- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NYSE:NET) Unveils Log Explorer for Streamlined Security and Performance Analysis

Reviewed by Simply Wall St

Cloudflare (NYSE:NET) recently announced the general availability of its Cloudflare Log Explorer tool, which enhances security insights and reduces reliance on third-party tools, providing significant value to businesses. This product innovation, alongside other strategic partnerships such as those with TD SYNNEX and TekStream, likely contributed to the company's notable 54% share price increase over the last quarter. While the market faced volatility due to geopolitical tensions and interest rate speculation, Cloudflare's advancements appear to have strengthened its position within the tech sector, which generally saw gains, as evidenced by the broader rise in tech stocks.

Buy, Hold or Sell Cloudflare? View our complete analysis and fair value estimate and you decide.

Cloudflare's shares have experienced a significant total return of 412% over the past five years. This highlights the company's strong performance in building value for shareholders. Over the past year, the company has also outpaced the US IT industry, which returned 39.2%. This suggests that Cloudflare's market position and product offerings are resonating well with investors.

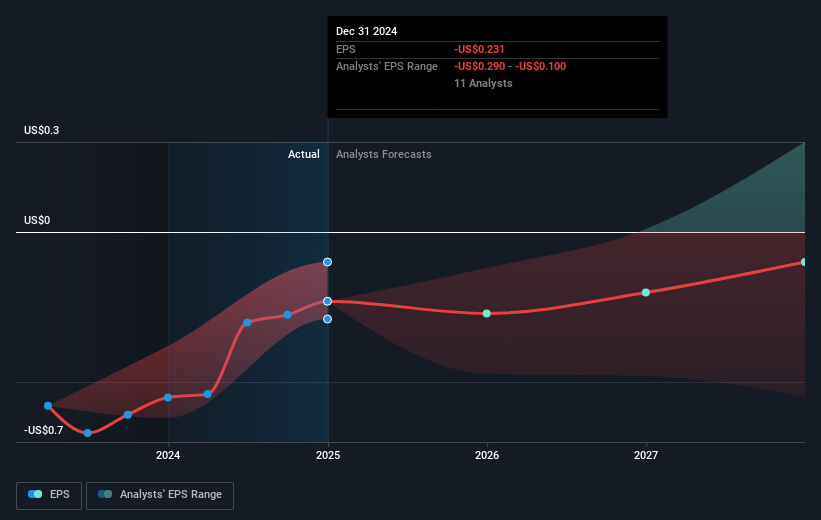

The share price surge, alongside recent product launches and partnerships, can potentially influence revenue and earnings projections. The introduction of innovative tools like the Cloudflare Log Explorer could increase the company's client base, thereby contributing to revenue growth which is expected at 19.6% per year, albeit slightly below the 20% threshold. While earnings are forecasted to grow significantly, it’s important to acknowledge that the company remains unprofitable at this time. Analysts' consensus suggests a fair value of US$154.17 per share, with the current share price being slightly below this target, indicating room for potential adjustments as Cloudflare continues to align its growth strategies with market demands.

Evaluate Cloudflare's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion