- United States

- /

- IT

- /

- NYSE:IT

Can Gartner's (IT) Expanded Buyback and AI Insights Shape Its Competitive Edge in a Shifting Market?

Reviewed by Sasha Jovanovic

- Earlier this week, Gartner expanded its share buyback authorization by an additional US$1 billion and shared new analysis forecasting a rapid consolidation in the agentic AI market as supply outpaces demand, with capital-rich incumbents expected to lead acquisitions of specialized AI firms.

- This development highlights Gartner's influence in shaping technology market conversations and reflects management's effort to reinforce shareholder value amid industry change and macroeconomic uncertainty.

- We'll explore how Gartner's expanded capital return program and thought leadership on AI market consolidation could impact its long-term investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Gartner Investment Narrative Recap

To be a Gartner shareholder today, you need to believe that enterprise adoption of AI, digital transformation, and continued demand for trusted tech research will keep driving growth, even as generative AI tools and cost constraints pressure traditional subscription models. The latest US$1 billion buyback shows management’s focus on capital returns, but does not directly offset the key short-term risk: potential subscription revenue deceleration if clients shift spend to alternative research or delay renewals. Its impact on the company’s big picture is largely incremental.

Among recent announcements, Gartner’s ongoing expansion of its share buyback authorization stands out. This program is closely tied to investor confidence in Gartner’s ability to generate free cash flow amidst a potential wave of AI-driven market consolidation and evolving client needs. But with macro and competitive pressures mounting, investors should also stay aware of...

Read the full narrative on Gartner (it's free!)

Gartner's outlook projects $7.4 billion in revenue and $821.8 million in earnings by 2028. This assumes annual revenue growth of 4.7% but a decline in earnings of $478.2 million from the current $1.3 billion.

Uncover how Gartner's forecasts yield a $300.60 fair value, a 26% upside to its current price.

Exploring Other Perspectives

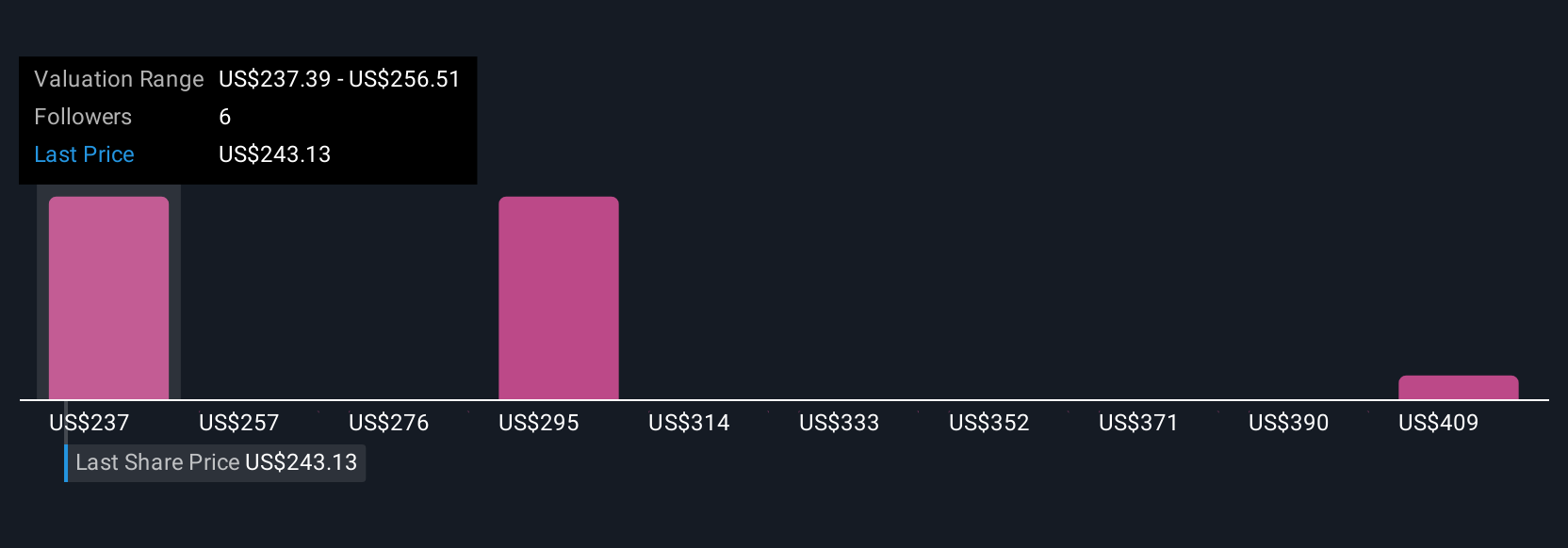

Simply Wall St Community members have set fair value estimates for Gartner stock ranging from US$223.67 to US$300.60, reflecting a wide spread across just two viewpoints. While opinions differ, pressure from emerging AI tools and client cost cutting could become more important for Gartner’s future performance; consider these varied perspectives as you weigh your own outlook.

Explore 2 other fair value estimates on Gartner - why the stock might be worth as much as 26% more than the current price!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives