- United States

- /

- IT

- /

- NYSE:IT

Gartner (IT) Sees 29% Weekly Price Decline Despite Strong Q2 2025 Financial Results

Reviewed by Simply Wall St

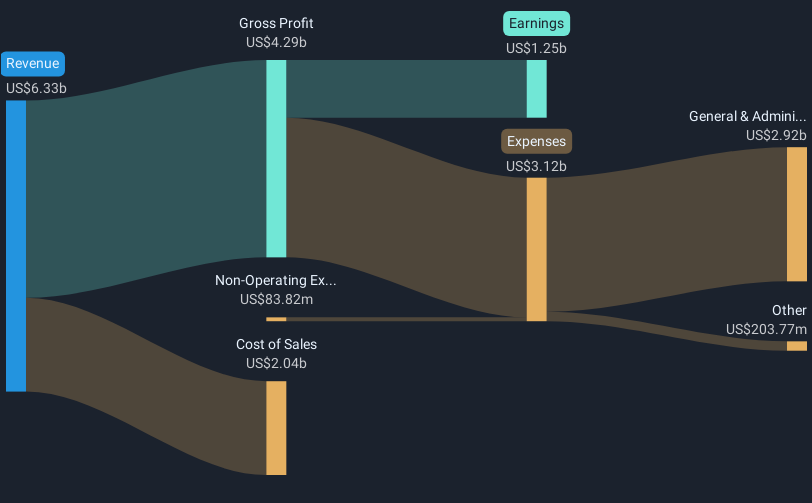

Gartner (IT) recently announced robust Q2 2025 financial results, showcasing significant year-over-year increases in sales, revenue, and net income, with the Basic EPS rising to $3.12 from $2.95. Despite this financial growth and updates to its buyback program, Gartner's stock saw a 29% price decline last week. This price movement contrasts with the broader market's performance, which showed positive momentum as investors assessed earnings and trade developments. While Gartner's strategic actions could have potentially supported shareholder confidence, they did not reflect positively in the company’s stock performance over the week.

We've identified 3 weaknesses for Gartner (1 can't be ignored) that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcement of Gartner's significant Q2 2025 results, coupled with the updates to its buyback program, underscores efforts to drive shareholder value. Yet, the stock's abrupt 29% decline last week suggests market skepticism, possibly influenced by broader macroeconomic uncertainties and currency fluctuations highlighted in the narrative. Despite positive Q2 results and operational metrics, these factors might overshadow the company's efforts to boost sales through AI and sales headcount expansions, impacting revenue growth expectations.

Over the longer term, Gartner's shares returned 86.34% including dividends over the past five years, reflecting substantial growth relative to the recent downturn. However, in the past year, IT underperformed the US IT industry's 23.3% return, indicating challenges amid varying macroeconomic and policy conditions.

Forecast revisions might occur as analysts reassess Gartner's revenue and earnings potential. Current predictions of earnings reaching $917 million in three years, with declining profit margins, may be revisited if continued macroeconomic challenges persist. The stock's current price of $243.71 reflects a 25.06% discount to the consensus analyst price target of $304.78, presenting a valuation gap. Whether the company's initiatives will realign with market valuations remains subject to performance and broader market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)