- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Partners With Fresche Solutions To Enhance Cloud Migration Services

Reviewed by Simply Wall St

In the recent quarter, IBM and Fresche Solutions formed a partnership to deliver managed services for Power Virtual Server, highlighting the ongoing push towards IT modernization in cloud services. International Business Machines (NYSE:IBM) saw a 7% price increase during this period, coinciding with several important announcements, including its initiatives with Mitsubishi to enhance customer experiences using AI and extended collaborations with companies like Juniper and L'Oreal. These partnerships align with the company's strategic focus on expanding its cloud and AI capabilities amidst a broader market downturn, where major indices like the S&P 500 and Nasdaq Composite faced declines over the past quarter. IBM's steady advancements in teaming with firms to leverage cutting-edge technologies showcase its resolve to drive growth and resilience despite macroeconomic pressures present in the past months. These developments may have positively influenced investor sentiment, potentially contributing to IBM's share price increase of 7.48% in the last quarter.

Over the past five years, International Business Machines (NYSE:IBM) has experienced a substantial total shareholder return of 217.29%. This performance reflects both market-driven dynamics and several pivotal corporate developments. Notably, IBM's strategic alliances, such as the expanded collaboration with Juniper Networks in February 2025 to optimize IT networks using AI, played a significant role in the company's growth. Additionally, IBM launched Granite 3.2 in late February 2025, enhancing enterprise applications, which likely bolstered investor confidence. The steady increase in dividends, including the recent quarterly declaration of US$1.67 per share in January 2025, further underscores IBM's commitment to shareholder value.

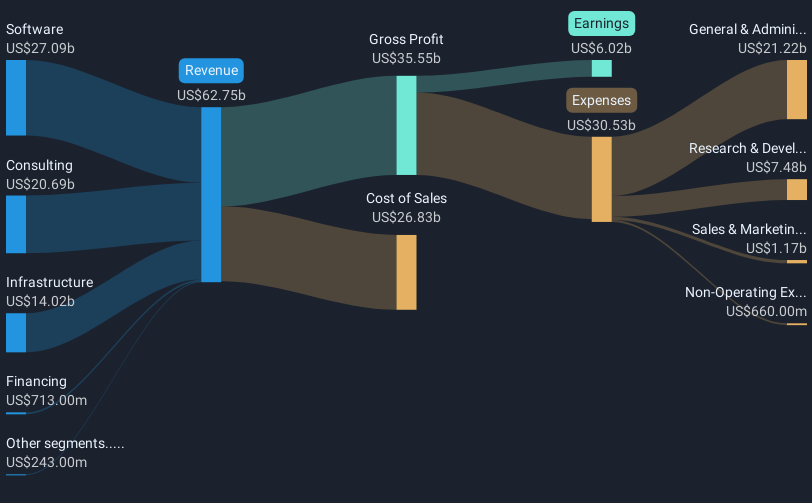

IBM's financial performance demonstrated a complex landscape. Despite the recent Q4 2024 financial results showing a decline in net income to US$2.92 billion compared to the previous year, its robust return on equity at 21.96% implies efficient profit generation. Comparative to the US IT industry, IBM outperformed, achieving a higher one-year return than the industry’s 4.2% performance, indicating significant relative resilience. This combination of strategic moves and financial metrics likely supported IBM's long-term shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade International Business Machines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives