- United States

- /

- Software

- /

- NYSE:HUBS

MatrixPoint Joins HubSpot (NYSE:HUBS) Solutions Partner Program Expanding CRM Expertise

Reviewed by Simply Wall St

MatrixPoint’s announcement of joining HubSpot's (NYSE:HUBS) Solutions Partner Program highlights a significant development focused on enhancing customer engagement. This collaboration, emphasizing customer-centric growth and CRM practice expansion, potentially aligns with HubSpot's goals to broaden its service offerings. Amidst a flat market, with tech stocks reacting to various trade and earnings news, HubSpot's price remained steady over the past month. The partnership, along with HubSpot's share buyback announcement, added positive weight to broader market sentiment, balancing the company's earnings report which showed a revenue increase but recorded a loss.

Buy, Hold or Sell HubSpot? View our complete analysis and fair value estimate and you decide.

The recent partnership between MatrixPoint and HubSpot to enhance customer engagement through the HubSpot Solutions Partner Program aligns well with HubSpot's strategy to integrate AI and expand its CRM capabilities. This move could drive revenue growth by improving operational efficiency and customer insights. The company's total return over the past five years, including share price and dividends, was 193.55%, highlighting a strong performance. However, in the past year, HubSpot's stock underperformed the US Software industry, which recorded a 17.2% return, while also trailing the broader US market's 11.5% return.

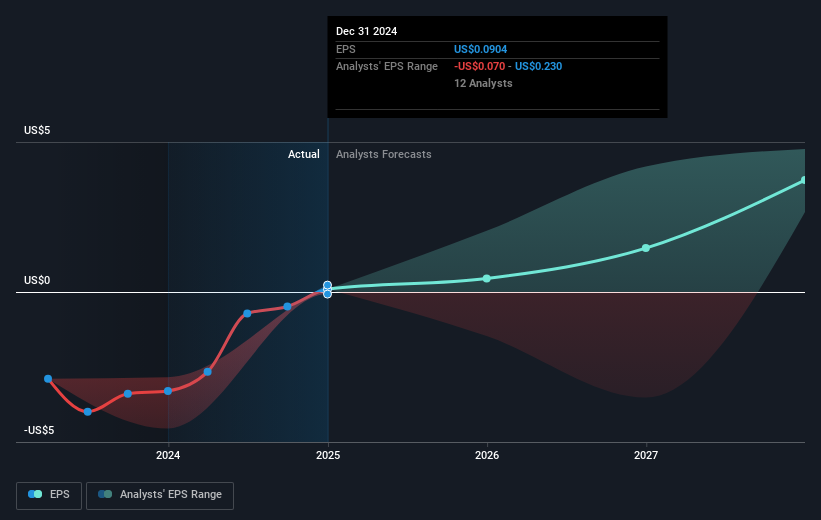

Regarding financial forecasts, HubSpot anticipates revenue growth by enhancing customer engagement and expanding upmarket with new pricing strategies. Analysts expect earnings to ascend to US$279.6 million by 2028 from US$4.6 million today. With a price target of US$763.10, HubSpot's current share price of US$612.69 shows a 19.7% potential increase. The integration efforts, if successful, could support these revenue and earnings projections, although analysts note risks such as pricing model challenges and foreign exchange headwinds. Investors should weigh these developments when considering HubSpot's future growth trajectory.

Click here to discover the nuances of HubSpot with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion