- United States

- /

- Software

- /

- NasdaqGS:SNPS

US High Growth Tech Stocks To Watch In July 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a 12% increase over the last year, with earnings projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability in alignment with these promising market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.75% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.78% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.02% | 60.01% | ★★★★★★ |

| Lumentum Holdings | 23.14% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Synopsys (SNPS)

Simply Wall St Growth Rating: ★★★★☆☆

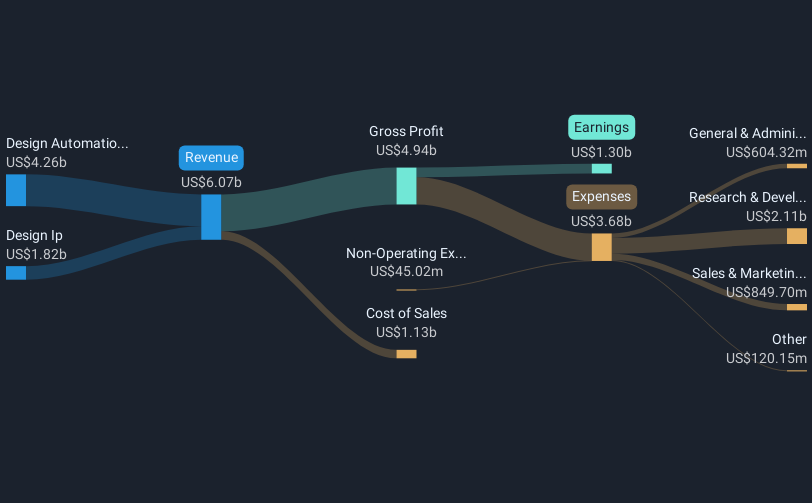

Overview: Synopsys, Inc. is a company that specializes in providing electronic design automation software for designing and testing integrated circuits, with a market capitalization of approximately $85.57 billion.

Operations: The company generates revenue primarily from two segments: Design Automation, contributing $4.32 billion, and Design IP, accounting for $1.90 billion.

Synopsys, a leader in silicon-to-systems design solutions, recently demonstrated its robustness in the high-tech sector with significant strategic alliances and technological advancements. The company's collaboration with Broadcom on PCIe 6.x IP solutions underscores its pivotal role in next-generation AI infrastructures, enhancing scalability and reducing design risks for AI data centers. This partnership not only fortifies Synopsys' market position but also accelerates product development timelines across the tech industry. Furthermore, Synopsys' engagement with Plug and Play to equip startups with advanced EDA tools reflects its commitment to fostering innovation at grassroots levels, potentially lowering entry barriers for new entrants in chip design. These strategic moves are complemented by a strong financial performance, with annual revenue growth projected at 11.6% and earnings expected to increase by 16.2% annually, showcasing the company's ability to maintain momentum amidst dynamic market conditions.

- Unlock comprehensive insights into our analysis of Synopsys stock in this health report.

Understand Synopsys' track record by examining our Past report.

Warner Music Group (WMG)

Simply Wall St Growth Rating: ★★★★☆☆

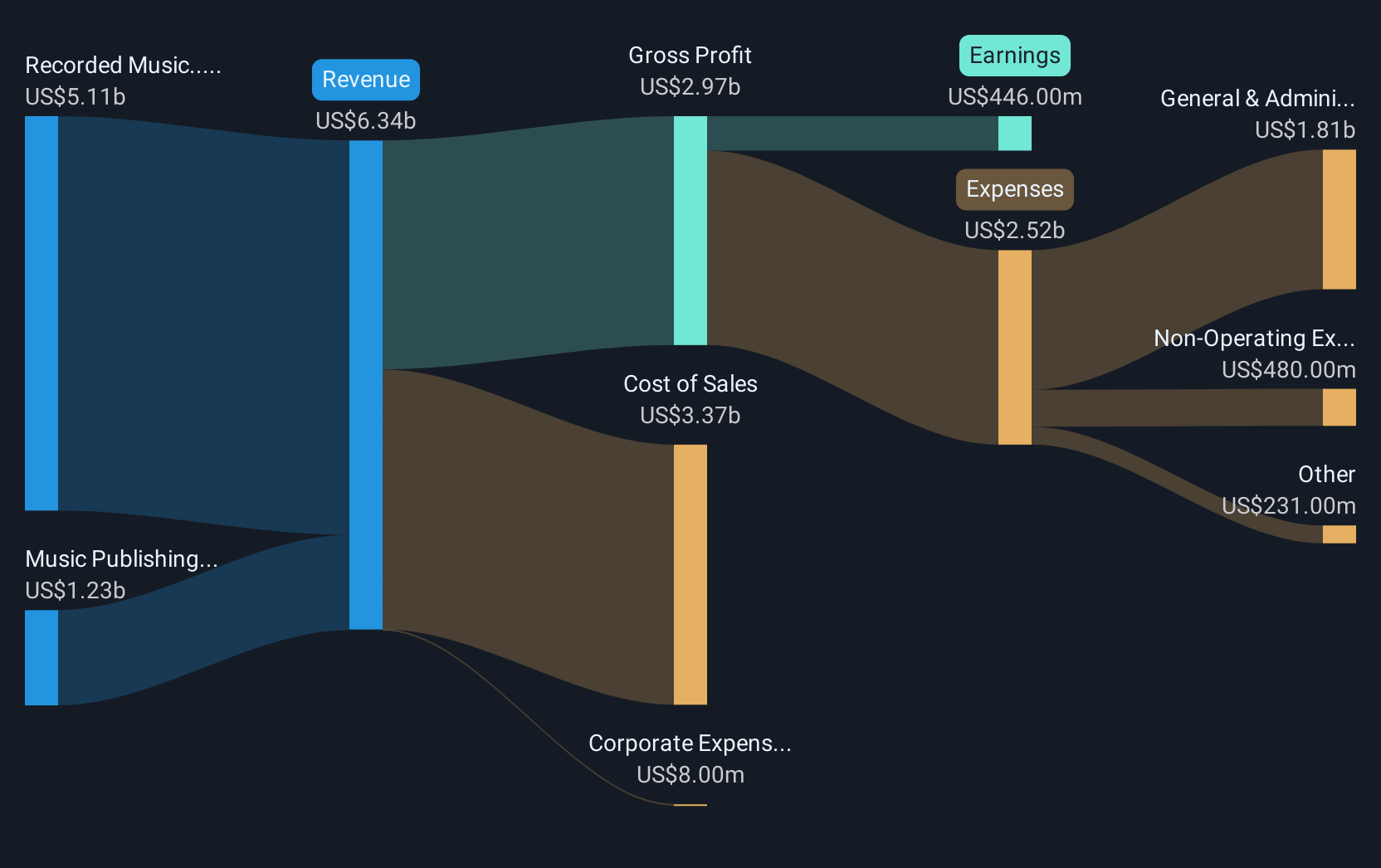

Overview: Warner Music Group Corp. is a global music entertainment company with operations in the United States, the United Kingdom, Germany, and other international markets, and it has a market cap of approximately $15.37 billion.

Operations: The company generates revenue primarily through its Recorded Music segment, which accounts for $5.11 billion, and its Music Publishing segment, contributing $1.23 billion.

Despite facing a challenging environment with a revenue growth of 4.9% per year, Warner Music Group (WMG) is making strategic moves to bolster its market position. The recent joint venture with Bain Capital, involving the acquisition of music catalogs worth up to $1.2 billion, showcases WMG's innovative approach to expanding its assets and enhancing artist and songwriter legacies. This move is timely as streaming and technology shifts open new audience channels. Furthermore, WMG's expected earnings growth at an impressive rate of 21.4% annually signals strong future prospects despite current industry hurdles like its negative earnings growth last year at -14.6%. These initiatives reflect WMG's proactive stance in navigating the evolving music landscape while aiming for substantial financial improvement.

Guidewire Software (GWRE)

Simply Wall St Growth Rating: ★★★★☆☆

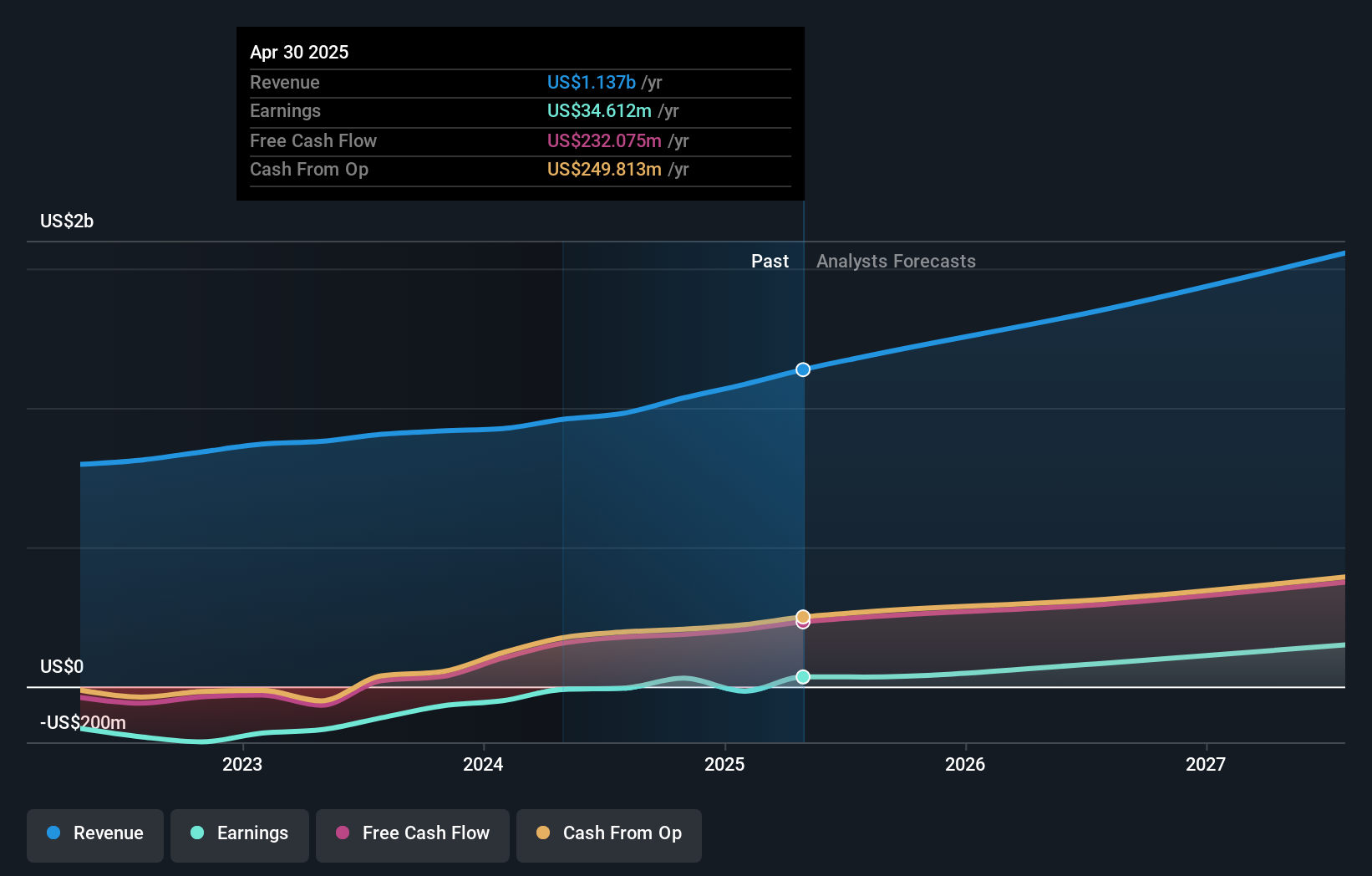

Overview: Guidewire Software, Inc. offers a platform tailored for property and casualty insurers globally, with a market capitalization of approximately $19.40 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, which brought in $1.14 billion.

Guidewire Software, despite recent drops from multiple Russell indices, demonstrates robust growth and innovation in the tech sector. With a significant 12.8% annual revenue increase and an impressive 41.7% forecasted earnings growth, it outpaces the US market average significantly. The company's strategic integration of Docusign into its PolicyCenter and ClaimCenter platforms underscores its commitment to enhancing operational efficiencies and customer satisfaction in the insurance industry. This move not only streamlines processes but also aligns with evolving digital expectations, potentially setting a new standard for industry practices while bolstering Guidewire's competitive edge in a challenging market landscape.

- Click here to discover the nuances of Guidewire Software with our detailed analytical health report.

Turning Ideas Into Actions

- Reveal the 227 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives