outlook, enabling smarter, story-driven investing.

On Simply Wall St’s Community page, millions of investors share and update Narratives in real time, making it an easy and accessible tool for anyone to use. Narratives help you decide when to buy or sell by directly comparing your own Fair Value to the current Price, while automatically updating whenever news or earnings data changes the picture.

For Cloudflare, Narratives range from bullish forecasts expecting rapid AI-fueled revenue growth and price targets as high as $255, to more cautious views highlighting competitive risk and fair values as low as $90. This shows just how much your story can impact your investment decision.

Do you think there's more to the story for Cloudflare? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives