- United States

- /

- IT

- /

- NYSE:IT

Why Gartner (IT) Is Up 7.8% After Record Buyback, Insider Buying, and New ESG Index Win

Reviewed by Sasha Jovanovic

- In recent days, Gartner has drawn attention as a director bought 43,300 shares and the company executed a record US$1.00 billion stock buyback in Q3, while being added to the iSTOXX MUTB Global ESG Quality 200 index.

- These moves suggest leadership is signaling confidence and could attract incremental demand from ESG-focused investors at a time when AI-related business model risks remain in focus.

- Next, we’ll examine how this combination of insider buying and record buybacks may influence Gartner’s existing investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Gartner Investment Narrative Recap

To own Gartner today, you need to believe its research and advisory model will stay essential even as generative AI challenges how clients access information. The near term focus is on whether contract value growth can stabilize after recent disappointments, while AI driven substitution remains the biggest structural risk. Recent insider buying, record Q3 US$1.00 billion buybacks and ESG index inclusion are supportive, but do not fundamentally change these core questions.

The most relevant recent development here is the record Q3 2025 repurchase of 3,953,532 shares for about US$1.05 billion, alongside expanded buyback authorization. For existing shareholders, this capital return sits directly against concerns about slowing contract value growth and margin pressure, effectively sharpening the contrast between management’s capital allocation decisions and the operational headwinds that are still in play.

Yet investors should also be aware that, if clients increasingly lean on generative AI instead of paid research, Gartner’s subscription economics could...

Read the full narrative on Gartner (it's free!)

Gartner's narrative projects $7.4 billion revenue and $821.8 million earnings by 2028. This requires 4.7% yearly revenue growth and an earnings decrease of about $478 million from $1.3 billion today.

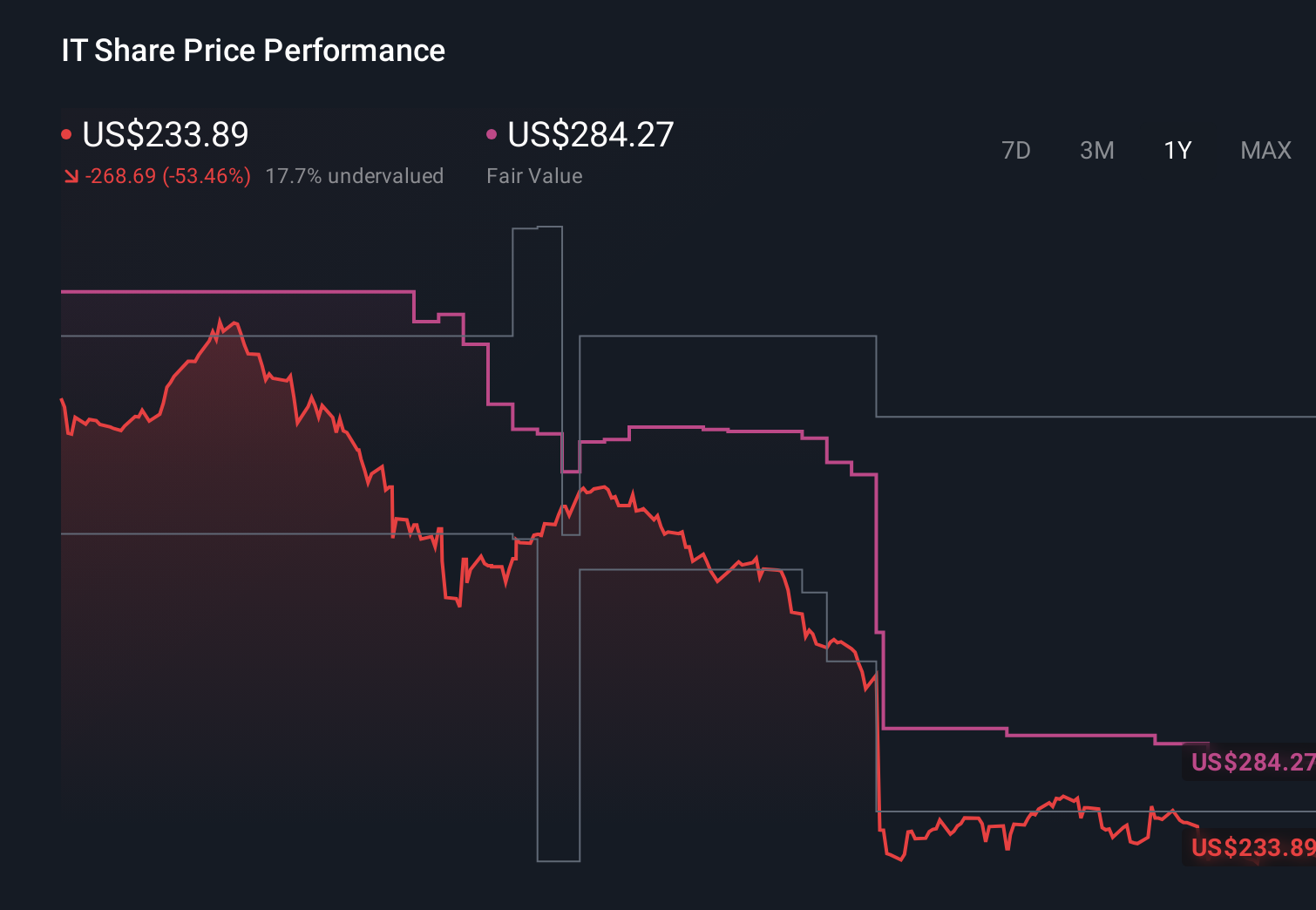

Uncover how Gartner's forecasts yield a $284.27 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Gartner’s fair value between US$284 and US$421 per share, underlining just how far opinions can stretch. Set those views against the growing risk that generative AI tools could substitute for parts of Gartner’s subscription research, and it becomes even more important to compare several perspectives before forming your own.

Explore 3 other fair value estimates on Gartner - why the stock might be worth as much as 70% more than the current price!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)