- United States

- /

- IT

- /

- NYSE:IBM

Is IBM's Quantum Leap Keeping Shares Fairly Priced in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with International Business Machines stock? You are not alone. Regular headlines about quantum computing breakthroughs and a rapid-fire series of news events have kept this tech giant in the spotlight, and the stock has not exactly been under the radar either. Just over the past month, IBM's shares have seen a sharp 8.6% rise, adding to an impressive 24.6% gain over the past year. If you zoom out a bit more, the longer-term numbers are even more significant, with the stock up 143.1% over three years and 215.0% over five years. The latest bump seems to track with optimistic buzz about IBM's prospects in quantum technology. IBM is being described as a frontrunner in the race for "Quantum advantage," something that could have game-changing real-world implications over the next decade.

But of course, stock price momentum is only half the story. Just because shares have soared does not always mean a company is overvalued or undervalued. Looking at IBM's value score, the company passes just 1 out of 6 key undervaluation checks. That is not a huge ringing endorsement from the usual valuation metrics, but it also means there could be specific hidden strengths or growth levers that are not reflected yet in a basic screen.

So how should you make sense of IBM's recent rally, especially when the traditional numbers might not tell the full story? Let's walk through the most popular valuation approaches analysts use. Each has merits and pitfalls. Later, we will get into one potentially better way to gauge if IBM is a buy, hold, or sell today.

International Business Machines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: International Business Machines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This gives investors a sense of what the business might actually be worth based on fundamentals rather than just market sentiment.

For International Business Machines, the current Free Cash Flow stands at approximately $11.5 Billion. Analysts project steady growth over the coming years, with Free Cash Flow expected to rise to $18.7 Billion by the end of 2029. While professional forecasts typically look out about five years, Simply Wall St continues projections further and estimates that by 2035, IBM's annual cash flow could reach $24.1 Billion. All these figures are calculated in US dollars.

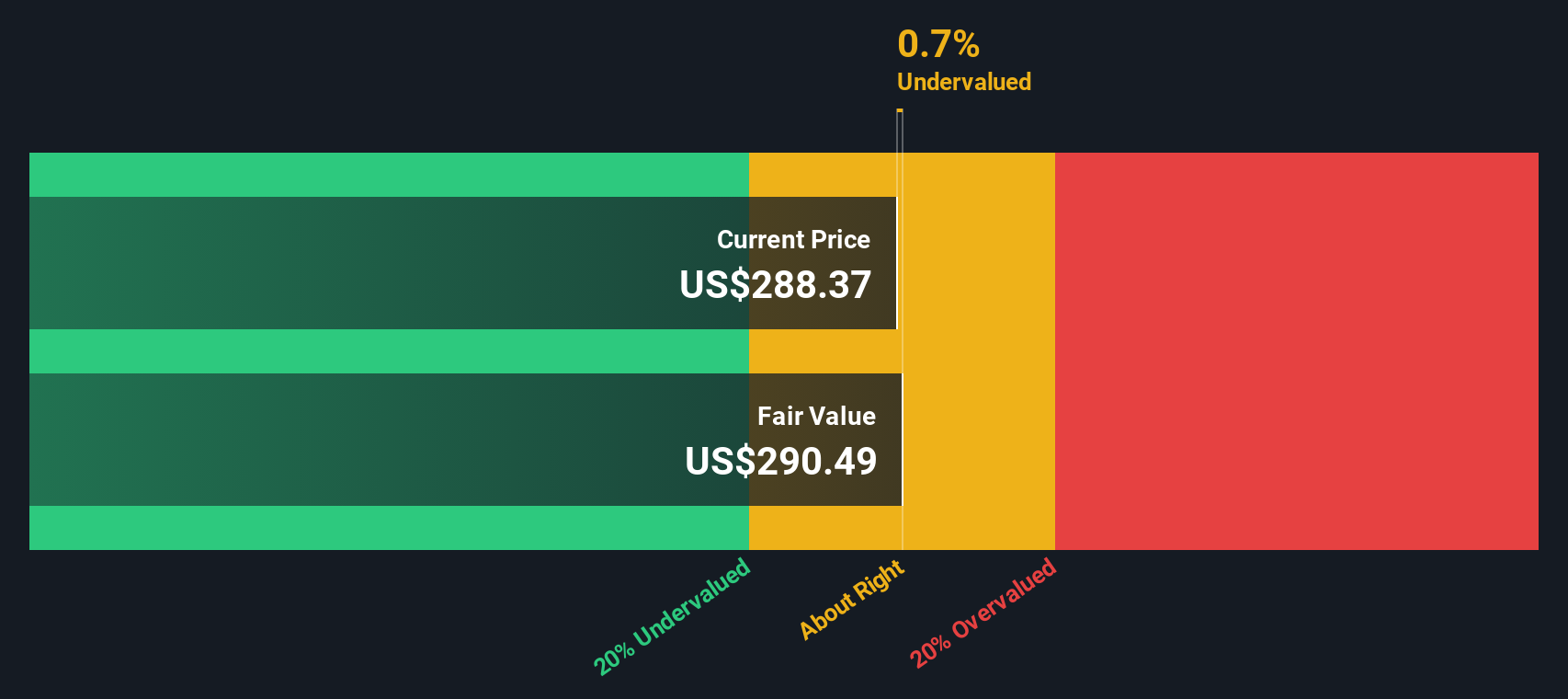

Using a 2 Stage Free Cash Flow to Equity model, the DCF calculation places IBM's intrinsic fair value at $289.34 per share. This price is about 2.8% above the company’s current share price, suggesting the stock is trading very close to its estimated fair value based on cash flow fundamentals.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out International Business Machines's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: International Business Machines Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a core valuation multiple for profitable companies like International Business Machines because it directly relates a company's share price to its per-share earnings. For established firms generating steady profits, the PE ratio is often the market's go-to tool to quickly gauge how expensive a stock is relative to its underlying earnings power.

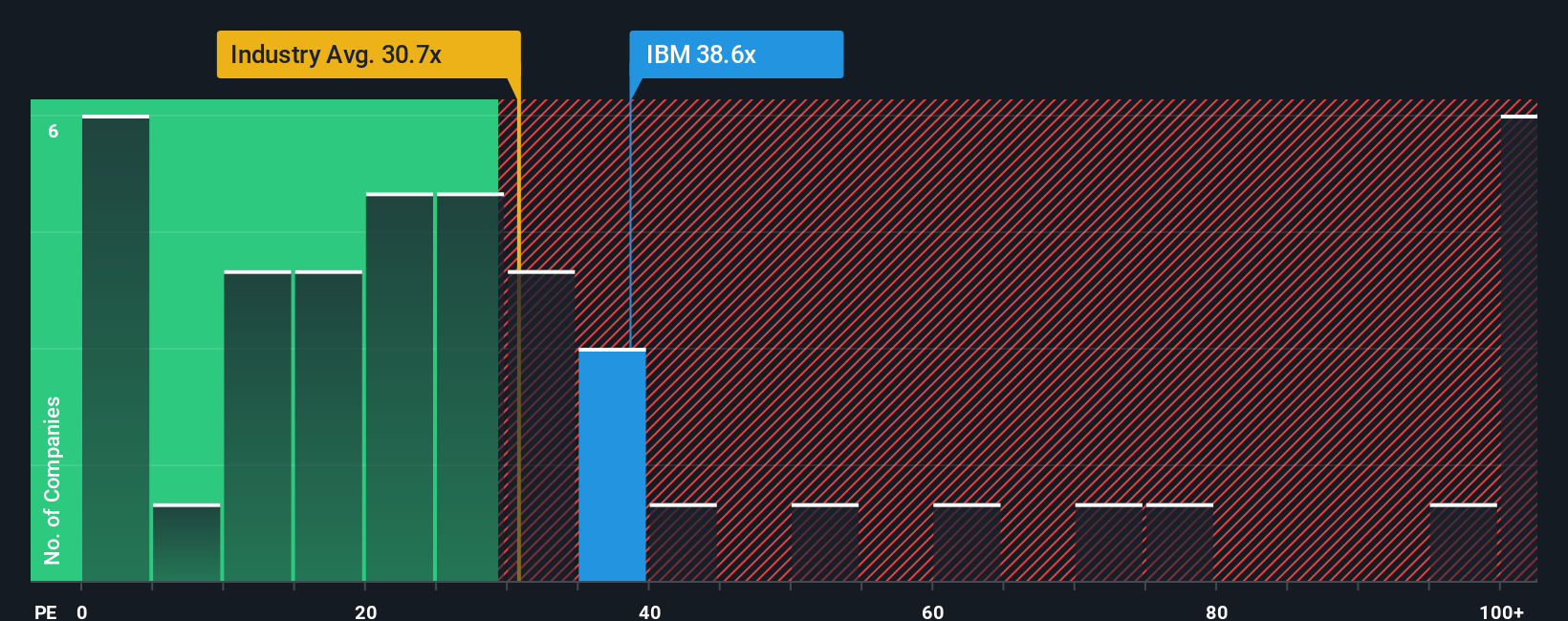

However, determining what counts as a “normal” or “fair” PE ratio depends on factors like how fast a company is expected to grow, its predictability, and the risks of its business. A high-growth but riskier firm typically demands a higher PE, while slow-growth or riskier companies warrant a lower PE. Comparing IBM’s PE ratio to industry standards, IBM currently trades at 44.7x earnings. That is notably higher than the IT industry average of 32.0x and above the peer average of 20.4x.

To offer a more tailored perspective, Simply Wall St applies its proprietary “Fair Ratio” method. This metric estimates a specific PE ratio for IBM based on its earnings outlook, risk profile, margin strength, industry factors, and market cap. Rather than the basic peer or industry comparison, the Fair Ratio adjusts for IBM’s unique characteristics, providing a more nuanced way to judge valuation. For IBM, the Fair Ratio is 43.2x, very close to the current 44.7x, suggesting the stock is fairly priced once its quality and growth are factored in.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Business Machines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, approachable way to tie your investment view of a company to the numbers. In other words, it links the story you believe about International Business Machines to a projected financial forecast, and ultimately to your own estimate of fair value.

Narratives make it easier for investors to move beyond static “one-size-fits-all” analysis. You can give your perspective on where IBM is heading, adjust assumptions such as future revenue or margins, and instantly see how your story compares to current market prices or what other investors believe.

This dynamic approach is built into Simply Wall St’s Community page, used by millions of investors to share and compare possible outcomes for companies. When news breaks or earnings come out, Narratives get updated in real time, so your investment view can evolve quickly with new information.

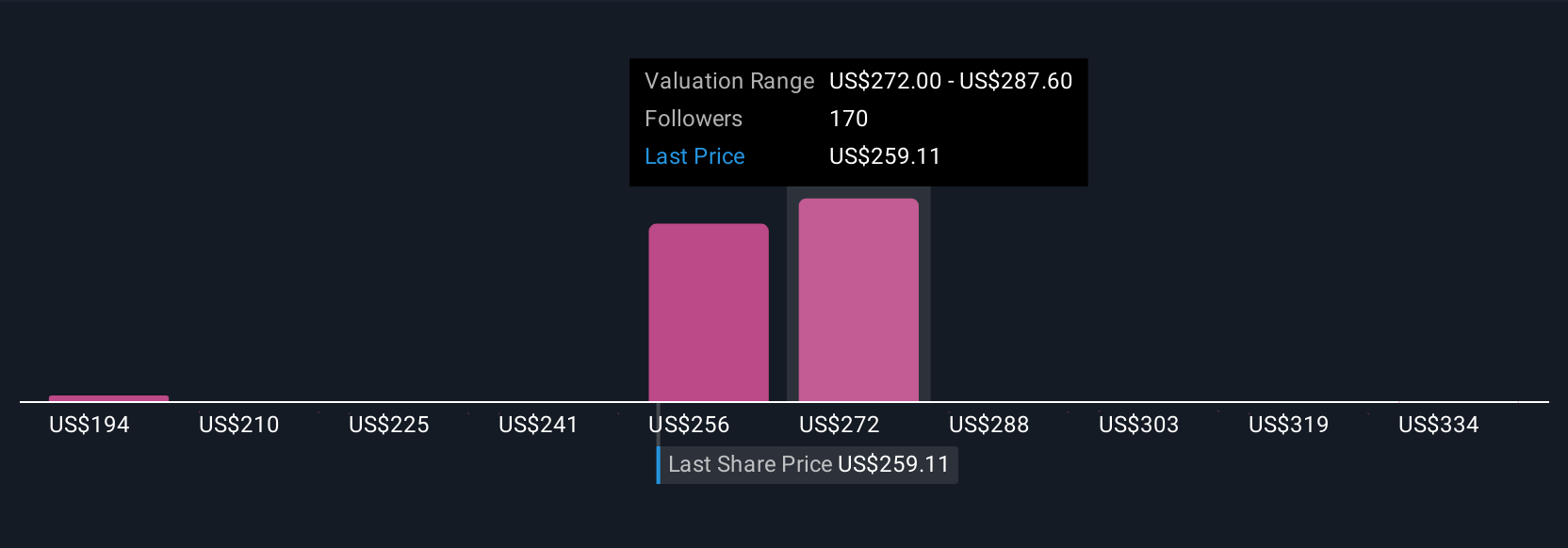

For example, some investors maintain a bullish Narrative for IBM and see a fair value as high as $350, driven by rapid growth in AI and hybrid cloud. Others see risks that justify a fair value closer to $198 as competition and legacy business headwinds weigh on future earnings.

For International Business Machines, we will make it really easy for you with previews of two leading International Business Machines Narratives:

🐂 International Business Machines Bull Case

Fair Value: $281.32

Valuation difference: 0.0% undervalued

Expected revenue growth: 5.1%

- IBM's focus on hybrid cloud, artificial intelligence, and strategic acquisitions is expected to drive sustained revenue growth, margin improvement, and stronger client relationships as organizations modernize their IT infrastructure.

- Investments in technologies like the z17 mainframe, generative AI, and acquisitions such as HashiCorp enhance IBM's differentiation, pricing power, and long-term recurring software revenue.

- The analyst consensus fair value is $281.32, just about matching the recent close. This reflects a view that IBM is fairly priced if assumed growth, margin expansion, and cost management are achieved.

🐻 International Business Machines Bear Case

Fair Value: $198.00

Valuation difference: 42.1% overvalued

Expected revenue growth: 4.6%

- Intensifying competition from hyperscale cloud providers and the structural shift toward public cloud solutions are seen as major threats to IBM's core business, placing limits on future revenue and margin growth.

- Ongoing operational and financial challenges, including compliance costs, debt, and a need for heavy investment, could constrain IBM's ability to innovate and pressure long-term earnings power.

- The most bearish price target is $198, about 42% below the latest close. Analysts with this perspective believe that current market expectations are too optimistic given industry headwinds and IBM's legacy exposure.

Do you think there's more to the story for International Business Machines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion