- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM): Valuation in Focus as New AI Partnerships and Automation Initiatives Drive Investor Interest

Reviewed by Kshitija Bhandaru

International Business Machines (IBM) has been busy, announcing new AI workflow automation tools for Oracle Fusion Applications, teaming up with Bharti Airtel to boost AI across clouds, and expanding its presence in enterprise automation. These moves come as investors watch the company’s next earnings with fresh curiosity.

See our latest analysis for International Business Machines.

IBM’s share price has gained 27.9% year-to-date, with recent momentum likely fueled by a string of high-profile AI partnerships and product launches, including its new workflow automation agents and enterprise cloud collaborations. While the past three years have seen an impressive 143% total shareholder return, the company’s performance now reflects a blend of ongoing growth enthusiasm and a broader shift toward recognizing established tech leaders in the AI race.

If new developments in automation and cloud caught your attention, it’s also an ideal time to explore the broader landscape of tech innovators. See the full list for free with See the full list for free..

With IBM’s valuation now hovering near analyst price targets and investor optimism running high, an important question arises: Is the market underestimating the company’s growth prospects, or has future upside already been factored in, leaving little room for surprise?

Most Popular Narrative: Fairly Valued

IBM’s current share price is nearly identical to the narrative fair value, suggesting market sentiment is closely aligned with widespread analyst expectations. This sets up a fascinating landscape for growth catalysts to shape the outlook going forward.

Investments in advanced technologies like the z17 mainframe and generative AI enhance differentiation and pricing power. These factors could potentially boost infrastructure revenue and net margins.

Curious about which ambitious revenue and profit assumptions drive this razor-thin fair value margin? There is a future profit multiple that defies sector averages. See how bold forecasts and margin expansion are factored in.

Result: Fair Value of $281.32 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty in the macroeconomic environment and competitive pressures in virtualization could significantly impact IBM's revenue growth trajectory and valuation outlook.

Find out about the key risks to this International Business Machines narrative.

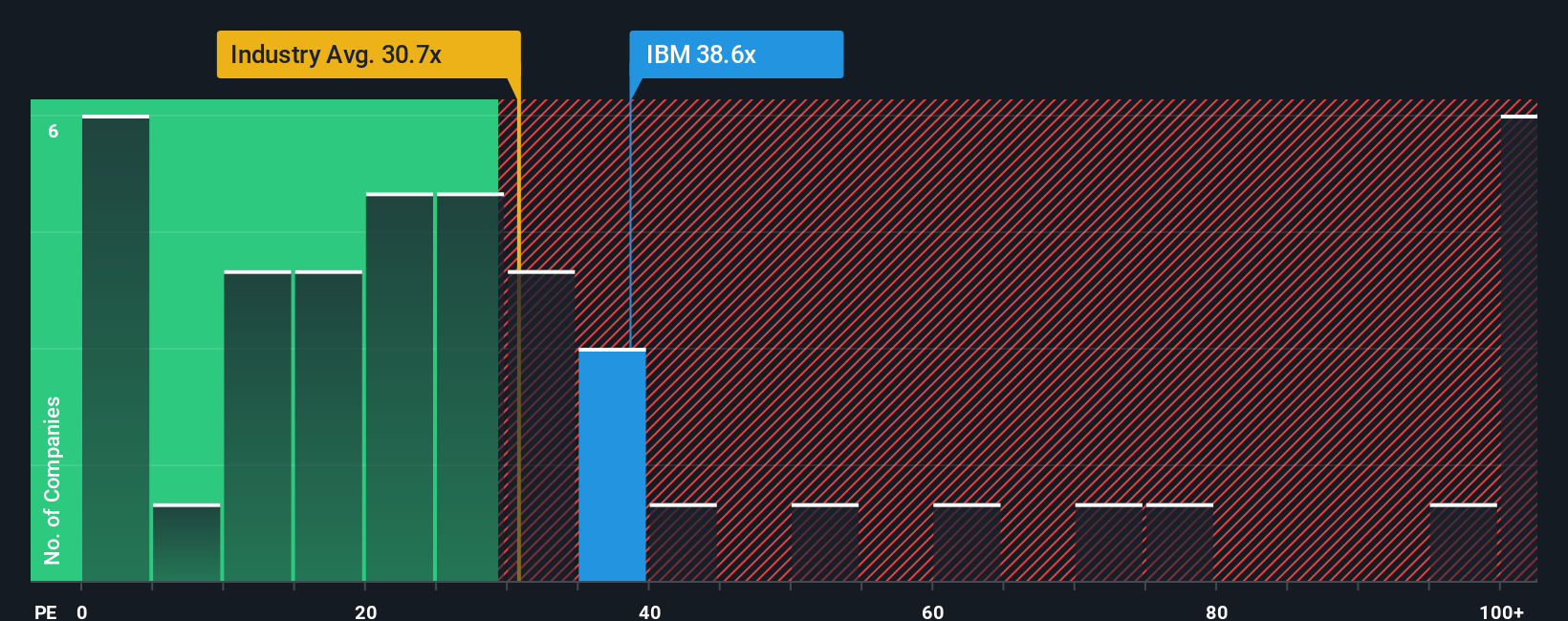

Another View: Price Tag Above the Norm

Looking from another angle, IBM's share price appears steep compared to peers. Its price-to-earnings ratio stands at 44.7x, which is more than double the peer average of 20.4x and is also above the fair ratio of 43.2x. This premium might indicate higher risk unless future growth truly delivers. Will investors continue to pay a higher price, or could this rich valuation face a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Business Machines Narrative

If you have a different take or enjoy digging into the numbers yourself, it’s easy to craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit your strategy to just one success story? Use the Simply Wall Street Screener to spot fresh trends and hidden winners before others catch on.

- Supercharge your portfolio with passive income and tap into these 18 dividend stocks with yields > 3% that consistently deliver attractive yields over 3%.

- Capitalize on rapid breakthroughs in artificial intelligence by checking out these 24 AI penny stocks driving innovation and reshaping the business landscape.

- Secure your edge by uncovering value with these 878 undervalued stocks based on cash flows for stocks currently trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives