- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT): Assessing Valuation After Consistent Earnings Beats and Expanding AI-Driven Growth Targets

Reviewed by Simply Wall St

Samsara (IOT) is back in focus after stringing together more than seven quarters of earnings beats, pairing that track record with ambitious Q3 2026 growth targets and steadily improving operating margins.

See our latest analysis for Samsara.

The latest earnings beat has not fully translated into a strong near term move, with a 30 day share price return of minus 5.45 percent and a year to date share price return of minus 13.66 percent. However, the three year total shareholder return of 225.45 percent suggests the longer term growth story is still intact and that momentum is pausing rather than breaking.

If Samsara's trajectory has you thinking more broadly about connected operations and automation, this could be a smart moment to hunt for other high growth tech and AI stocks that are building similar long term themes into their growth stories.

With growth still brisk but the share price cooling and analysts’ targets implying meaningful upside, is Samsara quietly slipping into undervalued territory, or is the market already baking in its next leg of expansion?

Most Popular Narrative Narrative: 21.2% Undervalued

With Samsara closing at $37.98 against a narrative fair value of $48.20, the most followed storyline sees meaningful upside anchored in long run growth.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year over year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Curious how that growth pace, rising margins and share count expansion all combine into one aggressive future earnings multiple and discount rate story? Unpack the full narrative to see which bold revenue and profitability assumptions are doing the heavy lifting behind this upside view.

Result: Fair Value of $48.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long enterprise sales cycles and uncertainty around monetizing AI products could slow ARR growth and challenge the upbeat, long-term valuation story.

Find out about the key risks to this Samsara narrative.

Another Lens on Value

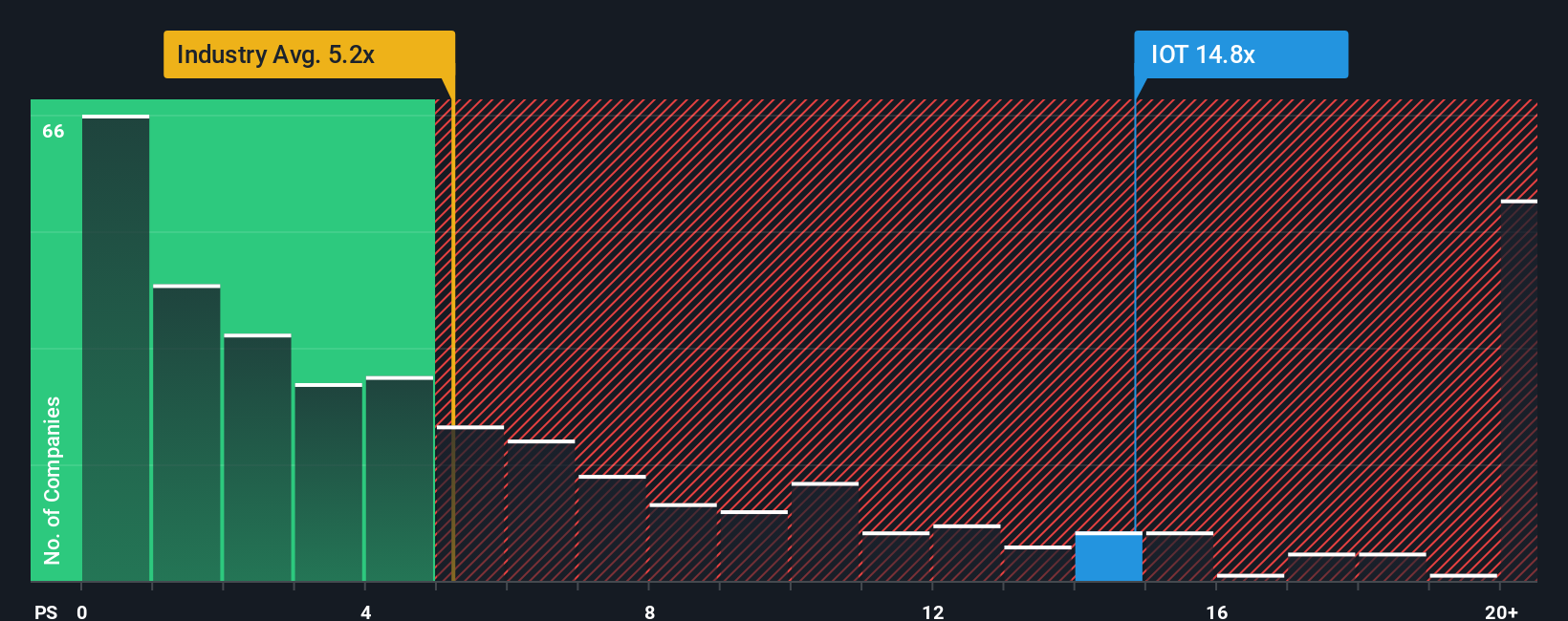

While the narrative fair value points to upside, Samsara’s price to sales ratio of 15.3 times is far richer than both US software peers at 4.7 times and an estimated fair ratio of 10.1 times. This raises the risk that any growth wobble could trigger a sharp de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next steps with targeted stock lists built from hard data, so you are not relying on headlines or hunches.

- Explore potential mispricings by scanning these 935 undervalued stocks based on cash flows where strong cash flows and discounted valuations may support compelling long term returns.

- Follow powerful technology trends by focusing on these 25 AI penny stocks that may convert AI-related tailwinds into meaningful revenue and earnings growth.

- Reinforce your income strategy with these 14 dividend stocks with yields > 3% that aim to balance yield with sustainable payout ratios and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026