- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM) Net Profit Margin Rises to 12.1%, Reinforcing Bullish Margin Narratives

Reviewed by Simply Wall St

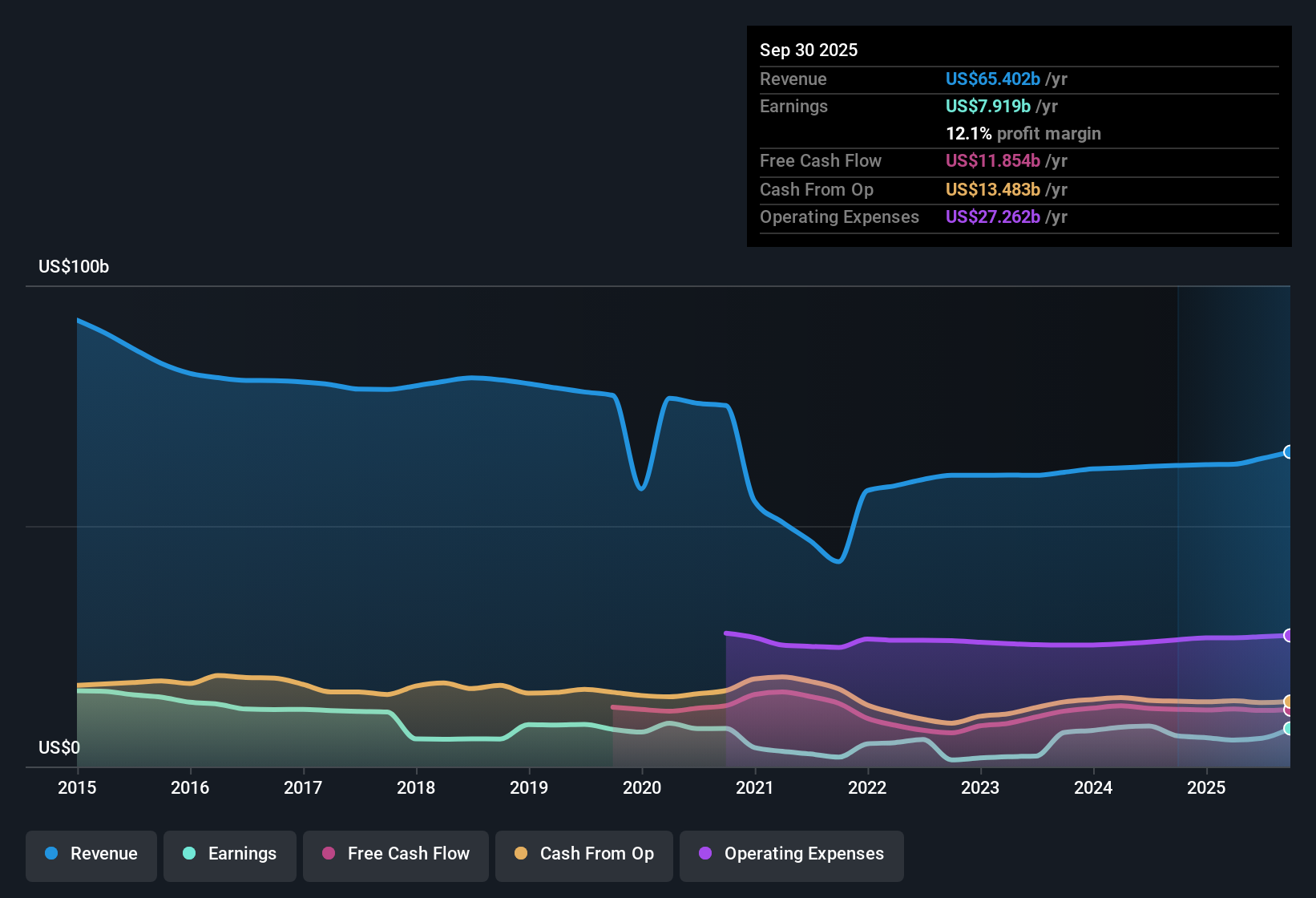

International Business Machines (IBM) posted ongoing growth, with revenue forecast to rise 4.7% per year and EPS set to climb 8.6% annually, both trailing the broader US market. Net profit margin improved to 12.1%, up from 10.2% a year ago. The company delivered a standout 24.3% earnings growth in the most recent year, well ahead of its five-year average of 14%. As investors digest these results, steady profitability and historically strong dividends stand out. However, premium valuation and recent non-recurring expenses keep some caution in play.

See our full analysis for International Business Machines.

Next, we’ll put the latest numbers head-to-head with the prevailing narratives to see which stories hold up and which might need a second look.

See what the community is saying about International Business Machines

Profit Margin Tops 12% as Operating Model Shifts

- IBM’s net profit margin stands at 12.1%, reflecting an improvement from last year.

- Bulls highlight that margin gains support their view that integrating Red Hat, HashiCorp, and DataStax is accelerating the shift to high-margin, recurring software revenue.

- The bullish narrative points to the company’s pipeline for AI and hybrid cloud deals, including a $7.5 billion AI book of business, as a signal that margins could keep rising beyond the 12.1% level, supporting premium valuation.

Bulls argue recent margin gains support a structural shift toward high-value software as the key profit engine. 🐂 International Business Machines Bull Case

Legacy Pressures Remain Despite Earnings Acceleration

- IBM’s five-year annual earnings growth averages 14%, but the most recent year saw a much faster 24.3% pace, suggesting volatility tied to nonrecurring events.

- Bears argue that competitive threats from hyperscale cloud and SaaS providers could limit IBM’s ability to sustain these gains.

- The bearish narrative flags that as legacy mainframe and traditional services revenues decline, newer hybrid cloud and AI offerings must scale rapidly to offset the drag, or else this growth may not last.

Bears caution that even with this strong year of profit growth, IBM’s underlying exposure to legacy decline and rising competition keeps downside risk firmly in play. 🐻 International Business Machines Bear Case

Premium Valuation Demands Ongoing Outperformance

- IBM trades above fair value relative to both its direct industry peers and the broader IT sector on a price-to-earnings basis.

- Consensus narrative notes that analysts’ average price target is $285.59, just 0.2% above IBM’s recent share price of $285.00.

- This slim margin implies the market already prices in the company’s forward growth outlook and improving margins, while also recognizing the risk from nonrecurring items and a premium valuation multiple.

- For upside from here, consensus expects IBM’s investments in hybrid cloud, AI, and software M&A to convert into sustained revenue growth and higher profitability without being derailed by macro pressures or execution risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for International Business Machines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the latest figures? Add your perspective and shape your own view in just a few minutes by Do it your way .

A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

IBM’s revenue growth and margins are improving. However, premium valuation and the lingering impact of nonrecurring losses raise concerns about upside and future stability.

If valuation risk has you second-guessing, use these 868 undervalued stocks based on cash flows to find companies that the market hasn’t already priced for perfection and may offer greater long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion