- United States

- /

- Software

- /

- NYSE:INFA

Informatica (INFA): Assessing Valuation as Shares Hold Steady in the Changing Software Sector

Reviewed by Kshitija Bhandaru

Informatica (INFA) shares have held steady recently, drawing attention from investors interested in how the company is faring amid shifts in the software sector. Many are curious whether Informatica's valuation reflects its growth outlook.

See our latest analysis for Informatica.

Over the past year, Informatica’s stock has quietly delivered a 3.8% total shareholder return, signaling steady progress as investors weigh the company’s growth efforts alongside broader technology sector shifts. Momentum appears to be gradually building, reflecting some renewed optimism in the software space.

If recent strength in software has you looking for your next tech winner, you might want to explore our curated list of leading technology and AI innovators: See the full list for free.

With shares edging higher but trading near analyst price targets, the real question for investors is whether Informatica is still undervalued or if the market has already accounted for its future growth potential.

Most Popular Narrative: Fairly Valued

With Informatica's last close price of $24.88 matching closely with the most widely followed fair value estimate of $24.40, the numbers suggest the market and consensus are largely aligned. The setup centers on growth assumptions and major shifts in business model at the heart of this valuation story.

Informatica's transition to a cloud-only strategy is expected to enhance long-term revenue through increased upsell and cross-sell opportunities on the IDMC platform, despite short-term revenue impacts due to subscription credits during migrations. The anticipated growth of cloud subscription ARR, aiming to reach the $1 billion milestone in 2025, is expected to drive future earnings, with cloud subscriptions projected to account for nearly 60% of total ARR by the end of the year.

What are the key drivers that make analysts confident this price is right? They are factoring in bold improvements in profit margins and a future earnings multiple that draws attention. Curious what mix of growth, profitability, and market positioning justifies that forecast? Dig deeper for the assumptions shaping this fair value.

Result: Fair Value of $24.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a drop in renewal rates or prolonged impacts from declines in professional services could quickly challenge the confidence behind the current valuation outlook.

Find out about the key risks to this Informatica narrative.

Another View: Looking at Sales Multiples

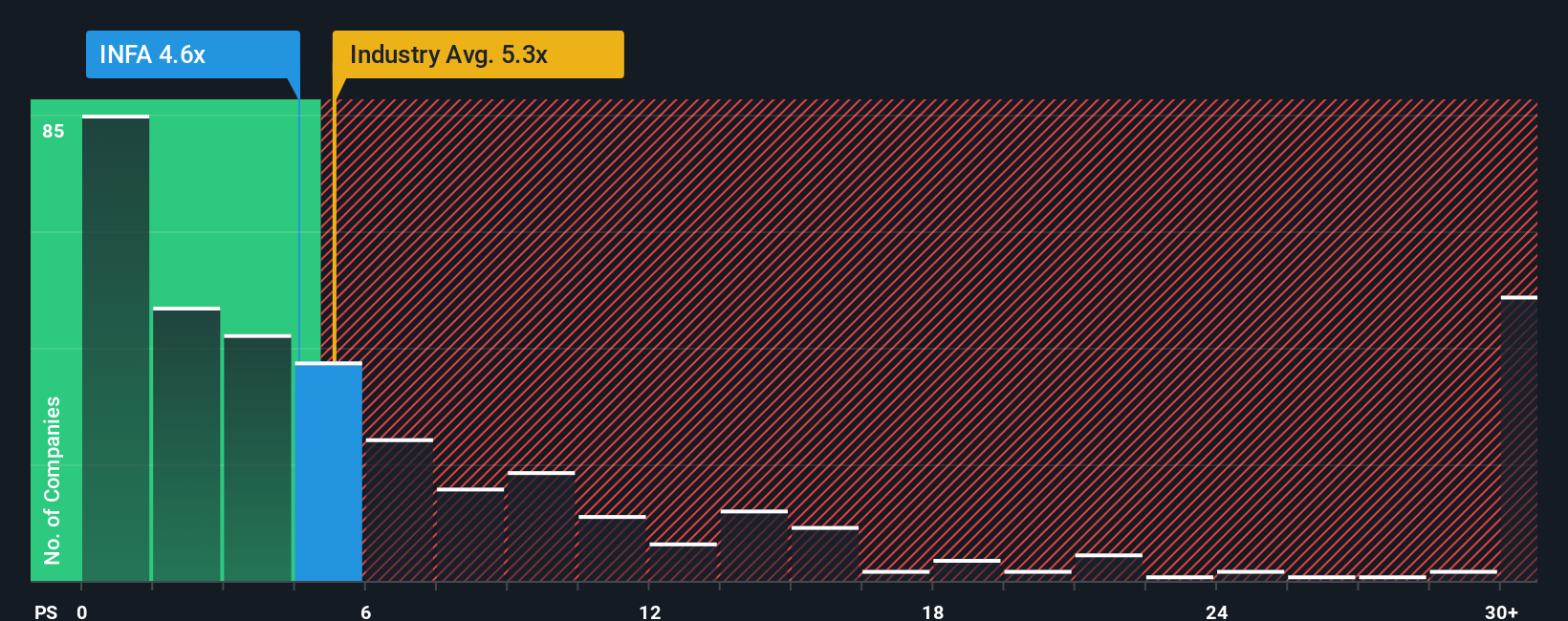

While the fair value estimate points to Informatica being about right, a different lens tells its own story. Based on the price-to-sales ratio of 4.6x, Informatica is trading notably below both its industry average of 5.3x and the fair ratio of 5.5x. This hints at potential undervaluation. Could this gap represent an overlooked opportunity, or does it signal lingering doubts about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Informatica Narrative

If the consensus doesn't fit your perspective, you have the tools to dive into the latest numbers and shape your own outlook in just a few minutes. Do it your way

A great starting point for your Informatica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to find your next big opportunity? Don’t let today’s market leaders slip through your fingers. There are fresh ideas waiting to be uncovered.

- Tap into the latest surge in artificial intelligence by reviewing these 24 AI penny stocks, where rapidly growing innovators are grabbing headlines and investor attention.

- Access potential turnarounds and hidden gems as you browse these 904 undervalued stocks based on cash flows, featuring companies trading below their true worth.

- Grow your portfolio with reliable income streams by checking out these 19 dividend stocks with yields > 3%, packed with stocks offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INFA

Informatica

Develops an artificial intelligence-powered platform that connects, manages, and unifies data across multi-vendor, multi-cloud, and hybrid systems at enterprise scale worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives