- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Expands AI And Cloud Partnerships With New Initiatives

Reviewed by Simply Wall St

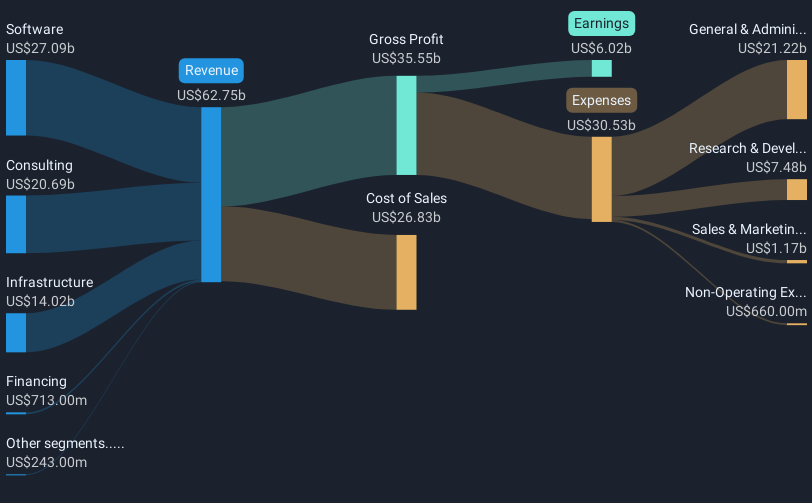

International Business Machines (NYSE:IBM) announced several developments, including the establishment of a Microsoft Practice and a partnership with Box on April 29, 2025, alongside a dividend increase to $1.68 per share, reflecting its strategic focus on enhancing AI and cloud solutions. Over the last quarter, IBM's stock rose 5% in alignment with broader market trends, which gained 5.2%. Though the company's initiatives were significant, they added to existing upward market movements amid generally positive earnings reports, rather than deviating from overall stock market direction.

We've spotted 5 possible red flags for International Business Machines you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

IBM's recent announcement of a Microsoft Practice establishment and partnership with Box, alongside a dividend increase to $1.68 per share, aligns with its ongoing strategy to amplify AI and cloud solutions. These developments may strengthen its service offerings, potentially enhancing future revenue streams and improving earnings forecasts. The initiatives reflect an effort to keep pace with industry trends, although integration risks remain a consideration given IBM’s reliance on acquisitions.

Over a five-year horizon, IBM's total shareholder returns were 157.04%, a substantial gain illustrating robust long-term performance. This compares to a year-over-year performance that saw IBM outpace the IT industry return of 16.4%. Such historical data highlights IBM's enduring capacity to deliver value to shareholders, although past success is not indicative of future results.

IBM's recent 5% stock price increase aligns closely with broader market gains of 5.2% over the last quarter. With its current price standing at US$245.48, it is trading slightly below the average analyst price target of US$252.42, suggesting a modest discount. Recent strategic endeavors and partnerships could support gradual growth in revenue and profitability, though geopolitical and supply chain challenges persist as potential headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives