- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NYSE:NET) Soars 44% In Past Month

Reviewed by Simply Wall St

Cloudflare (NYSE:NET) recently demonstrated a substantial increase in its share price, climbing 44% over the past month. This surge aligns with the announcement of new earnings guidance and strategic partnerships, signaling the company's ongoing growth trajectory. Specific collaborations with TekStream, Diligent, and Rakuten Mobile underscore Cloudflare's focus on enhancing cybersecurity capabilities and market expansion, which could have bolstered investor confidence. Meanwhile, the broader market experienced gains, with major indices like the Nasdaq Composite and S&P 500 extending their winning streaks. Cloudflare's positive performance seems to reflect a combination of strategic moves and favorable market conditions.

Be aware that Cloudflare is showing 1 possible red flag in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past five years, Cloudflare's total shareholder return has increased by a very large percentage, illustrating substantial long-term growth. In comparison, over the last year, Cloudflare outperformed both the US IT industry and the broader US market, delivering stronger returns against the industry's 27.6% gain and the market's 10.6% advancement. This difference highlights Cloudflare's resilience and market positioning.

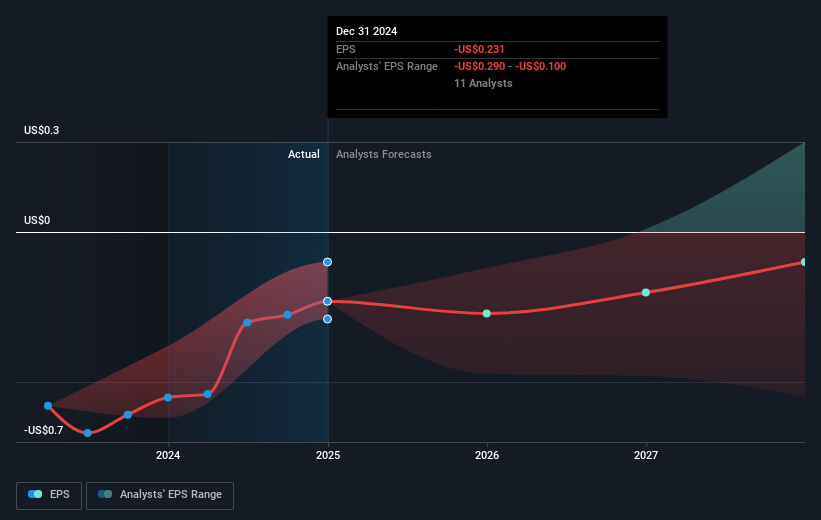

The recent surge in share price, coupled with strategic partnerships and revised earnings guidance, could positively impact future revenue and earnings forecasts. The partnerships with TekStream, Diligent, and Rakuten Mobile, along with the enhancement of cybersecurity offerings, positions Cloudflare for potential market share expansion and revenue growth. With projected revenue of US$500 million to US$501 million for Q2 2025, Cloudflare aims to continue its growth trajectory.

Despite this optimism, the company's current share price trades slightly above the consensus analyst price target of US$143.21. This indicates a potential investor perception of overvaluation in the short term, requiring careful monitoring of upcoming financial results and strategic developments to validate this market sentiment.

The valuation report we've compiled suggests that Cloudflare's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives