- United States

- /

- Consumer Finance

- /

- NYSE:YRD

Three Undiscovered Gems In The US Market With Promising Potential

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months it has risen by 34%, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are not widely recognized but show promising potential can be key to capitalizing on future growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Tiptree | 68.59% | 20.55% | 20.06% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that provides nuclear fuel components and services to the nuclear power industry across various countries, including the United States, Belgium, and Japan, with a market cap of approximately $973.38 million.

Operations: Centrus Energy generates revenue primarily from two segments: Low-Enriched Uranium (LEU) at $320.80 million and Technical Solutions at $71.80 million. The company's net profit margin trend shows variability, reflecting the impact of its revenue streams and cost structure on profitability.

Centrus Energy, a notable player in the energy sector, has shown impressive earnings growth of 164.9% over the past year, outpacing its industry peers. The company reported a net income of US$30.6 million for Q2 2024, up from US$12.7 million the previous year, with basic earnings per share rising to US$1.89 from US$0.84. Despite recent shareholder dilution and a volatile share price, Centrus trades at 60% below its estimated fair value and maintains more cash than total debt, indicating financial resilience amidst challenges in the sector.

- Unlock comprehensive insights into our analysis of Centrus Energy stock in this health report.

Examine Centrus Energy's past performance report to understand how it has performed in the past.

AMTD Digital (NYSE:HKD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AMTD Digital Inc., operating through its subsidiaries, provides digital solutions services across financial and non-financial sectors, as well as digital media, content marketing services, and hospitality operations in Asia, with a market cap of $614.86 million.

Operations: AMTD Digital generates revenue through digital solutions in both financial and non-financial sectors, alongside digital media and hospitality services. The company operates with a market cap of approximately $614.86 million.

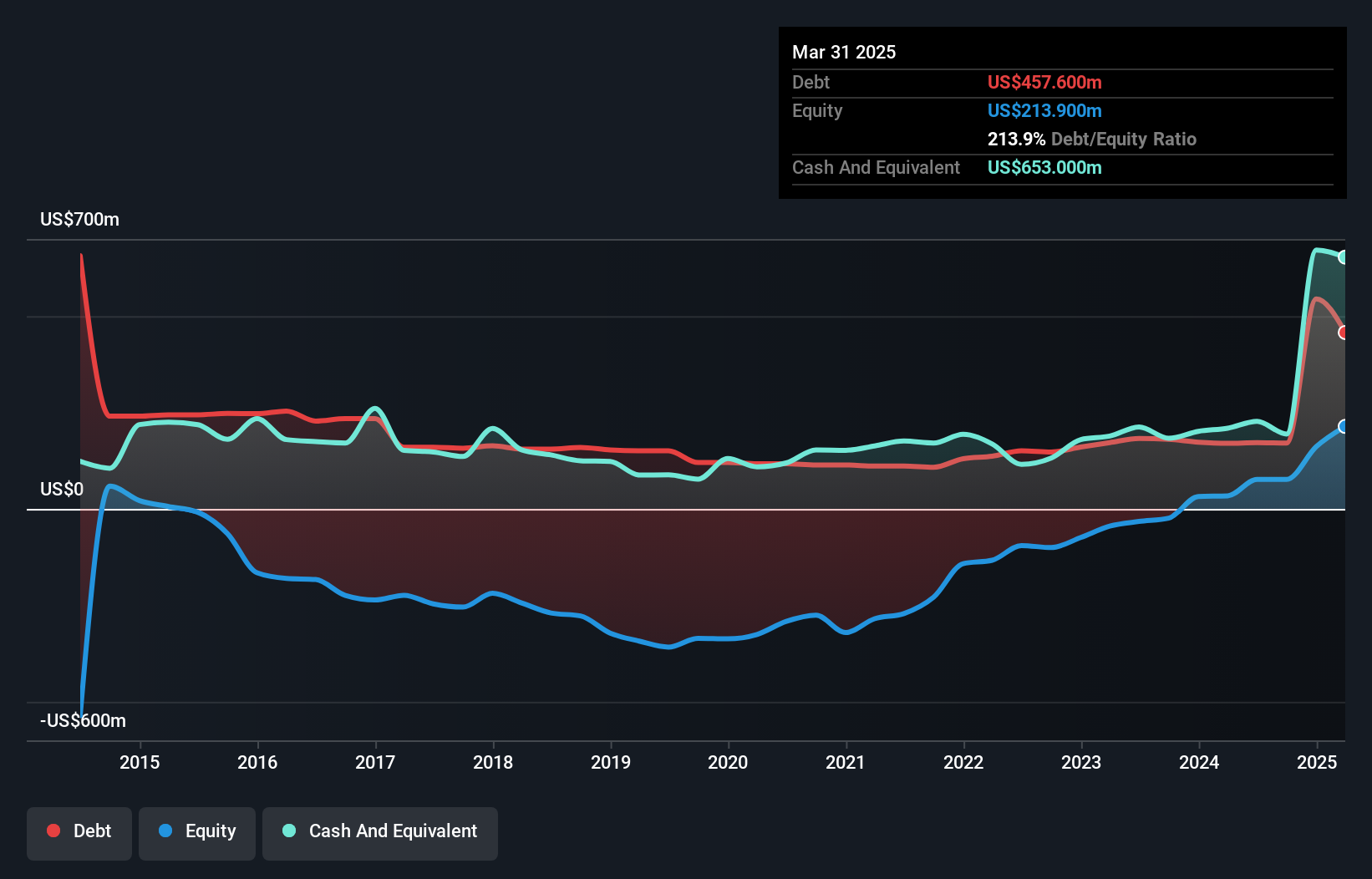

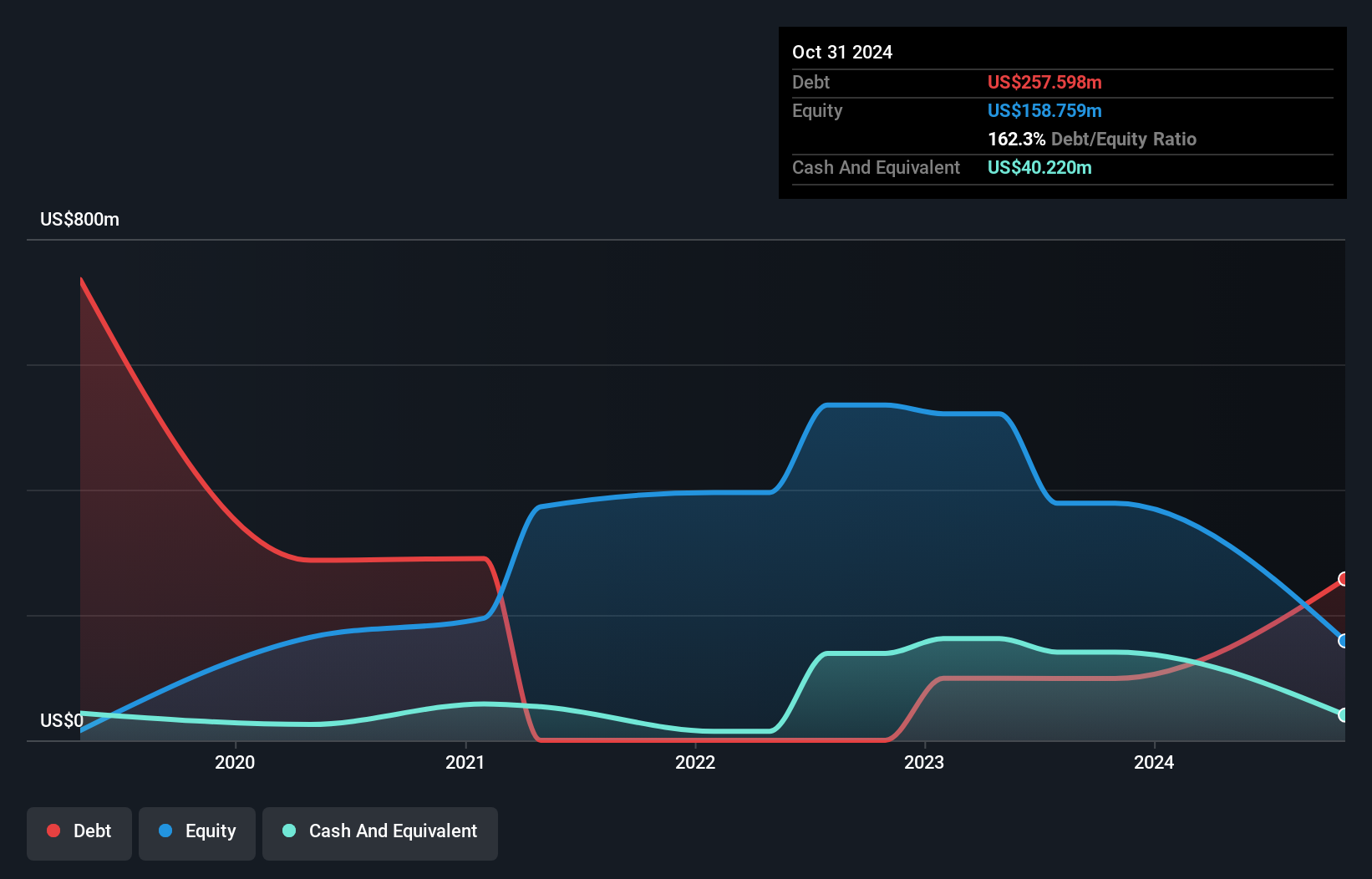

AMTD Digital, a small player in the digital sector, boasts a price-to-earnings ratio of 12x, which is below the US market average of 18.3x. The company experienced an impressive earnings growth of 88.6% over the past year, outpacing the software industry's average growth rate of 23.6%. However, its financial results were notably impacted by a significant one-off gain of US$46M in the last year ending October 31, 2023. Despite having more cash than total debt and covering interest payments comfortably, its share price has been highly volatile over recent months.

- Dive into the specifics of AMTD Digital here with our thorough health report.

Explore historical data to track AMTD Digital's performance over time in our Past section.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. operates an AI-powered platform offering financial services in China with a market capitalization of $634.62 million.

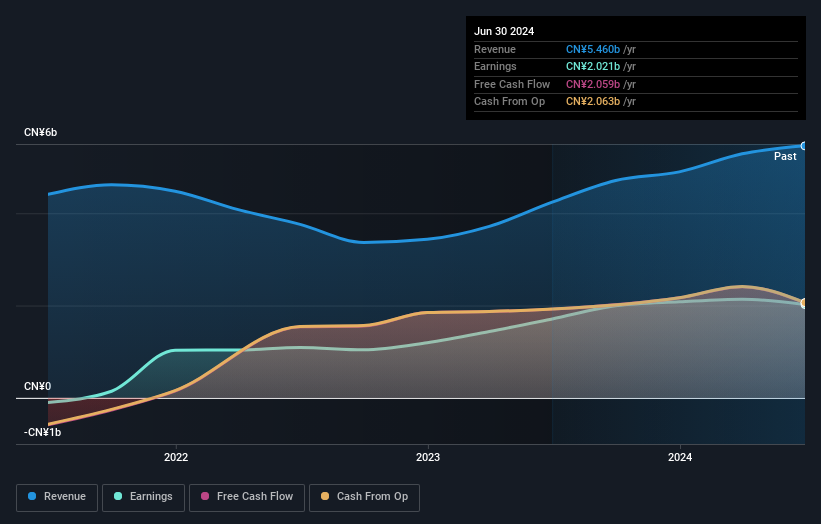

Operations: Yiren Digital generates revenue primarily from its Financial Services Business, which accounts for CN¥3.04 billion, and its Insurance Brokerage Business, contributing CN¥579.22 million. The company also earns from the Consumption & Lifestyle segment with a revenue of CN¥1.84 billion.

Yiren Digital, a nimble player in the financial sector, stands out with its debt-free status and robust earnings growth of 18.2% over the past year, surpassing industry norms. Trading at a significant discount of 68.3% below estimated fair value, it also boasts high-quality earnings. Recently, Yiren completed a share buyback of 4.87%, reflecting confidence in its valuation strategy while announcing dividends and appointing Yuning Feng as CFO to steer financial operations forward effectively.

- Click here and access our complete health analysis report to understand the dynamics of Yiren Digital.

Evaluate Yiren Digital's historical performance by accessing our past performance report.

Key Takeaways

- Explore the 215 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Flawless balance sheet, good value and pays a dividend.