- United States

- /

- IT

- /

- NYSE:IBM

Does IBM’s Cloud Growth Lag Threaten Its Ability to Lead in AI Despite Strong Q3 Results? (IBM)

Reviewed by Sasha Jovanovic

- International Business Machines (IBM) reported its third-quarter 2025 earnings, with revenue rising to US$16.33 billion and net income improving to US$1.74 billion, alongside raising its full-year revenue growth outlook to over 5% in constant currency.

- Despite surpassing analyst expectations and highlighting US$9.5 billion in its AI business, investor concerns focused on slower growth in IBM’s core cloud software division, reflecting cautious sentiment regarding the company’s ability to fully harness increasing AI demand.

- We’ll examine how IBM’s strong overall performance but soft cloud software growth impacts its longer-term investment narrative and outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

International Business Machines Investment Narrative Recap

To be an IBM shareholder, you need to believe that the company's focus on hybrid cloud and AI can drive sustainable revenue and earnings growth, even as competitive and macroeconomic pressures persist. The recent earnings report, which highlighted solid performance and a raised revenue outlook of over 5% for the year, brings renewed attention to IBM's ability to turn strong AI momentum into profit. However, the most immediate risk remains the sustained slow growth in its core cloud software unit, which could limit IBM's capture of surging AI demand. The impact of last quarter's results makes this risk more material, fueling a short-term cautious sentiment.

Among recent announcements, IBM's expanded partnership with Groq to enhance AI deployment on the watsonx platform is especially relevant. Showcasing tangible efforts to scale enterprise AI capabilities, the move provides context for both the opportunities and ongoing challenges spotlighted in the latest earnings, particularly around cloud and software-driven growth.

Yet, investors should also be aware that, despite headline growth, IBM faces increasing pressure from persistent software competition and...

Read the full narrative on International Business Machines (it's free!)

International Business Machines' outlook anticipates $74.4 billion in revenue and $10.5 billion in earnings by 2028. This scenario stipulates a 5.1% annual revenue growth and a $4.6 billion increase in earnings from the current $5.9 billion.

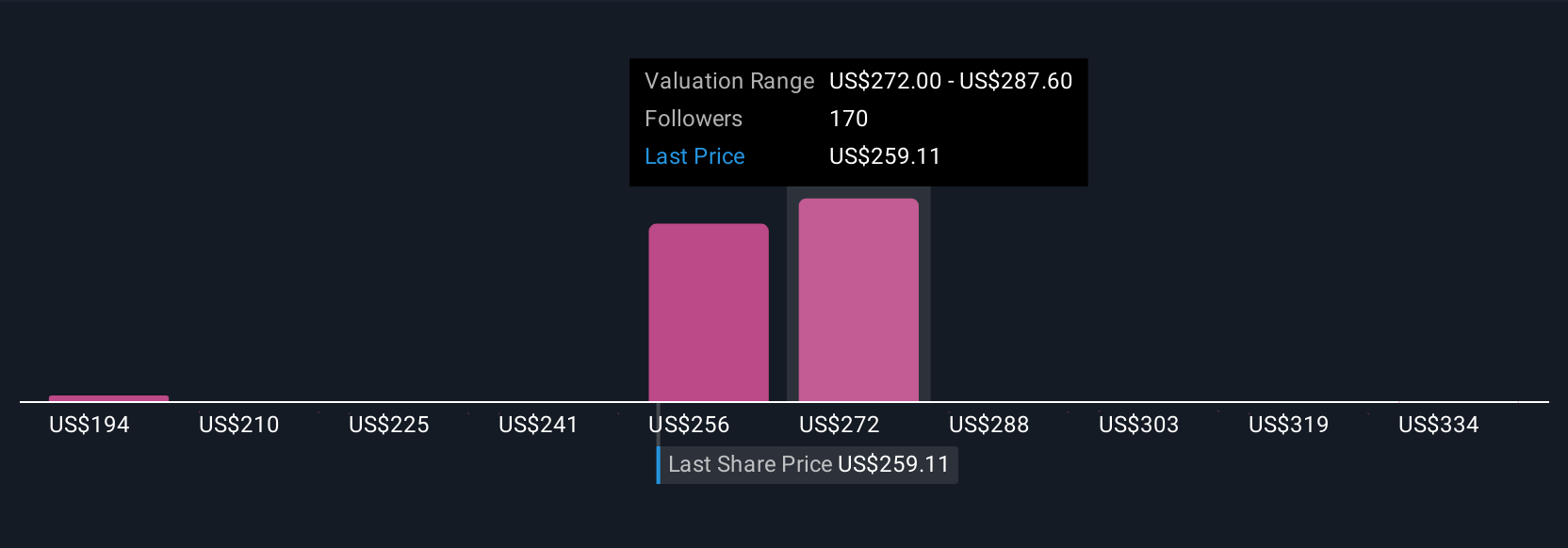

Uncover how International Business Machines' forecasts yield a $287.70 fair value, in line with its current price.

Exploring Other Perspectives

Some analysts were far more optimistic, forecasting US$76.6 billion revenue and US$12.1 billion earnings by 2028, largely based on faster AI and cloud adoption. If you believe IBM's pipeline can materially outpace consensus, these top-end forecasts might still feel achievable, but the latest news could reshape these expectations in either direction. It's important to understand how different viewpoints weigh longer-term risks and opportunities.

Explore 17 other fair value estimates on International Business Machines - why the stock might be worth as much as 22% more than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives