- United States

- /

- Software

- /

- NYSE:HUBS

The Bull Case For HubSpot (HUBS) Could Change Following Its Unveiling of AI-Centric ‘The Loop’

Reviewed by Simply Wall St

- Earlier this month, Talkdesk and CallRail each announced expanded AI-powered integrations with HubSpot at the INBOUND conference, while HubSpot unveiled 'The Loop,' an AI-centric marketing playbook aimed at reinventing personalized, data-driven growth strategies.

- A key takeaway is that HubSpot is accelerating ecosystem expansion and hybrid AI-human collaboration, broadening the platform’s capabilities for unified customer engagement and workflow automation.

- We'll examine how the introduction of 'The Loop' highlights HubSpot's emphasis on AI-driven marketing evolution in its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

HubSpot Investment Narrative Recap

Owning HubSpot often comes down to believing in its ability to lead the ongoing shift toward integrated, AI-powered CRM workflows for SMBs and mid-sized businesses. The latest AI integrations and the launch of 'The Loop' reinforce HubSpot's position as an innovator, though they do not fundamentally change the biggest near-term catalyst, adoption and monetization of new AI products, or the most important risk, which remains rising competition in a softening SMB market.

The expanded Talkdesk integration stands out for how it brings powerful AI contact center automation directly into HubSpot, extending the ecosystem and simplifying unified customer interactions. In the context of attracting new customers and deepening existing relationships, robust partner integrations help address near-term growth drivers as HubSpot faces headwinds from competitive pressures and evolving customer acquisition channels.

Yet, while these advances move HubSpot forward, investors should also be aware that rising competition, especially from larger SaaS providers and new AI-centric platforms, could...

Read the full narrative on HubSpot (it's free!)

HubSpot's narrative projects $4.6 billion revenue and $388.4 million earnings by 2028. This requires 17.1% yearly revenue growth and a $400.3 million increase in earnings from -$11.9 million today.

Uncover how HubSpot's forecasts yield a $695.33 fair value, a 41% upside to its current price.

Exploring Other Perspectives

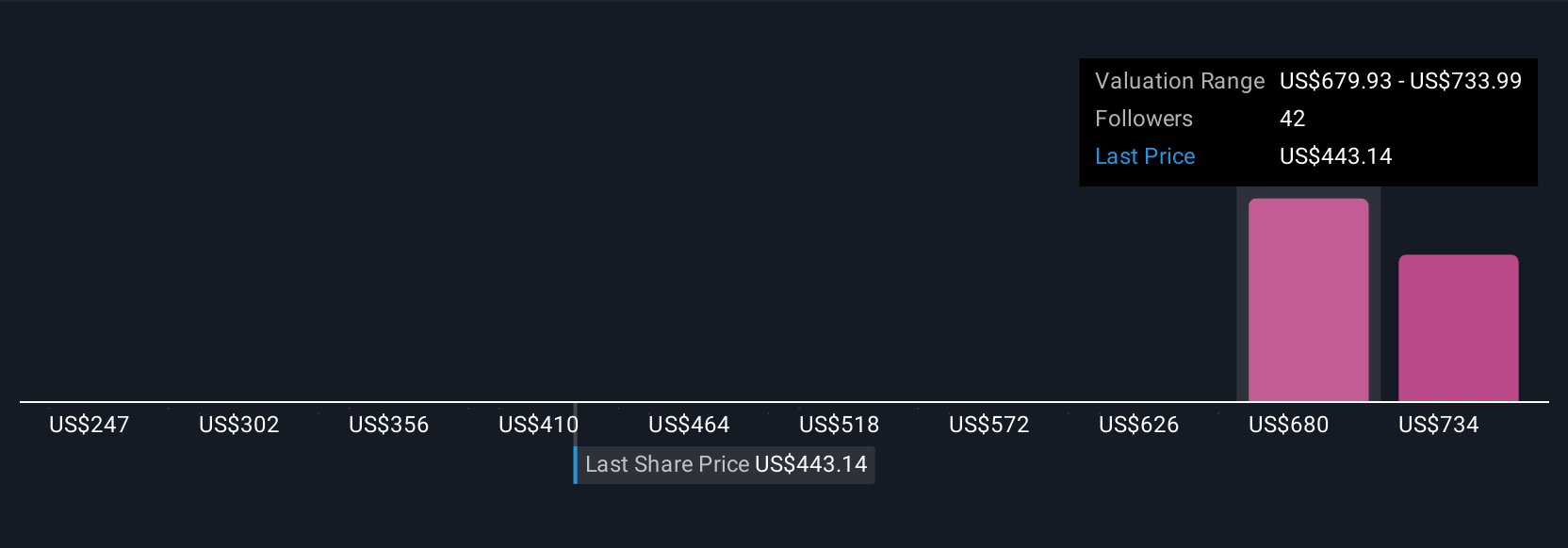

Simply Wall St Community members provided six distinct fair value estimates for HubSpot, spanning from US$247.44 to US$695.33 per share. As new AI-driven products roll out and partner integrations grow, the challenge of holding market share amid intensifying competition looms large for many in the market, making it essential to weigh multiple viewpoints before making a decision.

Explore 6 other fair value estimates on HubSpot - why the stock might be worth 50% less than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives