- United States

- /

- Software

- /

- NYSE:HUBS

HubSpot (HUBS): Valuation Revisited After Analyst Downgrades and New AI-Focused Board Appointment

Reviewed by Simply Wall St

User discussions around HubSpot (HUBS) are picking up this week as several major analyst firms have scaled back their outlooks on the company just days after its latest earnings announcement and a new board appointment.

See our latest analysis for HubSpot.

HubSpot’s stock has struggled for momentum in 2025, with a year-to-date share price return of -43.40% and a 1-year total shareholder return of -43.62%. The company continued buybacks and posted solid revenue growth. The recent board addition and steady earnings have kept long-term believers engaged. However, recent declines hint that investors are weighing near-term risks more heavily than future potential.

If you’re looking for your next opportunity in the software or tech space, now’s a good moment to discover fast growing stocks with high insider ownership.

With the stock trading well below analyst targets after recent downgrades and robust revenue growth, the question now is whether HubSpot is undervalued or if the market has already accounted for all its future gains.

Most Popular Narrative: 42.3% Undervalued

With HubSpot’s fair value estimate standing well above the last close, many see current prices as a potential disconnect from the company’s long-term prospects. The gap between price and valuation has created debate about future growth versus more immediate risks.

The company's quick pivot to adapt to shifting buyer behavior, such as declining traditional SEO and the rise of AI-powered search, positions HubSpot to capture new sources of lead generation (YouTube, social, newsletters, LLM citations). This supports customer growth and improves the durability of top-line expansion.

Want to know exactly which growth levers and profit assumptions power this bullish value? There is one bold earnings forecast at its core, and the future multiple rivals the most optimistic tech names. What else could make this fair value calculation so compelling? Read the narrative in full to see the numbers behind the optimism.

Result: Fair Value of $683.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including disruption from new AI marketing tools and heightened competition. These factors could challenge HubSpot’s growth trajectory and valuation outlook.

Find out about the key risks to this HubSpot narrative.

Another View: Looking Beyond Fair Value

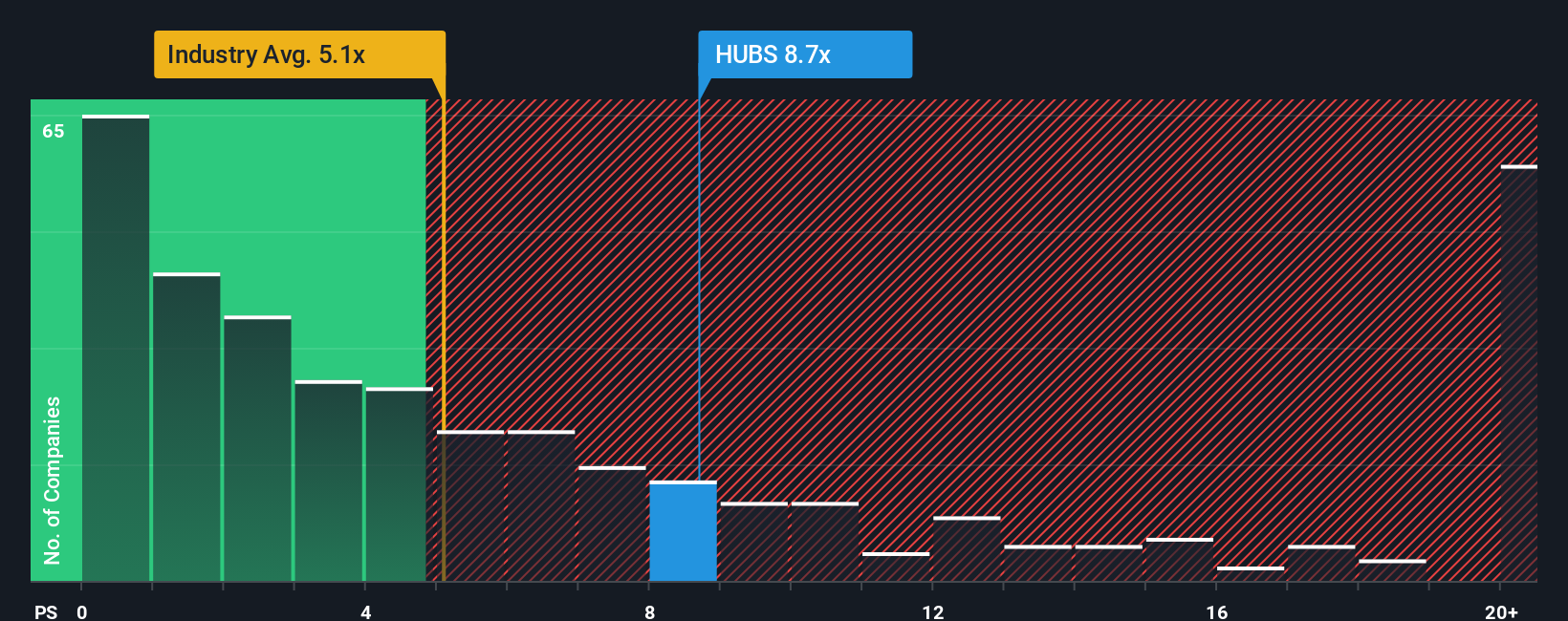

While the fair value estimate suggests HubSpot is undervalued, using the price-to-sales ratio paints a more cautious picture. At 6.9x, HubSpot trades well above the software industry average of 4.8x, but below the peer average of 9.8x and the fair ratio of 11.1x. This mixed position signals both opportunity and risk. Could the market be factoring in growth that has yet to materialize, or is there more upside if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HubSpot Narrative

If you want to challenge the consensus or dive deeper into the numbers yourself, it only takes a few minutes to create your own view. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HubSpot.

Looking for More Investment Ideas?

Unlock fresh opportunities now and expand your watchlist with companies transforming markets. Gain an edge before others catch on by using these powerful tools to spot untapped winners.

- Tap into major technology trends with these 25 AI penny stocks shaping the evolution of automation, big data, and digital intelligence.

- Capture value in overlooked sectors by targeting these 865 undervalued stocks based on cash flows that may be poised for a rebound as market sentiment shifts.

- Access consistent income potential by checking out these 14 dividend stocks with yields > 3%, ideal for boosting portfolio stability with robust yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives