- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Expands AI & Cloud Offerings With US$150 Billion Investment

Reviewed by Simply Wall St

International Business Machines (NYSE:IBM) recently declared an increase in its quarterly cash dividend and launched a new Microsoft Practice, aimed at enhancing digital transformation for clients. Over the last quarter, IBM's stock price increased by 5%, alongside market movements like the Dow's uptick amid strong earnings reports. The company's strategic moves, such as the $150 billion investment in the U.S. and the collaboration with Credo AI, added weight to the positive sentiment. These developments aligned with broader market optimism and investor confidence amidst general bullish trends in the market.

You should learn about the 5 possible red flags we've spotted with International Business Machines.

The recent developments, including IBM's increased dividend and collaboration with Microsoft and Credo AI, could significantly influence the narrative surrounding its future potential. The partnership with Microsoft is geared towards enhancing digital transformation efforts, potentially boosting client adoption of AI and technology solutions. However, concerns about geopolitical tensions and supply chain vulnerabilities still pose challenges to IBM's revenue growth. As businesses shift their focus to AI and digital transformations, IBM's strategic realignments in these areas might offset potential headwinds in consulting revenue.

Looking at the company's performance over the longer term, IBM achieved a total shareholder return of 155.44% over the past five years, highlighting strong historical performance. Comparing this to the industry, over the past year, IBM shares outperformed the US IT industry average, which returned 12.8%. This performance context underscores IBM's resilient position in the market, despite recent fluctuations.

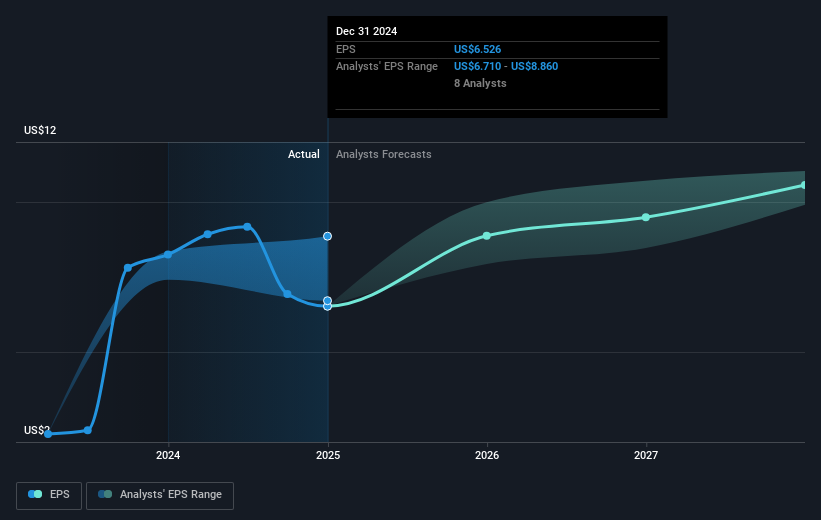

Regarding revenue and earnings forecasts, the recent announcements are likely to have a mixed impact. While the dividend increase and partnerships may bolster investor confidence and support revenue growth, integration risks from acquisitions and macroeconomic headwinds could temper earnings forecasts. With IBM's current share price of US$245.48, the price remains below the consensus analyst price target of US$252.42, albeit with a minor discount. Investors should consider these developments in their analysis of IBM's potential for future growth and valuation.

Learn about International Business Machines' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives