- United States

- /

- IT

- /

- NYSE:IBM

Can IBM’s Star-Studded AI Campaign Signal a Turning Point in Enterprise Adoption? (IBM)

Reviewed by Simply Wall St

- In late August 2025, International Business Machines launched a new brand campaign, "Let's create smarter business," featuring Formula 1 champion Lewis Hamilton to promote enterprise AI, hybrid cloud, and quantum technologies, with the campaign debuting during the US Open and running throughout the year.

- This initiative underscores IBM's focus on bridging the gap between AI pilot projects and full-scale enterprise adoption, highlighting its commitment to making AI solutions practical and impactful for businesses worldwide.

- We'll consider how IBM's renewed emphasis on enterprise AI adoption, highlighted by this campaign, could influence its growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

International Business Machines Investment Narrative Recap

For shareholders, the key thesis centers on IBM's ability to translate leadership in enterprise AI and hybrid cloud into sustainable growth, margin expansion, and stable dividends. The latest brand campaign with Lewis Hamilton showcases IBM's push into real-world AI adoption, but it does not appear to materially affect the primary short-term catalyst, successful enterprise-wide scaling of AI services, nor does it significantly alter the ongoing risk from client spending slowdowns amid macroeconomic uncertainty.

Among IBM's recent advancements, the new updates to the watsonx platform with Granite models (unveiled in May 2025) stand out for their direct connection to IBM's themes of AI scaling and integration. These enhancements support the very catalysts highlighted by the new campaign: encouraging enterprises to move from pilot AI projects to business-critical deployments and potentially increasing high-value, recurring software revenue.

In contrast, what investors also need to watch closely is…

Read the full narrative on International Business Machines (it's free!)

International Business Machines' outlook anticipates $74.4 billion in revenue and $10.5 billion in earnings by 2028. This implies a 5.1% annual revenue growth and a $4.6 billion increase in earnings from the current $5.9 billion level.

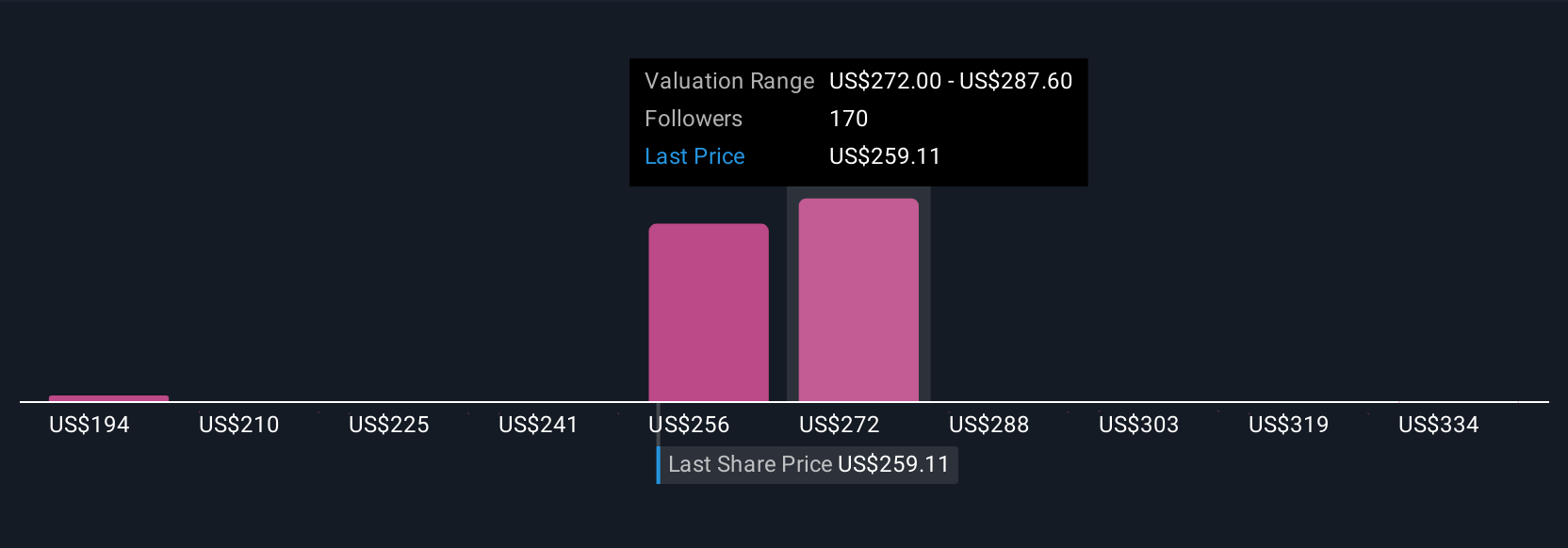

Uncover how International Business Machines' forecasts yield a $281.32 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were expecting revenues to reach US$76,500,000,000 and earnings of US$12,100,000,000 by 2028, seeing opportunities in rapid AI and hybrid cloud adoption. This outlook is even more bullish than consensus and highlights just how much expectations can differ if IBM maintains momentum and addresses the risk that legacy revenues may not be replaced quickly enough. Consider exploring all sides, as new developments could reshape these views.

Explore 15 other fair value estimates on International Business Machines - why the stock might be worth as much as 41% more than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026