- United States

- /

- IT

- /

- NYSE:IT

What Gartner (IT)'s Lowered Growth Outlook Means for Shareholders

Reviewed by Simply Wall St

- Earlier this month, UBS analyst Joshua Chan downgraded Gartner, Inc. to 'Hold' after the company reported second quarter results that fell short of expectations, leading to reductions in its 2025 and 2026 growth forecasts.

- This development highlights ongoing challenges for Gartner, as the company cited discretionary spending cuts and near-term softness across its research, consulting, and conferences businesses.

- We'll explore how slower client value growth and revised forecasts could affect Gartner's long-term investment narrative and risk profile.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gartner Investment Narrative Recap

To own Gartner stock, an investor needs to believe in its ability to drive predictable, long-term value through digital transformation, AI adoption, and enterprise IT spending, even as recent news signals turbulence ahead. The UBS downgrade, driven by a reduction in growth forecasts and short-term softness across key business lines, directly challenges the narrative that near-term weakness will be outweighed by secular demand. Right now, the biggest catalyst is Gartner’s proprietary AI tools engaging clients, but the greatest risk is a prolonged slowdown in client value (CV) growth.

Among recent developments, Gartner’s announcement of a $700 million increase in its share buyback authorization, bringing the total to $6 billion, stands out. While buybacks can reflect confidence and return capital to investors, their impact may be muted in the face of slower client growth and cautious forward guidance, which remain front of mind after the recent analyst downgrade.

But just as buybacks try to offset dips in sentiment, investors should be aware that persistent contract value headwinds could…

Read the full narrative on Gartner (it's free!)

Gartner is forecast to reach $7.4 billion in revenue and $810.6 million in earnings by 2028. This outlook assumes a 4.8% annual revenue growth rate, but earnings are expected to decrease by $489.4 million from their current level of $1.3 billion.

Uncover how Gartner's forecasts yield a $304.78 fair value, a 22% upside to its current price.

Exploring Other Perspectives

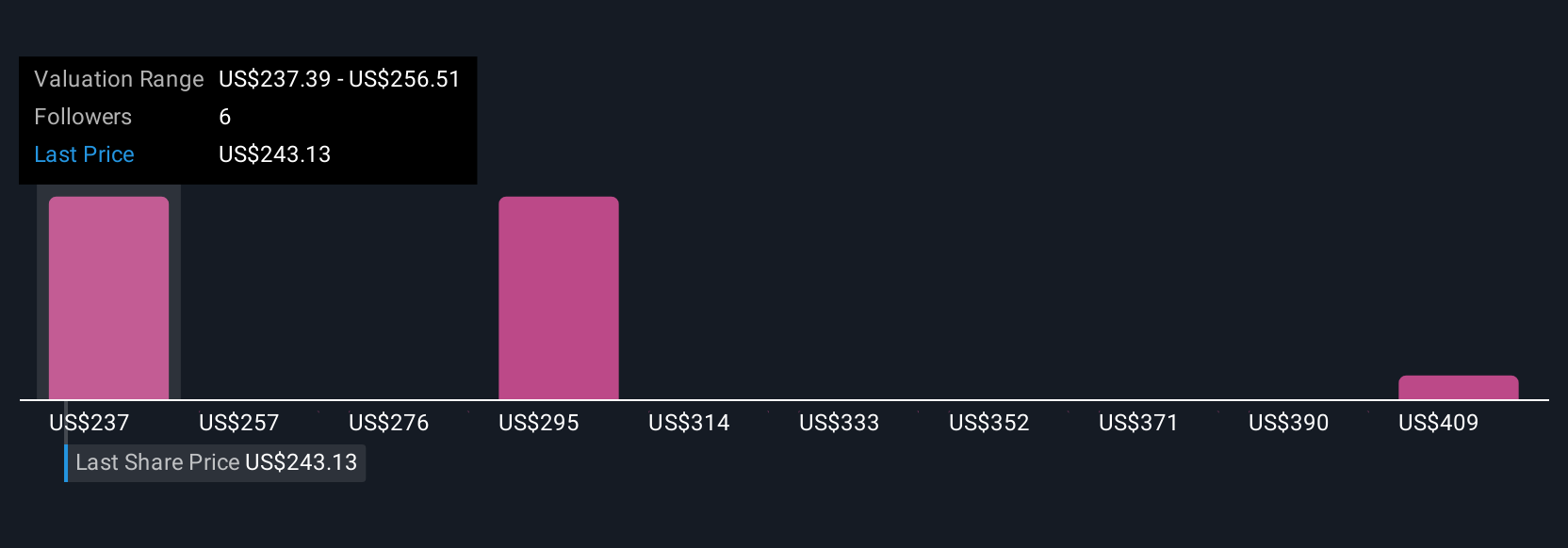

Simply Wall St Community fair value estimates for Gartner (3 perspectives) range from US$237.72 to US$428.59 per share. While opinions vary widely, many are closely watching the risk that extended corporate cost-cutting and renewed procurement constraints could shape Gartner's future earnings and revenue growth.

Explore 3 other fair value estimates on Gartner - why the stock might be worth as much as 72% more than the current price!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

No Opportunity In Gartner?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives