- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Partners With Clark Atlanta University For AI Skill Development

Reviewed by Simply Wall St

International Business Machines (NYSE:IBM) recently announced a partnership with Clark Atlanta University focused on AI education, a move that aligns with the growing demand for tech skills. Over the last quarter, IBM's share price rose 28%, significantly outpacing the market's 2% rise in the past week and highlighting investor optimism. The collaboration may have bolstered confidence in IBM's innovation trajectory. Despite challenges in financial performance, with a drop in net income compared to the prior year, initiatives like the dividend declaration and partnerships in AI emphasize IBM's growth strategy, potentially influencing investor sentiment positively in the last quarter.

IBM's recent partnership with Clark Atlanta University could further enhance its reputation in AI innovation. This move aligns with its broader focus on hybrid cloud and AI integration, essential areas noted in the company's current strategy amid macroeconomic challenges. Over the longer-term, IBM's total shareholder returns, factoring in both share price appreciation and dividends, reached an impressive 229.89% over five years, showcasing substantial growth. However, this recent partnership might only have a modest direct impact on short-term revenue and earnings forecasts, given the need for broader economic stability and the inherent uncertainties within the tech sector.

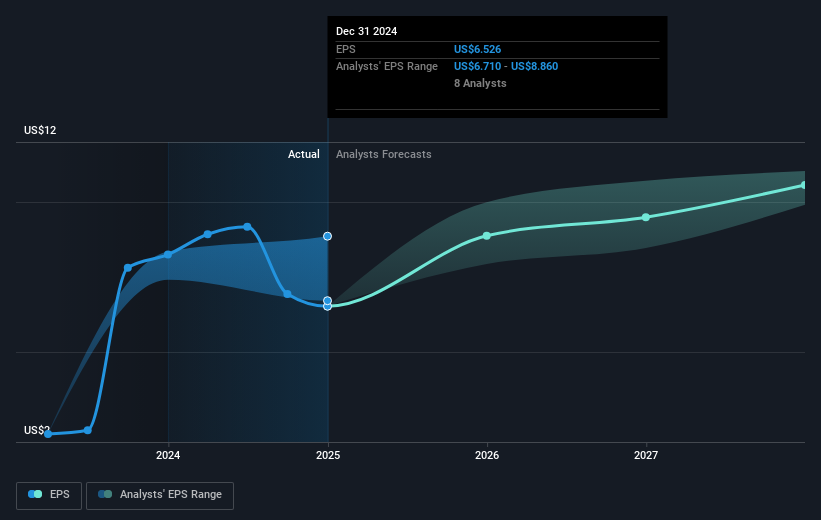

When considering IBM's recent share price surge of 28% against a modest 2% market rise over the past quarter, the company's performance is noteworthy. Yet, when mapped against analyst price targets, the current stock price of US$253.37 remains below the consensus target of US$260.02. This implies that despite recent upticks and developments, market expectations and stock valuation are not fully aligned. Over the past year, IBM has outpaced the US market return of 14.3% and the IT industry's 35.6%, providing a relative perspective on its performance trend. How these developments influence IBM's future financial trajectory remains contingent on multiple factors, including its ability to sustain growth amidst prevailing sector headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives