- United States

- /

- Communications

- /

- NYSE:CIEN

High Growth Tech Stocks In The US To Watch March 2025

Reviewed by Simply Wall St

The United States market has experienced a positive trend, climbing 2.1% over the last week and 8.1% in the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate innovation and strong potential for future expansion in alignment with these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.18% | 37.61% | ★★★★★★ |

| Alkami Technology | 20.45% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.82% | 58.64% | ★★★★★★ |

| AVITA Medical | 27.75% | 55.36% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| TKO Group Holdings | 22.54% | 25.17% | ★★★★★★ |

| Lumentum Holdings | 21.55% | 119.67% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Ciena (NYSE:CIEN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators across multiple regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India with a market capitalization of $9.37 billion.

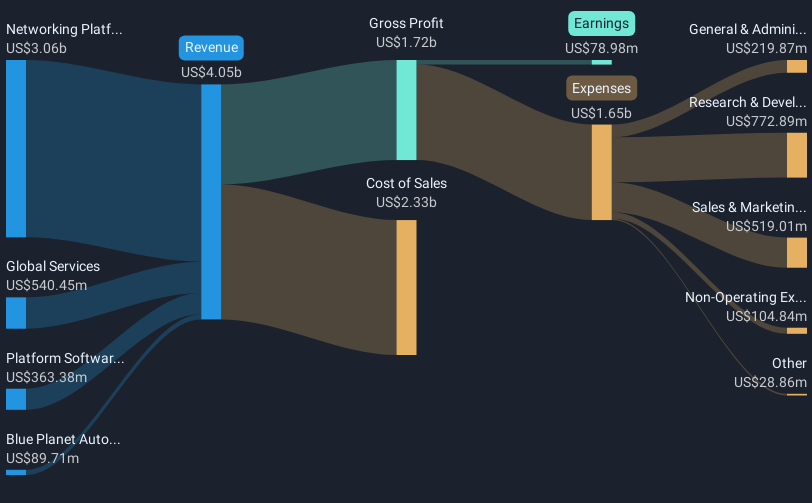

Operations: The company generates revenue primarily from Networking Platforms, contributing $3.06 billion, followed by Global Services at $540.45 million, and Platform Software and Services at $363.38 million. Blue Planet Automation Software and Services adds another $89.71 million to its revenue streams.

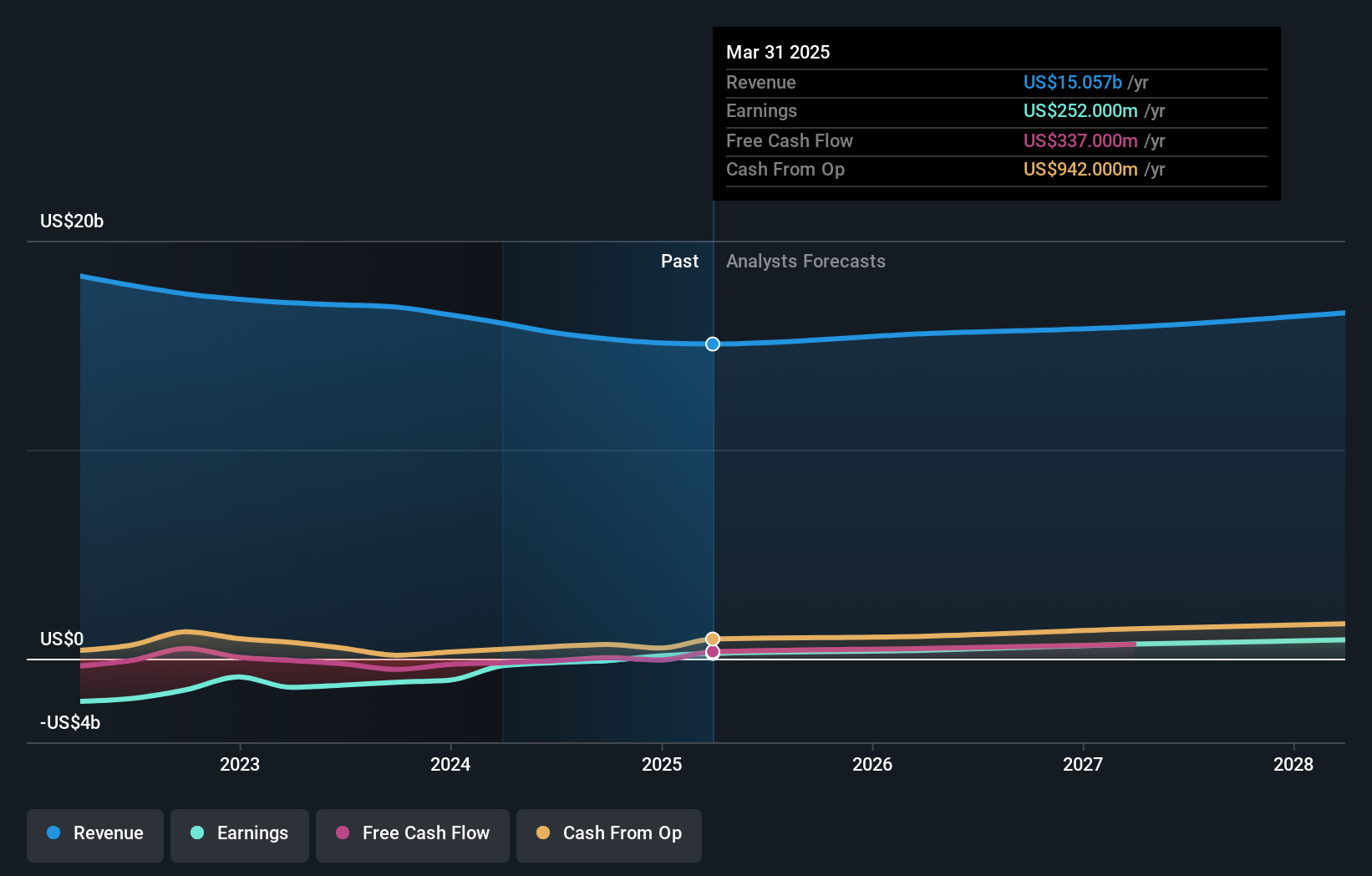

Ciena, a key player in the high-tech communications sector, is demonstrating robust growth with an anticipated annual revenue increase of 9.5% and earnings growth forecast at an impressive 51.1%. This performance is underpinned by significant investment in R&D, which has consistently exceeded industry norms to foster innovation—evidenced by their recent deployment of WaveLogic 6 Extreme technology that doubles data transmission capacity. Despite a challenging year with earnings contraction of -64.7%, Ciena's strategic focus on advanced optical solutions and client expansions like those with e& UAE and Lumen Technologies positions it well for future demands in AI-driven data traffic, highlighting its resilience and adaptability in a rapidly evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Ciena.

Understand Ciena's track record by examining our Past report.

Doximity (NYSE:DOCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doximity, Inc. operates a cloud-based digital platform for medical professionals in the United States with a market cap of approximately $11.76 billion.

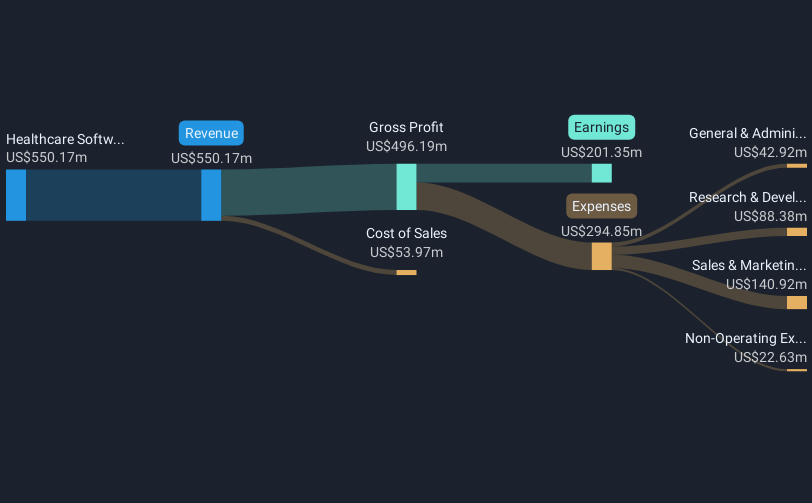

Operations: The company generates revenue primarily through its healthcare software segment, which contributes $550.17 million. Operating within the digital health sector, it focuses on providing tools and services tailored for medical professionals.

Doximity has showcased a promising trajectory in the tech sector, with its recent earnings report highlighting a significant uptick in performance. In the last quarter, revenue surged to $168.6 million from $135.28 million year-over-year, and net income climbed impressively to $75.2 million from $47.96 million, reflecting robust operational efficiency and market demand for its digital healthcare solutions. The firm's commitment to innovation is underscored by its R&D investments which have bolstered its competitive edge in a rapidly evolving industry landscape marked by increasing reliance on technology-driven healthcare services.

- Get an in-depth perspective on Doximity's performance by reading our health report here.

Gain insights into Doximity's historical performance by reviewing our past performance report.

Kyndryl Holdings (NYSE:KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a global technology services company specializing in IT infrastructure services with a market capitalization of approximately $8.03 billion.

Operations: Kyndryl Holdings generates revenue through its IT infrastructure services across various regions, with the United States contributing $3.90 billion and Principal Markets adding $5.63 billion to its revenue streams.

Kyndryl Holdings is pivoting towards high-growth areas, evidenced by its recent partnership with Microsoft to deploy an AI-powered healthcare assistant, enhancing clinician efficiency and patient care. This move aligns with the firm's strategic focus on integrating advanced technology solutions, as demonstrated by their new technology hub in Liverpool aimed at bolstering AI and software engineering capabilities. Despite a modest revenue growth forecast of 1.1% annually, Kyndryl's earnings are expected to surge by 47.3% per year, showcasing a robust profit trajectory that outpaces many in the tech sector. The company's R&D commitment is crucial for maintaining this momentum in a competitive landscape where innovation leads market trends.

- Click here and access our complete health analysis report to understand the dynamics of Kyndryl Holdings.

Review our historical performance report to gain insights into Kyndryl Holdings''s past performance.

Key Takeaways

- Discover the full array of 236 US High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives