- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Expands AI Innovations With Lumen And Oracle Collaborations

Reviewed by Simply Wall St

International Business Machines (NYSE:IBM) saw its shares rise by 10% over the past month, buoyed by strategic collaborations with Lumen Technologies and Oracle, which promise advancements in AI and cloud infrastructure. These partnerships aim to enhance enterprise productivity and real-time AI capabilities, aligning with global trends prioritizing technological innovation. Although the broader market experienced a slight dip as investors assessed economic implications of potential tariff changes and awaited Fed decisions, IBM’s announcements offered positive counterweight to market uncertainties. The company’s commitment to AI through these alliances likely added momentum to its stock performance, in line with the market's rise.

Find companies with promising cash flow potential yet trading below their fair value.

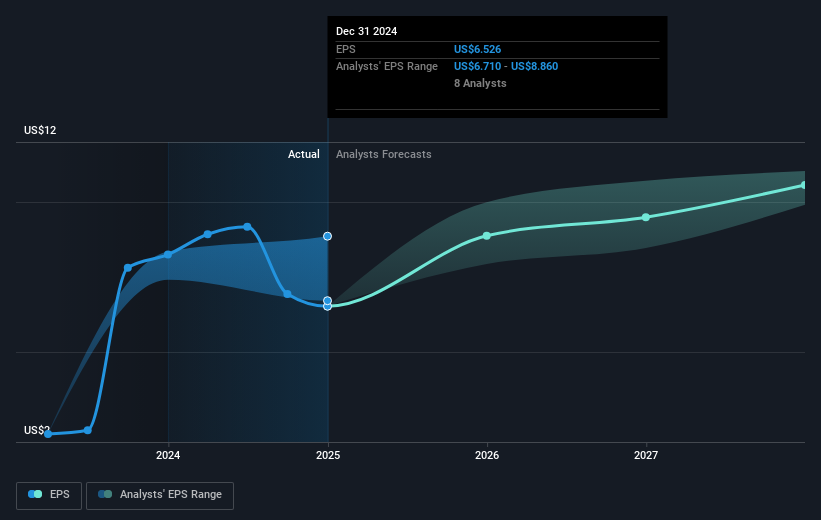

The recent collaborations between IBM and companies like Lumen Technologies and Oracle have not only bolstered IBM’s short-term share price but could also influence its longer-term revenue and earnings trajectory. With a focus on AI and cloud advancements, IBM's strategic direction appears well-aligned with industry trends, potentially enhancing its enterprise productivity solutions. Despite this positive news, analysts' forecasts for IBM are mixed. If anticipated AI and cloud growth slows, it could impact IBM's software revenue and net margins, presenting headwinds amid global economic uncertainties.

Over a longer term, IBM has delivered a total return, including dividends, of 164% over the last five years. Compared to the US IT industry, which returned 15.9% over the past year, IBM's performance could be perceived as robust, especially in the context of the broader market's more modest returns. Current market conditions show IBM’s share price slightly below the consensus analyst price target of US$252.42. This indicates that while there is room for upside, the market may already reflect some of the optimism surrounding IBM’s strategic initiatives.

Overall, while recent developments may inject optimism into forecasted earnings and revenue growth, these need to be fully realized against potential competitive and economic challenges. Investors should consider IBM’s current share price of US$241.82 relative to its long-term performance and analyst estimates, acknowledging the delicate balance between market optimism and inherent risks.

Learn about International Business Machines' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives