- United States

- /

- Software

- /

- NYSE:KVYO

Are Recent Partnerships Justifying Klaviyo’s 10% Share Price Rise?

Reviewed by Bailey Pemberton

- Ever wondered if Klaviyo is worth putting on your watchlist, or if there's hidden value behind the latest share price?

- Klaviyo’s stock has seen a steady 10.4% climb over the last month, even though it's still down 31.1% year-to-date. This trend suggests investors are re-evaluating its prospects and risk profile.

- Recent headlines have highlighted growing partnerships and product enhancements, which are fueling conversations among analysts and contributing to recent price momentum. Major companies adopting Klaviyo's platform have also influenced the latest sentiment shift.

- Based on our checks, Klaviyo registers a valuation score of 3 out of 6, positioning it in the middle. It is neither an obvious bargain nor showing significant red flags. Next, let’s explore the different ways to assess value, and why the "scorecard" approach might only scratch the surface of the bigger picture by the end of this article.

Find out why Klaviyo's -25.4% return over the last year is lagging behind its peers.

Approach 1: Klaviyo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to their present value. In Klaviyo's case, analysts and financial modeling platforms extrapolate anticipated cash flows over the next several years to assess what the business is worth today.

Currently, Klaviyo generates $162.6 million in Free Cash Flow (FCF). Analyst projections suggest Free Cash Flow could grow to approximately $216.1 million by 2029. Notably, direct analyst estimates extend for about five years, with further numbers extrapolated by Simply Wall St. As a result, the valuation utilizes both short-term analyst forecasts and longer-term modeled estimates.

After running these numbers through the DCF, Klaviyo’s estimated fair value is $11.68 per share. Compared to the current share price, this implies the stock is about 145.8% overvalued. The numbers point to a significant disconnect between the company’s intrinsic value based on projected cash generation and its market valuation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Klaviyo may be overvalued by 145.8%. Discover 930 undervalued stocks or create your own screener to find better value opportunities.

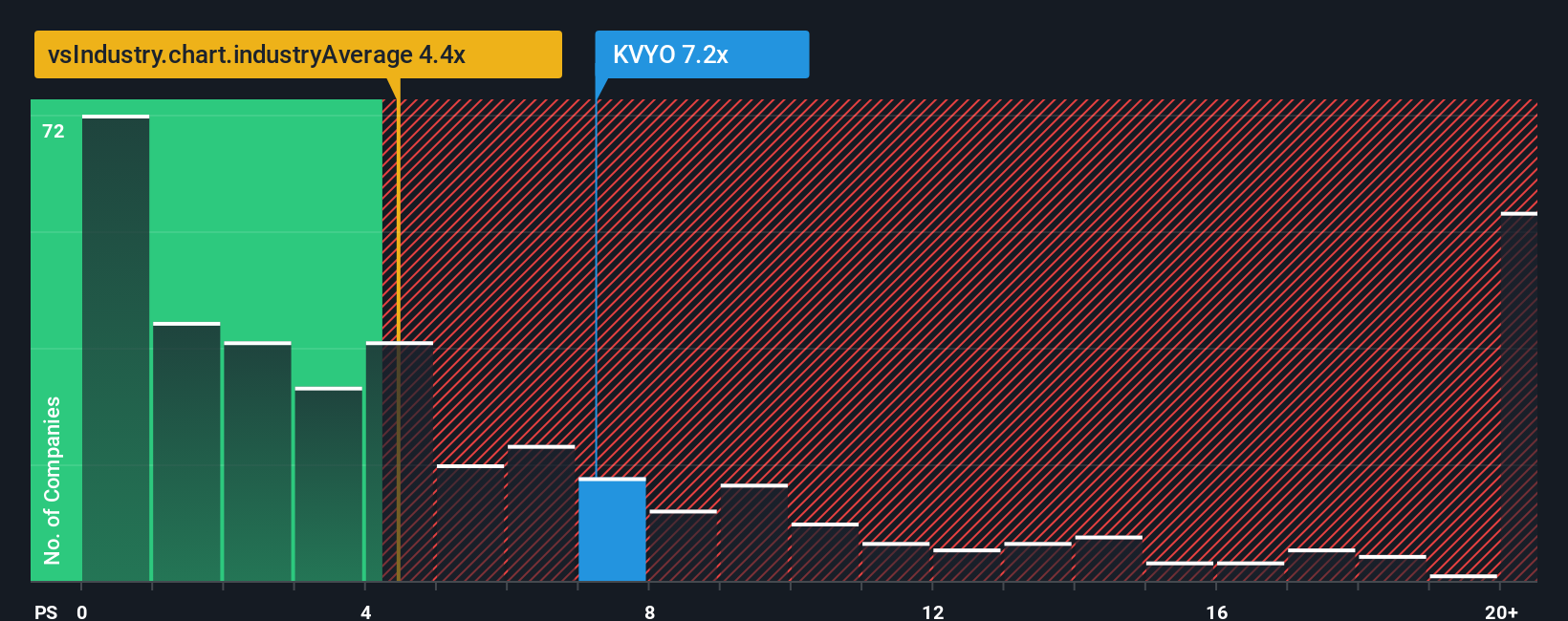

Approach 2: Klaviyo Price vs Sales

For companies like Klaviyo that are driving growth but are not yet profitable, the Price-to-Sales (P/S) ratio is often the most relevant valuation metric. The P/S ratio helps investors assess how much they are paying for every dollar of revenue, which is particularly helpful when net earnings are negative or highly variable due to ongoing investments in growth. Ideally, firms with higher growth prospects or unique competitive positions can warrant above-average multiples. Riskier or slower-growing companies tend to command lower multiples.

Currently, Klaviyo trades on a P/S ratio of 7.51x. For context, this compares to an industry average of 4.74x and a peer group average of 8.62x. These benchmarks help anchor expectations, but they do not consider the nuances of Klaviyo's specific growth rate, risk profile, or margins.

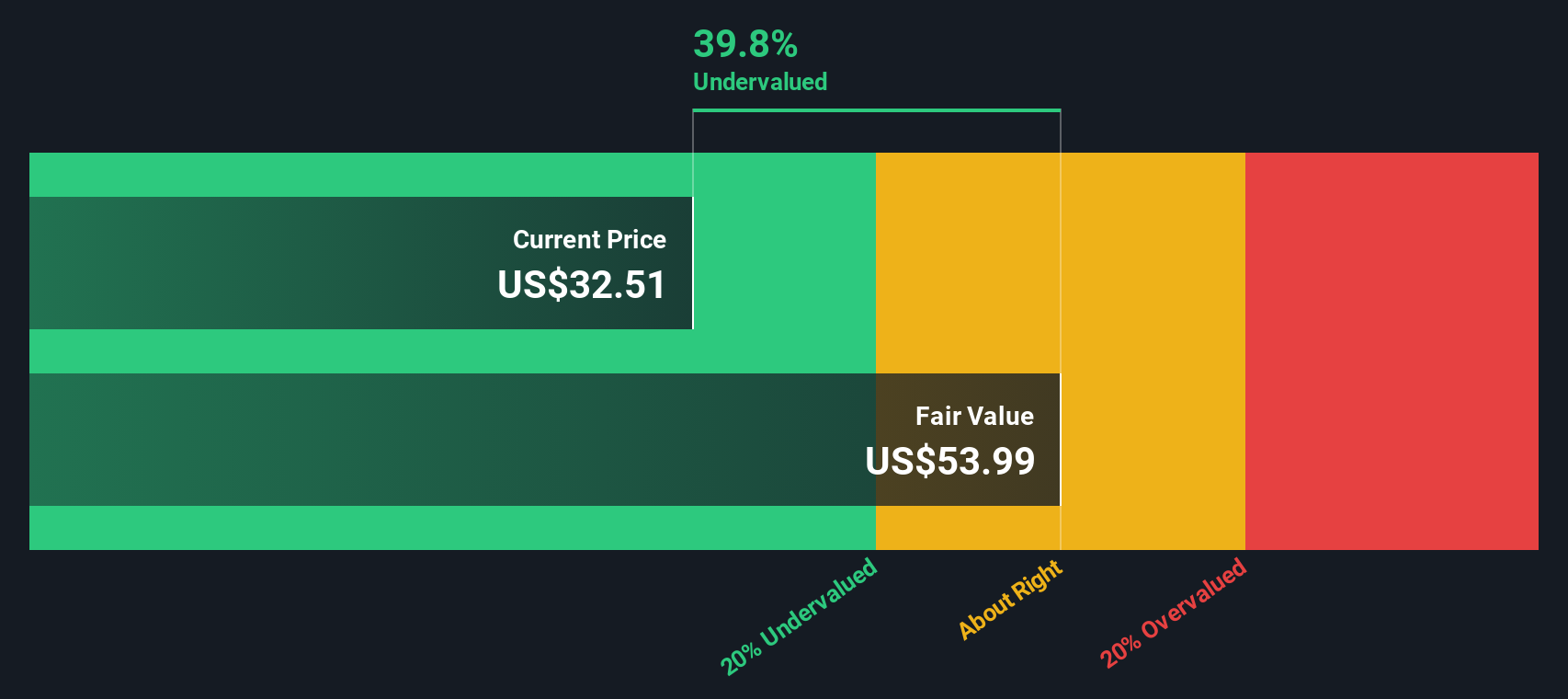

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio, calculated as 7.58x for Klaviyo, represents the multiple you would expect when factoring in the company's growth, profitability, market cap, industry dynamics, and risks. This approach offers a more tailored and holistic assessment than simply comparing to industry or peer averages. As a result, it provides a finer view of value that is attuned to the company's actual prospects.

With Klaviyo’s current P/S of 7.51x and a Fair Ratio of 7.58x, the stock appears to be priced about right on this metric, suggesting investors are neither underestimating nor overestimating the company’s growth-adjusted fundamentals at today’s levels.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Klaviyo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, accessible way to lay out your perspective or “story” about a company like Klaviyo, combining a company’s specific opportunities and risks with structured forecasts for its revenue, earnings, and margins, then translating that story into a fair value estimate.

Unlike traditional ratios and models, a Narrative ties a company’s evolving story directly to its financial outlook. This allows you to visualize your assumptions and see how they would impact Klaviyo's fair value, all in one place.

Narratives are available on Simply Wall St’s Community page and are crafted and shared by millions of investors just like you. This empowers you to compare your assessment to others, see the reasoning behind different estimates, and get a dynamic view. Narratives update automatically when news or earnings change the outlook.

For example, some investors believe Klaviyo’s international expansion and product innovation will justify a bullish fair value above $60 per share, while others emphasize risks from competition and margin pressure and set their fair values as low as $37. Narratives make it easy to compare these views and decide for yourself. This is a smarter, more personal, and flexible way to invest.

Do you think there's more to the story for Klaviyo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026