- United States

- /

- Software

- /

- NYSE:HUBS

How Attractive Is HubSpot After Its 7.5% Rally and Recent Valuation Checks?

Reviewed by Bailey Pemberton

Thinking about what to do with your HubSpot stock? You are not alone. The company has been on quite the ride lately, and investors are split on whether this is the perfect buying opportunity or a warning sign. Recently, shares closed at $469.67, after rallying 7.5% this past week. That bounce has recaptured some of the ground lost over the last month, when shares slid by 9.3%. Zooming out, HubSpot is down 32.7% so far this year and 17.0% over the last twelve months. Still, if you had stuck with it for three or five years, you would be looking at returns of roughly 62%, which is certainly nothing to sneeze at for long-term investors.

What is driving these shifts? While there have not been any explosive headlines, HubSpot has been making quiet progress in bolstering its CRM capabilities and expanding its integrations. These steady investments have kept the company on analysts’ radar, even as cautious market sentiment and broader tech volatility have weighed down shares. Behind all the numbers, what really matters is this: is HubSpot undervalued right now? According to a scorecard of six valuation checks, HubSpot is undervalued in four out of six, giving it a solid value score of 4.

Let’s dig into what those valuation checks actually mean, and, importantly, why simply relying on classic valuation ratios only tells part of the story. At the end, I will share an even better way to evaluate whether HubSpot is a buy right now.

Why HubSpot is lagging behind its peers

Approach 1: HubSpot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating how much cash a company is expected to generate in the future, then “discounting” those projections back to reflect today’s value. This approach is popular for growth-focused businesses like HubSpot, as it aims to capture the company’s long-term earnings power rather than just a snapshot of current performance.

HubSpot’s latest reported Free Cash Flow stands at $533.7 million. Analyst forecasts indicate that this number is projected to more than double within five years, reaching around $1.39 billion by 2029. The cash flow outlook further into the future is extrapolated by Simply Wall St’s model, which estimates Free Cash Flow rising to well over $2 billion by 2035. These projections are intended in US dollars based on the listing currency.

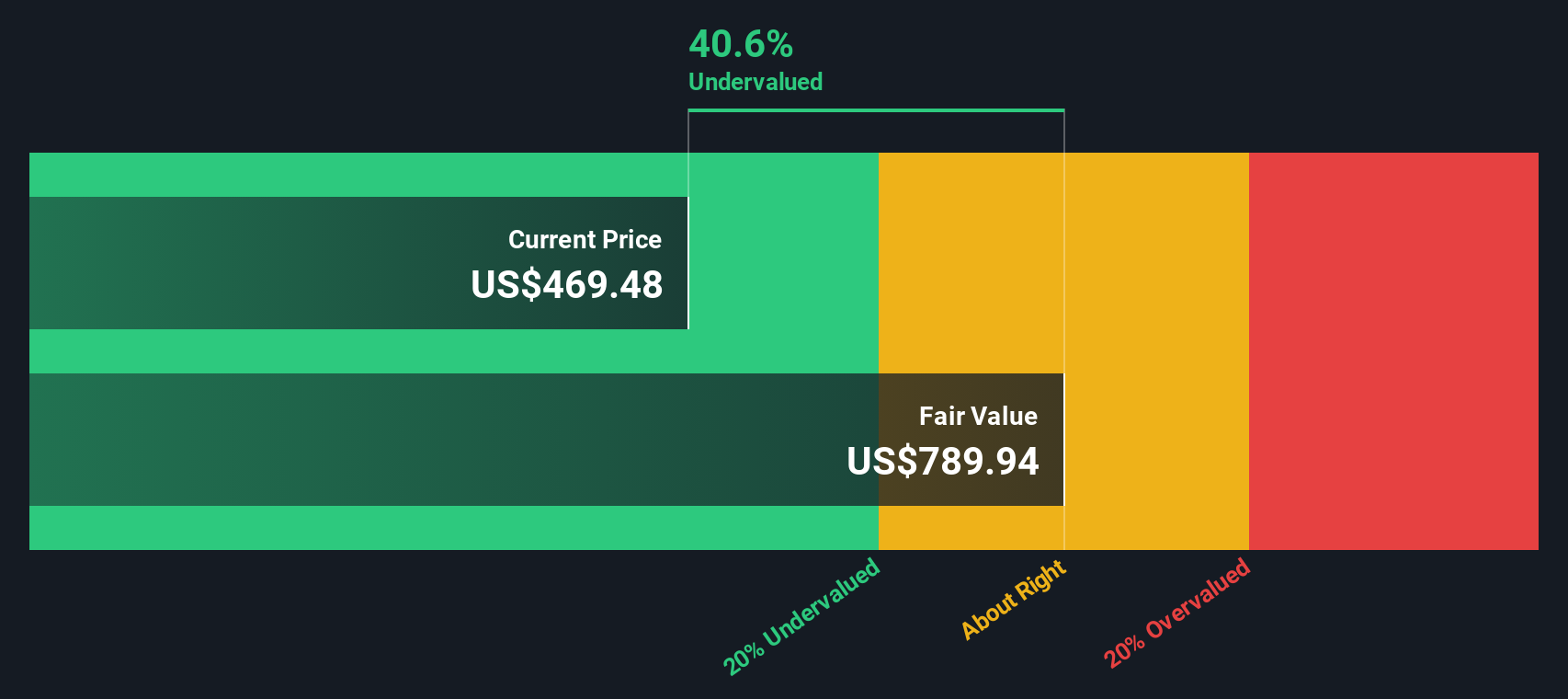

Based on these estimates, the DCF model calculates an intrinsic fair value of $575.14 per share. Compared with HubSpot’s current price of $469.67, the valuation suggests the stock is trading at an 18.3% discount to intrinsic value. In other words, shares appear to be meaningfully undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HubSpot is undervalued by 18.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: HubSpot Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used metric for valuing profitable software companies like HubSpot, especially those that are rapidly growing and reinvesting for future expansion. It provides a snapshot of how the market values each dollar of the company's revenue, making it a useful tool when earnings may not yet reflect the company’s long-term potential.

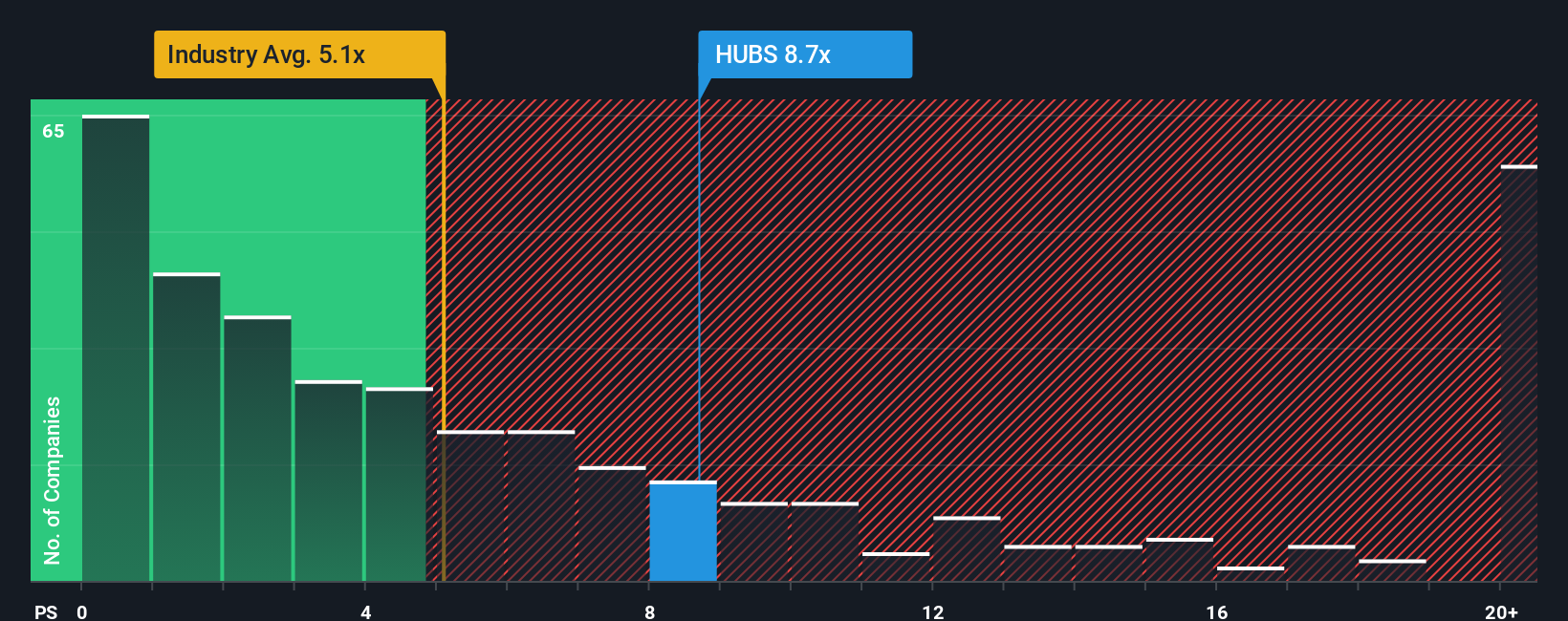

In the world of growth stocks, higher expectations for sales growth and lower risk usually justify a higher “normal” or “fair” P/S ratio. For HubSpot, the current P/S ratio stands at 8.7x. This is compared with the broader Software industry average of 5.3x and a peer group average of 12.7x. At first glance, HubSpot sits comfortably between its peer group and the sector as a whole.

To dig deeper, we look to Simply Wall St’s “Fair Ratio.” This proprietary figure calculates the P/S multiple a company deserves after factoring in variables like its earnings growth, profit margins, industry, market capitalization, and overall risk. Unlike simple peer or sector comparisons, the Fair Ratio is tailored to HubSpot’s unique situation and helps investors avoid misleading apples-to-oranges evaluations.

HubSpot’s calculated Fair Ratio is 11.9x. This is meaningfully above its current P/S ratio of 8.7x, suggesting the market may be pricing HubSpot more conservatively than its fundamentals warrant. According to this key metric, HubSpot remains undervalued relative to what would be expected for a company with its profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HubSpot Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your personal story and viewpoint about a company; it connects the facts and numbers to what you believe is truly happening with the business. Narratives allow you to spell out your assumptions on what is driving HubSpot’s future, such as expected revenue, profit margins, or risks, and then automatically link your outlook to a financial forecast and a calculated fair value.

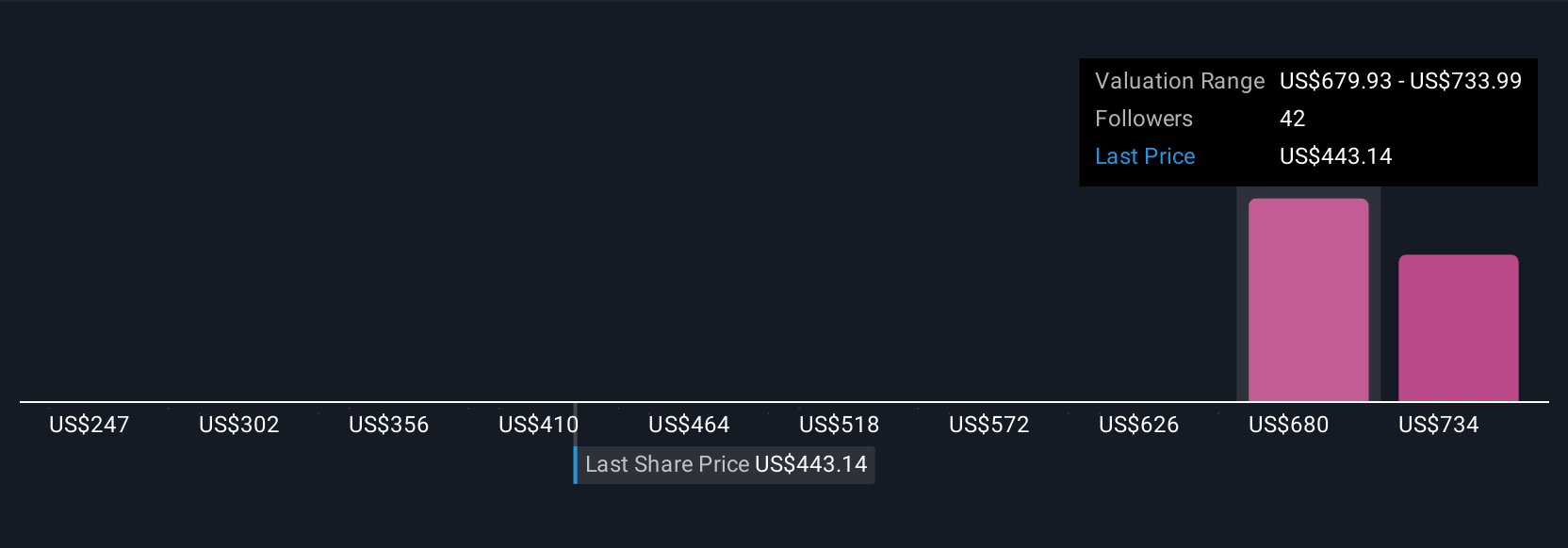

What makes Narratives especially powerful is that you do not need to be a financial expert. You can build and refine your own thesis using an accessible tool on Simply Wall St’s Community page, trusted by millions of investors. Narratives let you see, at a glance, how your perspective measures up against the latest price and how changes in the news or earnings will instantly update your numbers. For example, among Simply Wall St’s community, the most optimistic Narrative for HubSpot estimates a fair value of $910 per share, while the most cautious pegs it closer to $589, showing how different investors can come to very different conclusions using the same company data.

Do you think there's more to the story for HubSpot? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives