- United States

- /

- IT

- /

- NYSE:KD

What Does Recent Tech Volatility Mean for Kyndryl Stock Value in 2025?

Reviewed by Bailey Pemberton

If you’re wondering what to do with Kyndryl Holdings stock right now, you’re not alone. Plenty of investors are weighing how to navigate a price chart that looks, frankly, ambitious. Over the past year, shares have soared 30.4%, and the three-year return clocks in at a staggering 263.8%. That kind of rise gets attention for good reason. But there is also a hint of caution. Recent moves haven’t all gone straight up. In the last 30 days, the stock slipped by 6.5%, and year-to-date it’s down 13.8%. Still, after a modest 1.8% bump in the past week, the mood feels far from bleak, especially as the broader market has seen a shakeup in tech and infrastructure names. Some of that volatility can be traced to shifting optimism around corporate IT services, which Kyndryl rides as a pure play since its spin-off. Amidst all this action, the company earns a value score of 4 out of 6 on our undervaluation checks, a solid mark suggesting there may still be room for thoughtful investors.

Trying to separate hype from true value? In the next section, we’ll dig into how analysts size up Kyndryl Holdings using different valuation tools, and I’ll show you why one approach in particular might offer a smarter way forward.

Approach 1: Kyndryl Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for valuing a company by estimating its future cash flows and discounting them back to their present value. In the case of Kyndryl Holdings, the model takes into account current free cash flow as well as future projections, providing a picture of the company's long-term earning potential.

Kyndryl's most recent reported Free Cash Flow stands at $216.91 million. Looking ahead, projections anticipate a steady climb in cash generation, with estimates reaching $360.22 million in 2025 and rising toward approximately $2.61 billion by 2035, according to Simply Wall St’s long-term extrapolations. These increasing figures indicate confidence in the firm's ability to grow its core IT services business over the next decade.

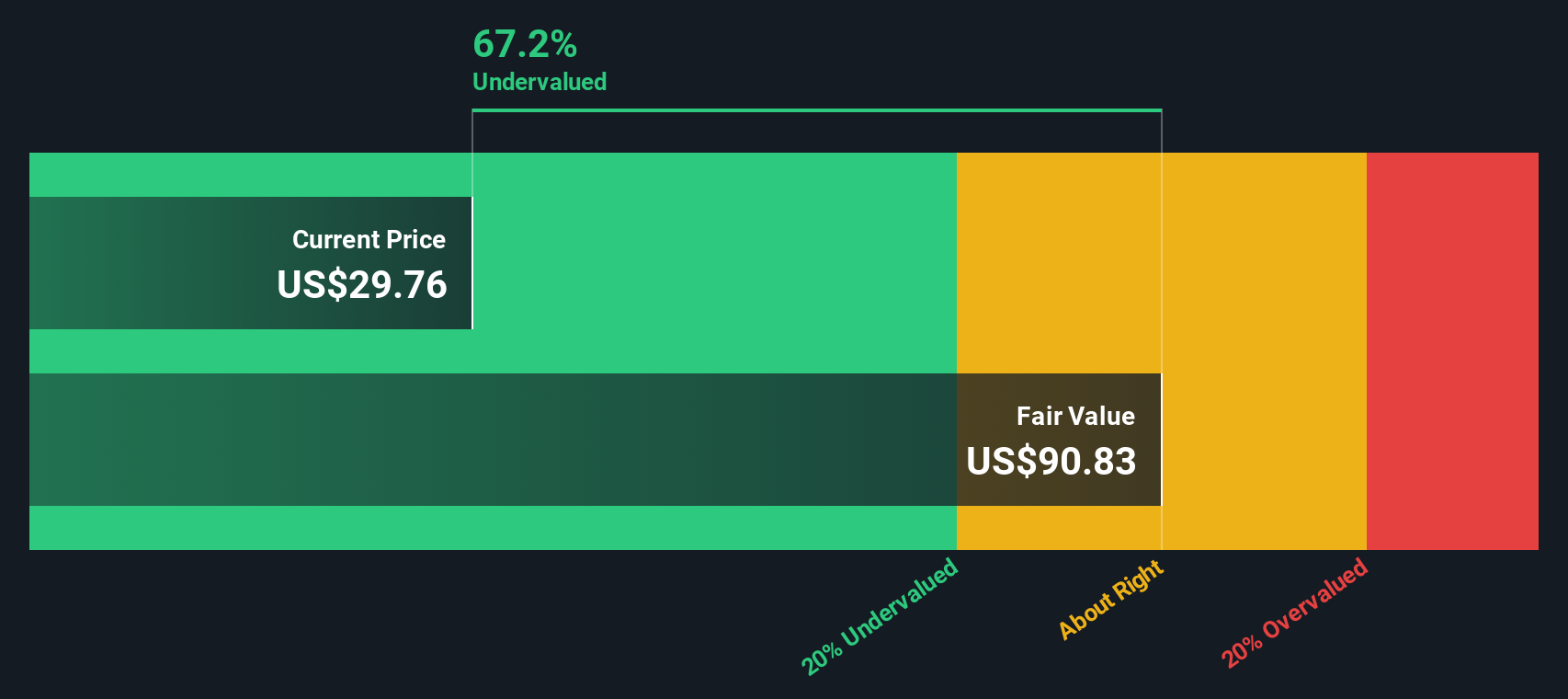

After calculating the figures, the DCF model yields an estimated fair value of $91.62 per share. Compared to the current share price, this calculation suggests the stock is trading at a 66.6% discount to its intrinsic value, highlighting notable potential for investors who believe in the growth story.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kyndryl Holdings is undervalued by 66.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kyndryl Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is often used to value profitable companies because it links a company's stock price directly to its actual earnings. For investors, this makes it a popular way to gauge whether a stock is expensive or cheap relative to the profits it generates.

However, what counts as a “normal” or “fair” PE ratio depends on several factors. Companies with higher expected growth or lower risk typically command higher PE ratios, while slower-growing or riskier firms trade at lower multiples. It is important to put this metric in context instead of using it in isolation.

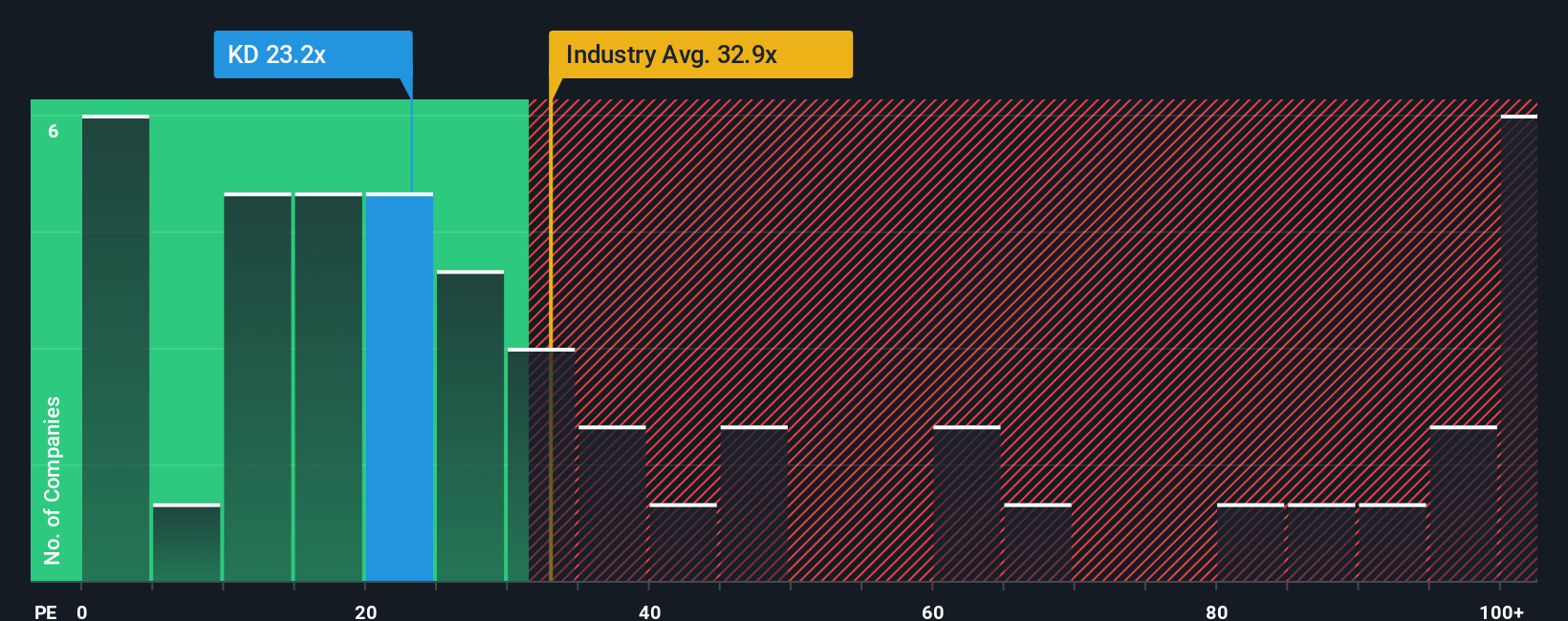

Kyndryl Holdings currently trades at a PE ratio of 23.84x. Compared to the average of its direct peers at 14.83x, and the broader IT industry average of 32.87x, Kyndryl sits somewhere between these two benchmarks. While these comparisons provide context, they can overlook unique factors specific to the company.

This is where Simply Wall St’s “Fair Ratio” comes in. For Kyndryl, that value is 53.66x. The Fair Ratio reflects a customized multiple that considers not just industry comparisons, but also Kyndryl’s own earnings growth, profit margins, risk profile, and market cap. This makes it a more well-rounded metric than straightforward peer or industry averages.

Comparing Kyndryl’s current PE to its Fair Ratio reveals that the shares are trading well below what is considered fair for the company’s outlook and profile. This suggests there may be potential value for patient investors willing to look past headline multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kyndryl Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way for investors to attach their own story or perspective to a company’s numbers, blending what they believe about its future revenue, earnings, and margins with an estimate of fair value. Narratives connect the big picture, such as why you think Kyndryl will succeed or face challenges, to a forward-looking forecast and a concrete fair value, helping clarify your investment thesis.

On Simply Wall St’s platform, Narratives are an easy-to-use tool available within the Community page and used by millions of investors worldwide. They empower you to decide when to buy or sell by comparing what you think is a fair value to the current share price. Plus, as new information, like news or earnings, arrives, Narratives update dynamically to ensure your perspective always reflects the latest reality.

For example, on Kyndryl Holdings, some investors are optimistic and predict a fair value of $55.00 based on rapid digital transformation and higher margins, while others are cautious, setting a fair value at $40.00 due to risks from legacy contracts and industry headwinds. Narratives let you weigh these perspectives and make your decision with confidence.

Do you think there's more to the story for Kyndryl Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives