- United States

- /

- Software

- /

- NYSE:MODN

Model N (NYSE:MODN) Shareholders Have Enjoyed A 79% Share Price Gain

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Model N share price has climbed 79% in five years, easily topping the market return of 47% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 9.2% in the last year.

Check out our latest analysis for Model N

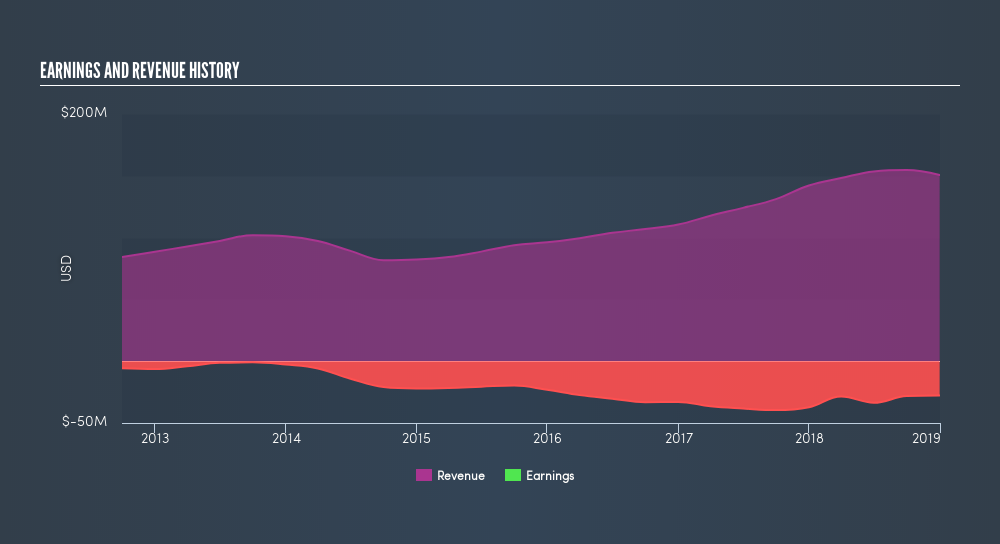

Because Model N is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Model N saw its revenue grow at 13% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 12% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. There's no doubt that it can be difficult to value pre-profit companies.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This freereport showing analyst forecasts should help you form a view on Model N

A Different Perspective

Model N provided a TSR of 9.2% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 12% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MODN

Model N

Provides cloud revenue management solutions for life sciences and high-tech companies in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives