- United States

- /

- Software

- /

- NYSE:INFA

Informatica (INFA): Evaluating Fair Value as Growth Moderates and Market Waits for Next Move

Reviewed by Kshitija Bhandaru

Informatica (INFA) shares have seen some movement as investors weigh the company’s recent performance and market positioning. While the past month showed a slight dip, year-over-year returns remain positive, which may indicate underlying stability.

See our latest analysis for Informatica.

After riding out some ups and downs, Informatica’s 1-year total shareholder return of 3.8% points to steady progress, even as momentum has slowed recently. With the share price now at $24.88, it seems investors are pausing to reassess growth prospects versus potential risks, following a period of stronger, longer-term gains.

If you’re interested in spotting what else the market might be rewarding, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading close to analyst targets and recent growth moderating, the big question is whether Informatica now represents an undervalued opportunity or if the market has already accounted for its future potential.

Most Popular Narrative: Fairly Valued

The narrative consensus suggests Informatica’s fair value is in line with the current share price, with only a marginal gap separating analyst targets and market price. This equilibrium reflects subdued expectations for wild valuation swings in the near term, making the following key narrative driver stand out even more.

Informatica's innovations, such as its AI-powered IDMC platform with CLAIRE AI and GenAI capabilities, are expected to capture a significant portion of the $62 billion addressable cloud market. This could potentially increase future revenue and earnings. Informatica's expansion in AI capabilities, with an increase in AI-driven use cases and AI blueprints with major tech partners, is expected to enhance revenue growth by driving the adoption of data management platforms.

Curious what bold assumptions power this fair value? The real story lies in growth upgrades, rapidly rising margins, and ambitious profit forecasts that most would not expect. How do analysts justify their price target with high growth multiples and future earnings leaps? Click to see what numbers drive the narrative’s fair value and what could surprise the market next.

Result: Fair Value of $24.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lower-than-expected renewals and foreign exchange headwinds could quickly undermine these fair value assumptions. This signals possible setbacks for Informatica's growth story.

Find out about the key risks to this Informatica narrative.

Another View: What the Ratios Reveal

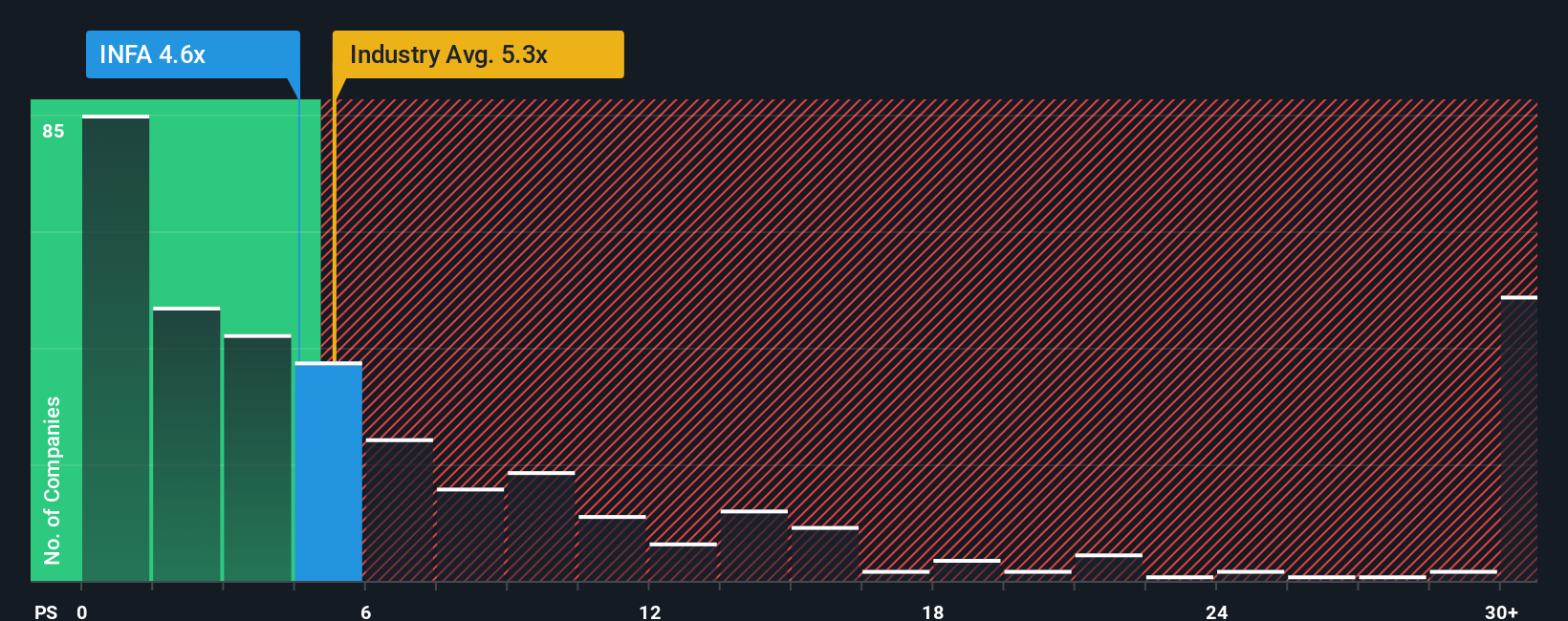

Looking through a different lens, Informatica’s price-to-sales ratio stands at 4.6x. This is noticeably lower than both its peer average of 6.9x and the US software industry’s 5.3x. The fair ratio, calculated at 5.5x, suggests the stock could move higher if sentiment shifts. Are investors overlooking a potential value or pricing in more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Informatica Narrative

If you see the story unfolding differently or want a hands-on look at the numbers, you can craft your own narrative in just a few minutes, your way. Do it your way

A great starting point for your Informatica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big win slip away. Expand your watchlist now with bold opportunities you can spot instantly using Simply Wall Street’s powerful tools.

- Grow your wealth with regular income by checking out these 19 dividend stocks with yields > 3% that offer yields above 3% and robust financial stamina.

- Spot tomorrow’s leaders by searching these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and fast-growing business models.

- Seize undervalued opportunities and get ahead of the crowd by reviewing these 910 undervalued stocks based on cash flows filtered for strong fundamentals and cash flow upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INFA

Informatica

Develops an artificial intelligence-powered platform that connects, manages, and unifies data across multi-vendor, multi-cloud, and hybrid systems at enterprise scale worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives