- United States

- /

- IT

- /

- NYSE:NET

3 Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has risen by 14% over the past year with earnings projected to grow by 15% annually. In this environment, growth stocks with significant insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.8% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| AST SpaceMobile (ASTS) | 32.2% | 68% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

We'll examine a selection from our screener results.

AST SpaceMobile (ASTS)

Simply Wall St Growth Rating: ★★★★★★

Overview: AST SpaceMobile, Inc. designs and develops the BlueBird satellite constellation in the United States, with a market cap of approximately $17.77 billion.

Operations: The company generates revenue from its Wireless Communications Equipment segment, which amounts to $4.64 million.

Insider Ownership: 32.2%

Revenue Growth Forecast: 57.4% p.a.

AST SpaceMobile exhibits high growth potential, with revenue projected to rise significantly above market averages. Recent strategic partnerships, such as the joint venture with Vodafone in Europe and collaboration with Vi in India, highlight its innovative approach to expanding satellite-based cellular networks. The company recently secured substantial funding through private placements and equipment financing. However, it faces challenges like significant insider selling and share price volatility despite being undervalued compared to its estimated fair value.

- Get an in-depth perspective on AST SpaceMobile's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that AST SpaceMobile's current price could be inflated.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. is a company that offers enterprise cloud applications both in the United States and internationally, with a market cap of approximately $60.50 billion.

Operations: The company generates revenue primarily from its cloud applications segment, amounting to $8.70 billion.

Insider Ownership: 19.4%

Revenue Growth Forecast: 11.4% p.a.

Workday, Inc. demonstrates strong growth potential with earnings forecasted to increase significantly at 29.9% annually, outpacing the US market average. Despite trading below its estimated fair value and experiencing a drop in profit margins, recent partnerships like those with Seattle University and Simpplr underscore its strategic expansion in cloud services and AI integration. The company's substantial share repurchase program further indicates confidence in its long-term growth trajectory despite current financial challenges.

- Take a closer look at Workday's potential here in our earnings growth report.

- Our valuation report here indicates Workday may be undervalued.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $65.79 billion.

Operations: Cloudflare generates revenue primarily from its Internet Telephone segment, which accounts for $1.77 billion.

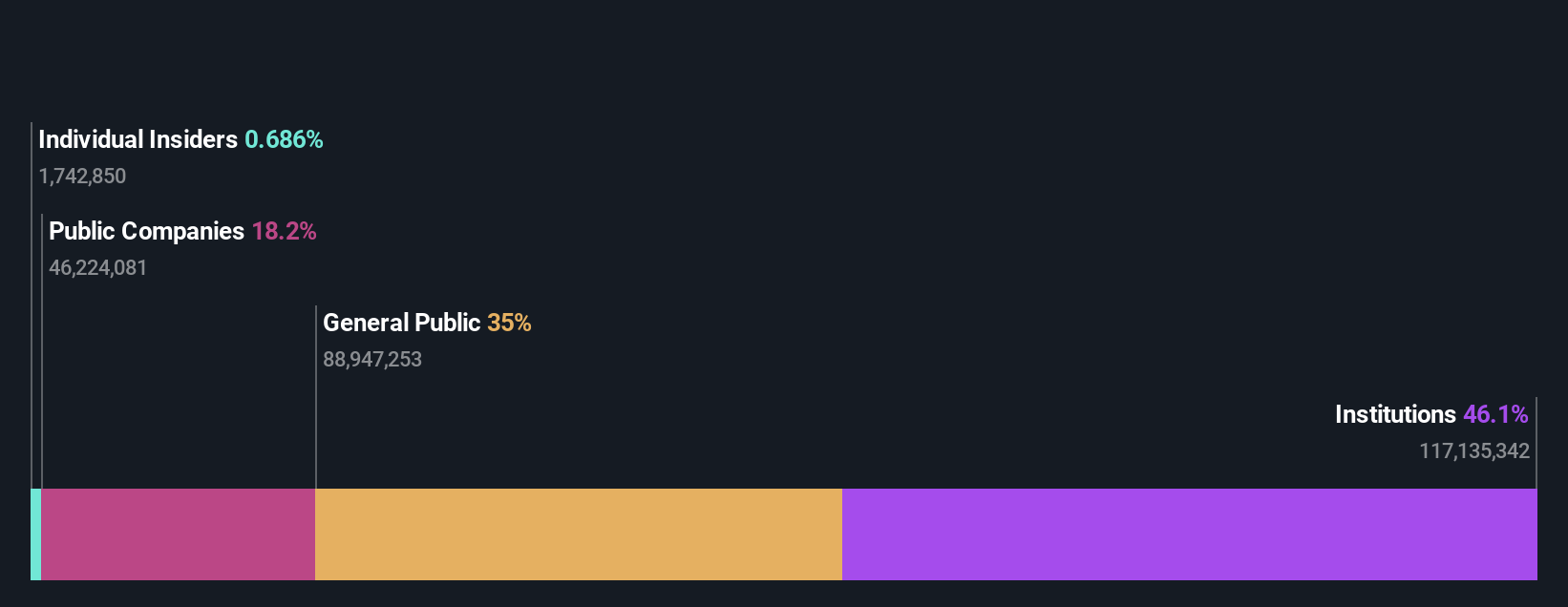

Insider Ownership: 10.7%

Revenue Growth Forecast: 19.6% p.a.

Cloudflare is poised for growth with earnings projected to rise 42.25% annually, surpassing market averages. Despite recent insider selling, the company maintains strategic momentum through innovations like its AI crawler blocking feature and partnerships expanding security services in Latin America and Japan. Cloudflare's recent US$1.75 billion fixed-income offering underscores financial strategy, while its Log Explorer tool aims to reduce costs for businesses by simplifying security insights within a single platform interface.

- Unlock comprehensive insights into our analysis of Cloudflare stock in this growth report.

- The analysis detailed in our Cloudflare valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Click this link to deep-dive into the 191 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives