- United States

- /

- Software

- /

- NYSE:HUBS

Some HubSpot, Inc. (NYSE:HUBS) Shareholders Look For Exit As Shares Take 26% Pounding

HubSpot, Inc. (NYSE:HUBS) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 2.6% over that longer period.

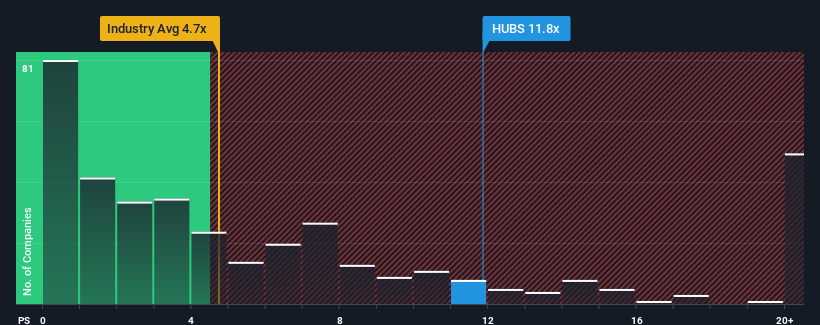

Although its price has dipped substantially, HubSpot may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 11.8x, since almost half of all companies in the Software industry in the United States have P/S ratios under 4.6x and even P/S lower than 1.9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for HubSpot

How HubSpot Has Been Performing

Recent times have been advantageous for HubSpot as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on HubSpot will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For HubSpot?

The only time you'd be truly comfortable seeing a P/S as steep as HubSpot's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The strong recent performance means it was also able to grow revenue by 102% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 21% per annum growth forecast for the broader industry.

In light of this, it's alarming that HubSpot's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Even after such a strong price drop, HubSpot's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see HubSpot trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - HubSpot has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives