- United States

- /

- IT

- /

- NYSE:GLOB

Globant (GLOB) Experiences 11% Drop Over Last Week

Reviewed by Simply Wall St

Globant (GLOB) is experiencing a period of pivotal developments, marked by new updates to its AI platform and the resignation of COO Patricia Pomies. However, the company's share price observed a 10.88% decline last week. This downturn coincided with a modest 1.3% overall market increase, leaving the company at odds with broader trends. Globant's recent product enhancements, which promise significant operational efficiency, and the anticipation of upcoming earnings results, may have added weight to its price adjustment. Yet, these strategic shifts appear to be temporarily overshadowed by market conditions and investor apprehension regarding interest rate expectations.

Every company has risks, and we've spotted 1 weakness for Globant you should know about.

The recent developments at Globant, including the updates to its AI platform and the resignation of COO Patricia Pomies, could potentially influence its narrative of AI-driven growth and global expansion. While these changes might foster operational improvements and market reach in the long term, they have coincided with a discernible 10.88% share price dip, contrasting with overall market growth. Investors may perceive uncertainties related to leadership changes and broader interest rate expectations, possibly affecting revenue and earnings forecasts.

Over the past five years, Globant's total shareholder return, factoring in dividends, witnessed a 61.73% decline. This underperformance contextualizes the recent share price movement amid mixed market conditions. Comparatively, Globant lagged behind the US IT industry, which saw a 14.3% increase over the past year. Such historical performance may shape investor sentiment, influencing perceived and actual company value.

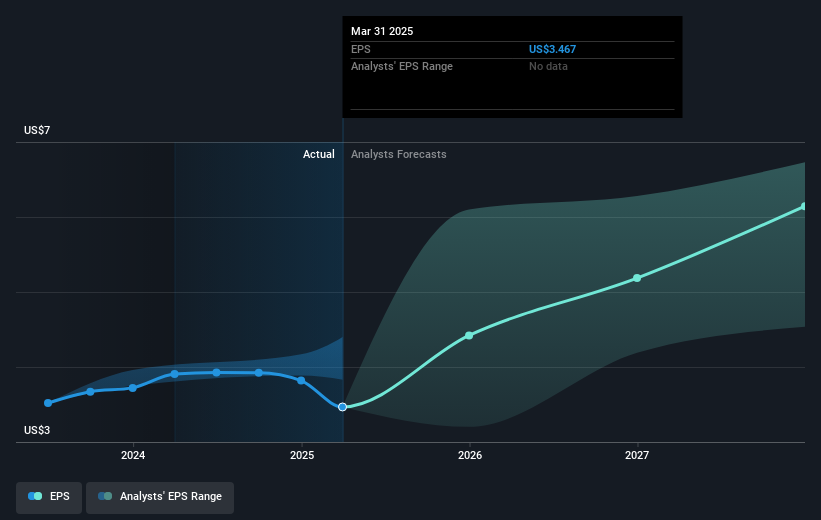

The current share price of US$66.46 exhibits a significant discount to the consensus price target of US$112.70. This gap suggests potential upside if Globant can align its strategic initiatives with analyst expectations, which anticipate considerable revenue and earnings growth. However, economic exposures and client dynamics pose risks that might impact these projections, necessitating careful evaluation by investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives