- United States

- /

- Software

- /

- NYSE:INFA

How Informatica’s Valuation Stacks Up After the Recent Q1 Earnings Beat

Reviewed by Bailey Pemberton

Thinking about what to do with Informatica stock? You are not alone. Recent movement in the shares has caught a lot of attention, and there is no shortage of opinions out there. Right now, the stock is hovering near $24.92, and you might notice the numbers are a bit of a mixed bag. Over the past week and month, Informatica has inched up by 0.4% and 0.6% respectively, but if you look at the year-to-date performance, it is down 2.1%. The past year also shows a slight dip, with shares falling 1.9%. Interestingly, the three-year return paints a much brighter picture, up over 20.4%, which suggests something has changed in how the market views Informatica’s long-term potential.

Part of what is driving this conversation is how analysts value the company right now. Based on a six-factor valuation check, Informatica scores a 4. That is, it is considered undervalued in four out of six key ways. Positive momentum and renewed interest have emerged as information management and data privacy solutions become more central to enterprise technology strategies, and investors are recalibrating their expectations accordingly.

So, is Informatica genuinely undervalued, or is the market missing something? Let’s dig into the different valuation approaches to get a clearer sense of where the company stands. Stick around, because I will share an even more insightful way to cut through the noise at the end.

Why Informatica is lagging behind its peers

Approach 1: Informatica Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting them back to today’s value, giving investors a sense of what the business is truly worth in present terms. This approach is especially useful for companies like Informatica, where future cash generating ability is a key consideration.

Currently, Informatica’s Free Cash Flow stands at $425.3 Million. Looking forward, analysts expect this to grow, with projections for 2026 showing Free Cash Flow of about $455.4 Million, continuing to increase each year thereafter through 2035. These ten-year forecasts, largely extrapolated by industry models after the initial five-year analyst estimates, show cash flows rising steadily and reflect confidence in Informatica’s ability to scale its operations.

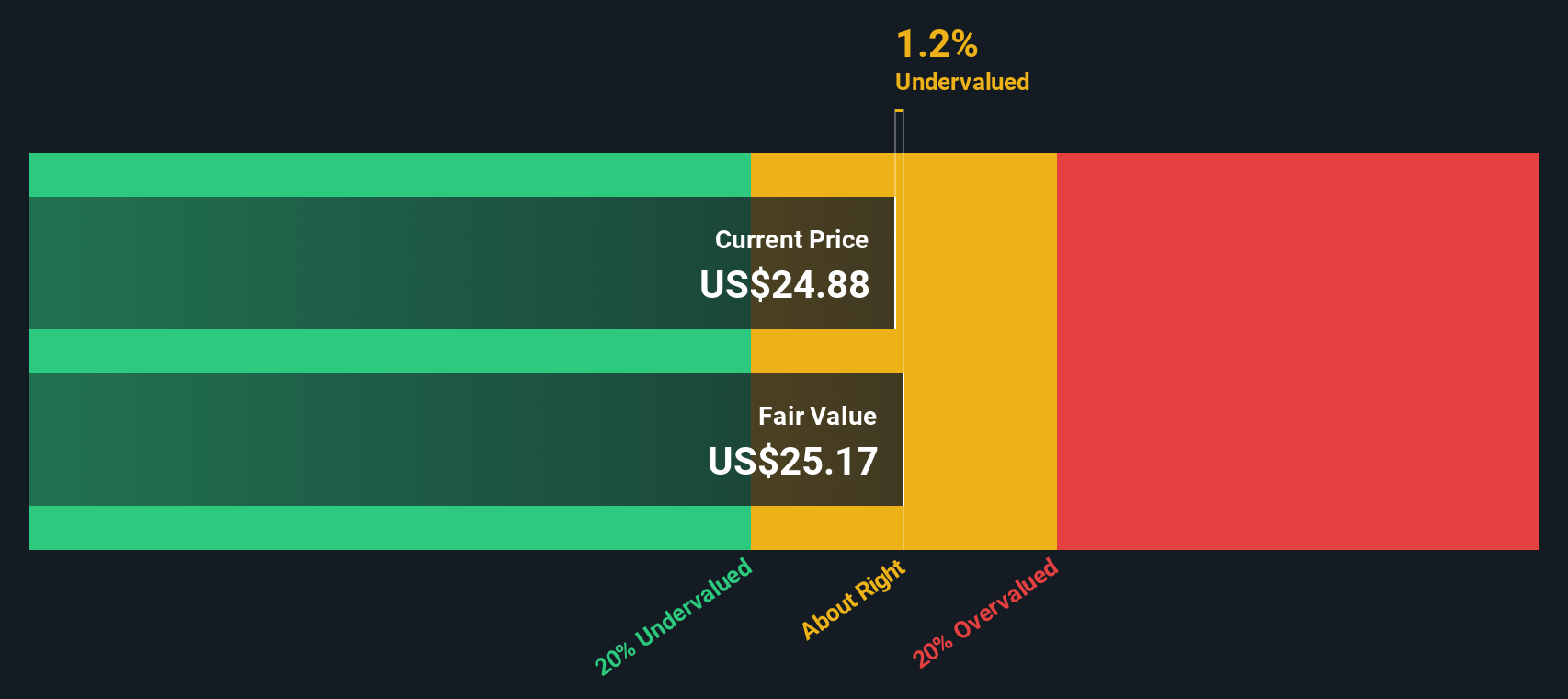

Based on this DCF analysis, which discounts the projected future cash flows back to their present value, the estimated intrinsic value for Informatica’s stock is $25.07 per share. With the current market price at approximately $24.92, this implies the stock is only about 0.6% undervalued using this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Informatica's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Informatica Price vs Sales (P/S Ratio)

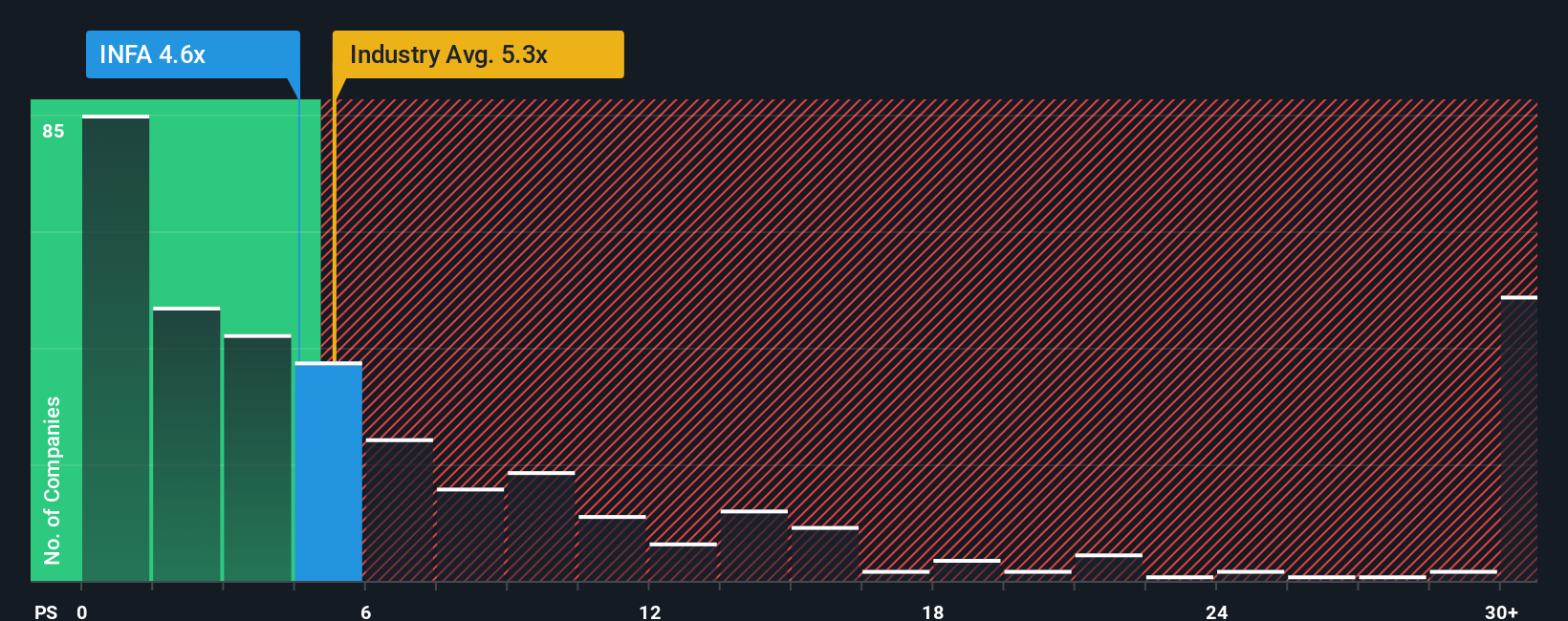

For technology companies like Informatica, the Price-to-Sales (P/S) ratio is often a preferred way to value the stock, particularly when profitability can swing from quarter to quarter or be affected by large investments in growth. The P/S ratio helps investors focus on how much they are paying for every dollar of sales, which is a reliable measure even when earnings are volatile.

Growth expectations and risk play a big role in shaping what is considered a “normal” or “fair” P/S multiple. Fast-growing companies with steady sales expansion often justify higher P/S ratios. On the other hand, elevated risk or slower growth tends to dampen them. Informatica’s current P/S ratio stands at 4.57x. This is lower than the Software industry average of 5.29x and well below the peer average of 6.84x, potentially signaling a value opportunity.

Simply Wall St offers an additional layer of insight with their proprietary “Fair Ratio,” which, in Informatica’s case, is calculated at 5.45x. Unlike simple peer or industry comparisons, the Fair Ratio is tailored to Informatica’s unique profile, blending expectations for its growth, profit margins, industry norms, market capitalization, and risk factors. This makes it a more nuanced benchmark for judging whether the stock is reasonably valued.

When comparing Informatica’s actual P/S ratio of 4.57x with the Fair Ratio of 5.45x, the difference is meaningful and suggests that the stock could be undervalued at current prices.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Informatica Narrative

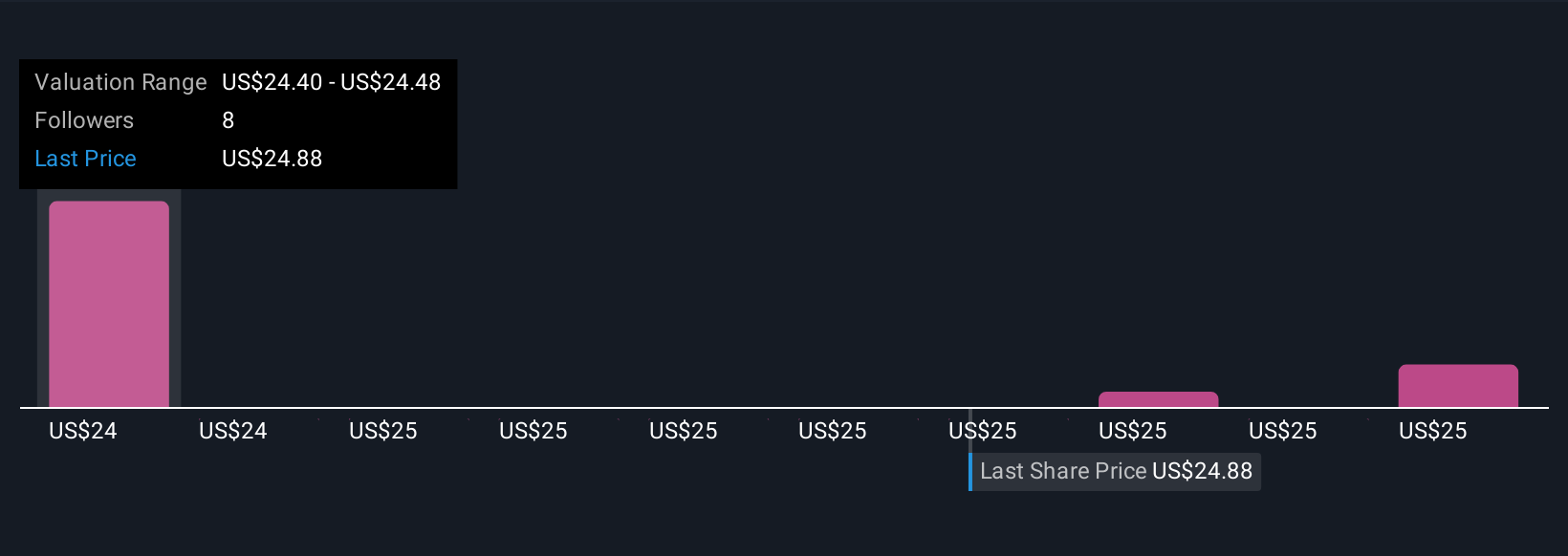

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story or perspective you have about a company that you connect to your forecast for its future. This includes your estimates for revenue, earnings, profit margins, and ultimately, what you believe the fair value should be. Narratives make investing more intuitive by linking a company’s journey directly to financial projections and valuations, allowing you to turn your view of Informatica’s business strategy, risks, and opportunities into a concrete number you can act on.

On Simply Wall St’s Community page, investors like you can create, share, and explore Narratives, which are an easy and accessible tool used by millions worldwide. Narratives help you clearly decide when to buy or sell by comparing your Fair Value to the current Price. Because they update dynamically whenever news or earnings come in, your view stays relevant.

For example, with Informatica, one Narrative might be more bullish and emphasize its cloud-only shift and AI partnerships, resulting in a higher fair value target of $25.0. Another investor might focus on execution risks and slower renewal growth and land at a more cautious fair value like $19.0. With Narratives, everyone’s unique perspective is captured and visible, helping you cut through the noise and make smarter decisions.

Do you think there's more to the story for Informatica? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INFA

Informatica

Develops an artificial intelligence-powered platform that connects, manages, and unifies data across multi-vendor, multi-cloud, and hybrid systems at enterprise scale worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)