- United States

- /

- Software

- /

- NYSE:HUBS

How Investors May Respond To HubSpot (HUBS) Bringing Meta AI Leader Clara Shih Onto Its Board

Reviewed by Sasha Jovanovic

- Earlier this month, HubSpot reported third quarter results showing revenue of US$809.52 million and net income of US$16.54 million, while also appointing Clara Shih, Meta’s Head of Business AI Group, to its Board of Directors.

- The combination of analyst downgrades, concerns about AI disruption, and leadership changes highlights both market skepticism and HubSpot's drive to enhance its AI capabilities.

- To assess the implications for HubSpot’s investment case, we’ll explore how Clara Shih’s board appointment could influence the company’s AI-driven growth trajectory.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

HubSpot Investment Narrative Recap

To be a HubSpot shareholder, you need to believe the company can maintain above-industry revenue growth by expanding AI-powered platform adoption, navigating competitive threats, and growing both upmarket and internationally. The latest news around Board appointments appears incrementally positive for HubSpot’s investment case but does not materially change the fact that near-term results will depend on the successful rollout and monetization of new AI features, while the main risk remains disruption to traditional customer acquisition channels from generative AI.

Among recent announcements, the appointment of Clara Shih to HubSpot’s board is particularly relevant. Her extensive experience in AI at both Meta and Salesforce could enhance HubSpot’s ability to build differentiated AI solutions, which may help accelerate product adoption as competitive intensity rises. This board addition aligns with HubSpot’s current focus on strengthening its AI capabilities as a response to evolving industry catalysts.

However, many investors may not fully appreciate the potential challenge if generative AI continues to reshape organic traffic and lead generation methods, creating risks that...

Read the full narrative on HubSpot (it's free!)

HubSpot's outlook anticipates $4.6 billion in revenue and $388.4 million in earnings by 2028. This reflects a required annual revenue growth rate of 17.1% and an earnings increase of $400.3 million from the current earnings of -$11.9 million.

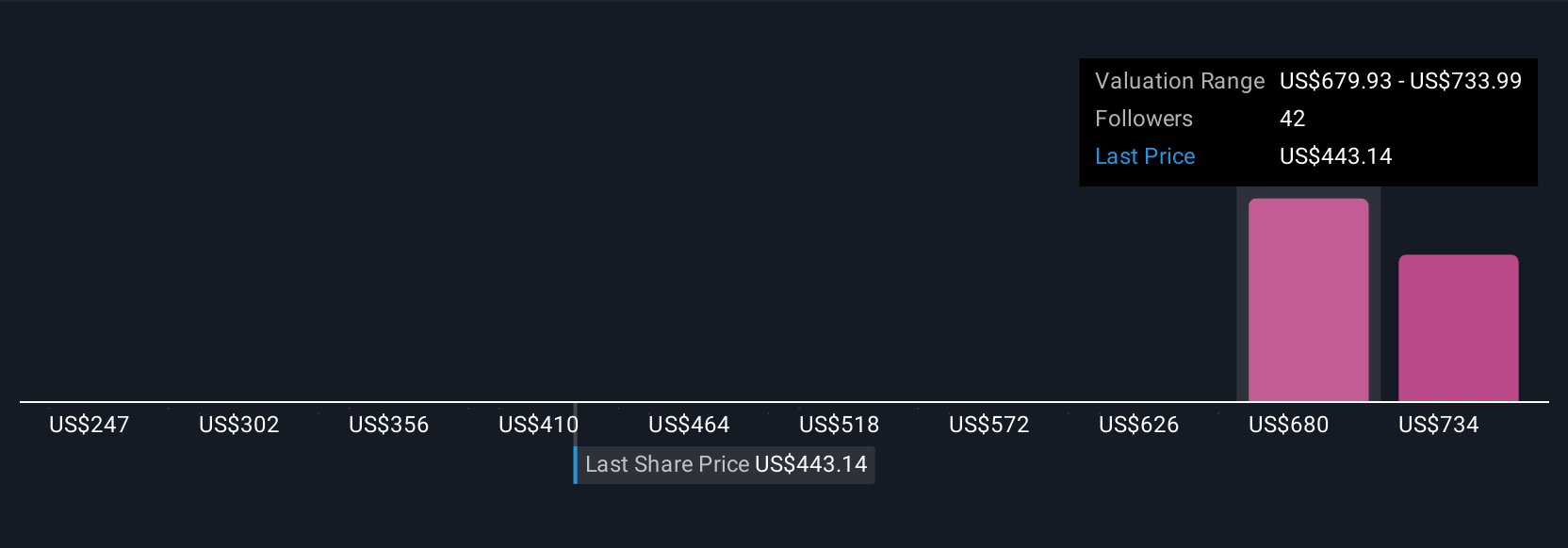

Uncover how HubSpot's forecasts yield a $683.57 fair value, a 72% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for HubSpot range from US$243.84 to US$683.57, across eight separate analyses. With emerging AI-related risks threatening historical customer acquisition channels, now is an ideal time to compare these diverse viewpoints.

Explore 8 other fair value estimates on HubSpot - why the stock might be worth as much as 72% more than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives