- United States

- /

- IT

- /

- NYSE:IT

Gartner (IT): Evaluating Valuation as $1 Billion Buyback Boosts Capital Return Strategy and AI Sector Focus

Reviewed by Kshitija Bhandaru

Gartner (NYSE:IT) has approved an additional $1 billion for share repurchases, boosting its capital return policy at a time when conversations about AI market consolidation have been picking up. This development could shift how some investors approach the stock.

See our latest analysis for Gartner.

After a tough stretch, Gartner’s year-to-date share price return is down 49 percent and the one-year total shareholder return sits at negative 53 percent. Momentum has been slow to rebuild, despite high-profile recognition for its AI expertise and ongoing activity among institutional investors. Still, the latest move to return more capital hints at management’s confidence in the business, even as the sector anticipates AI market shakeups and investors weigh both risks and resilience over the long haul.

If you’re looking to widen your scope beyond Gartner and spot what’s trending next, now’s a smart time to explore fast growing stocks with high insider ownership.

With shares trading well below recent highs and analysts reiterating buy ratings, the question for investors is clear: is Gartner trading at a meaningful discount, or is the market already factoring in any rebound and growth ahead?

Most Popular Narrative: 18.4% Undervalued

With Gartner’s latest close at $245.36 and the widely followed narrative fair value at $300.60, analysts are leaning towards a meaningfully higher valuation than the market is currently pricing in. The pricing gap is driven by expectations for renewed growth and robust capital returns, even as earnings and margins face cyclical pressures.

The rollout of AskGartner, a proprietary AI-powered tool, is expected to deepen client engagement, increase user efficiency, and make Gartner's vast research more accessible. This should boost client retention and subscription value over time, contributing to predictable recurring revenues and potentially supporting margin expansion.

How do sharp shifts in margins, future growth rates, and a bold multiple come together to drive this narrative’s projected upside? The calculations rest on some unexpectedly ambitious assumptions about Gartner’s recurring revenues, profit trajectory, and the critical role of new AI tools. Want to see the financial logic behind the price target? Take a look before the rest of the market catches on.

Result: Fair Value of $300.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost-cutting across key industries and the surge of generative AI could undermine Gartner’s subscription growth and earnings stability in unexpected ways.

Find out about the key risks to this Gartner narrative.

Another View: Looking at Value Through Today’s Ratio

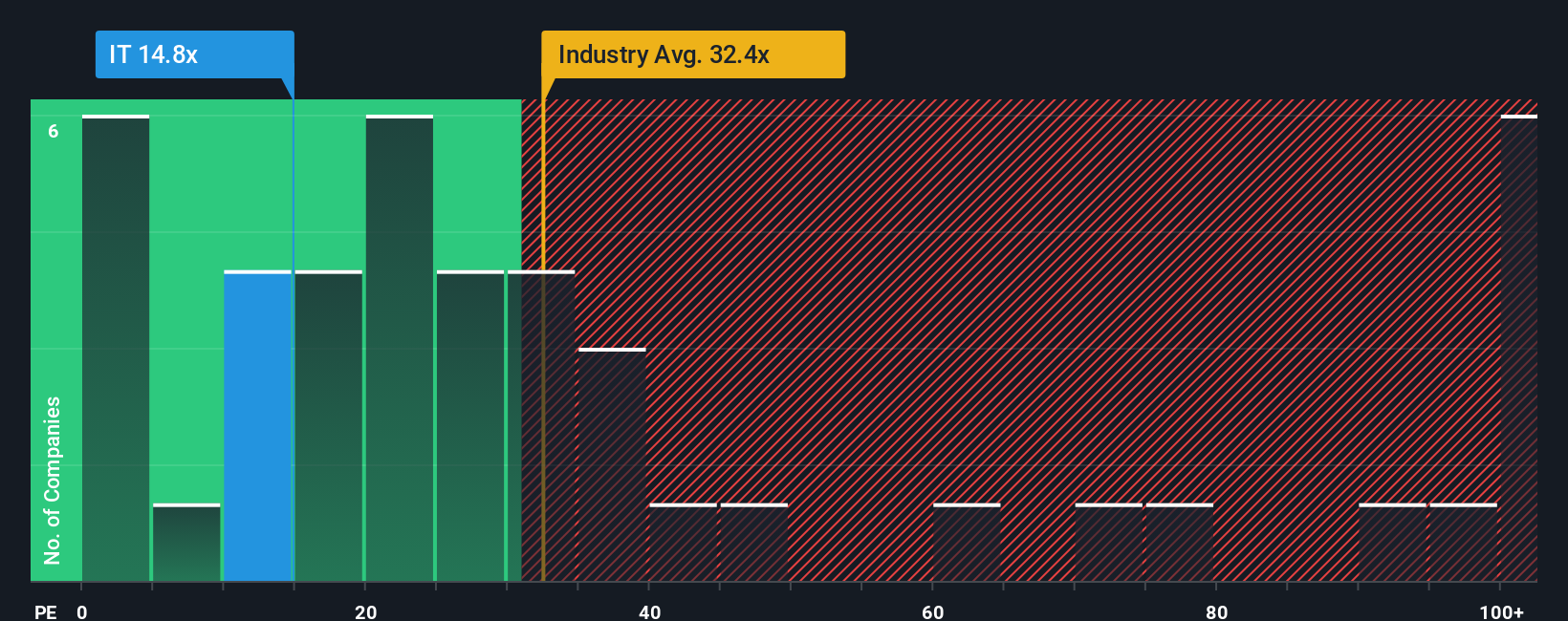

While the analyst narrative points to a rebound, Gartner’s price-to-earnings ratio currently sits at 14.7x, significantly below both the industry average of 30.7x and peer average of 21.4x, and under its own fair ratio of 22x. This gap could signal opportunity, or simply reflect real risks the market still sees ahead. Are these low multiples a bargain waiting to be uncovered, or a warning that the market’s caution is justified?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gartner for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gartner Narrative

If the analyst view or our calculations do not match your take, you can dive into the data and craft a Gartner story of your own in just a few minutes. Do it your way.

A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Seize the next big opportunity by taking action today. The Simply Wall Street Screener gives you powerful insights and tailored lists to help uncover tomorrow’s standout stocks before everyone else does.

- Unlock untapped value by checking out these 891 undervalued stocks based on cash flows, where cash flow metrics spotlight stocks flying under the radar but primed for future gains.

- Catch transformative trends as you browse these 25 AI penny stocks, a shortcut to companies pushing the envelope in artificial intelligence and digital automation.

- Grow your portfolio’s passive income with these 18 dividend stocks with yields > 3%, featuring businesses paying robust, sustainable yields well above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives